This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

COGARD Enters $3.1bn Loan Facility with AgBank; Aoyuan Sells Housing Site for $215mn

March 28, 2022

Country Garden (COGARD) has entered a loan facility of RMB 20bn ($3.14bn) with the AgBank of China’s Guangdong Branch, Shanghai Securities News reported. The loan will be used for by the developer and its affiliated firms to acquire properties. COGARD’s dollar bonds were slightly higher with its 3.875% 2030s up 1 point to 55.57.

China Aoyuan has sold its Canadian development site in Burnaby’s Brentwood Town Centre to Vancouver-based Anthem Properties Group and KingSett Capital. Bloomberg notes that the sale value was for CAD 215mn ($172mn) helping the troubled developer free-up some capital. Aoyuan’s dollar bonds were slightly higher, trading at 16-17 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Aoyuan Reports 1H Earnings

August 23, 2021

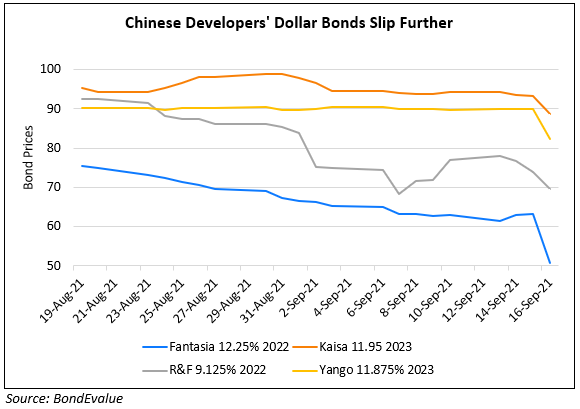

Chinese Developers’ Bonds Fall Sharply on Evergrande Spillover Risks

September 17, 2021