This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Citic Plans to Become Huarong’s Largest Shareholder; Huarong to Issue Profit Warning Next Week: REDD

August 16, 2021

Citic Group is said to have received State Council approval for a restructuring plan of China Huarong Asset Management Co. that involves Citic becoming the largest shareholder in the distressed state-owned asset manager, as per REDD, reported by Bloomberg. Citing people familiar with the matter, the REDD report stated that Huarong could become a subsidiary of Citic and that seven of its financial services units including Huarong Trust and Huarong Financial Leasing will be sold to strategic investors. However, further details including the timeline and treatment of Huarong’s $20bn offshore bonds remain unknown.

In related news, REDD reported last week that Huarong is planning to issue a profit warning this week before releasing 2020 financial results next week. As per one of the sources, the distressed asset manager could report an impairment of CNY 100bn ($15.4bn).

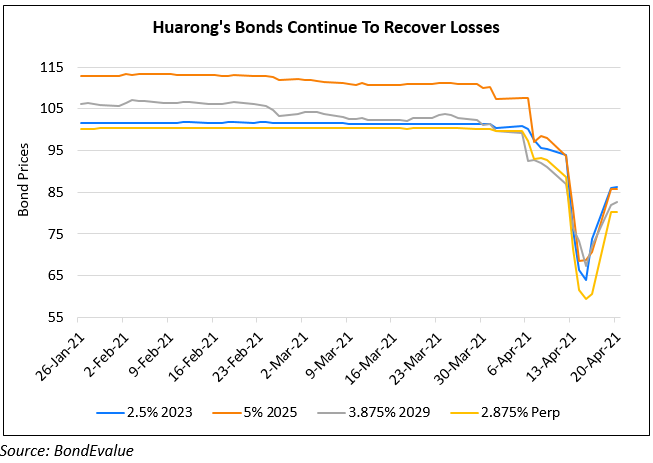

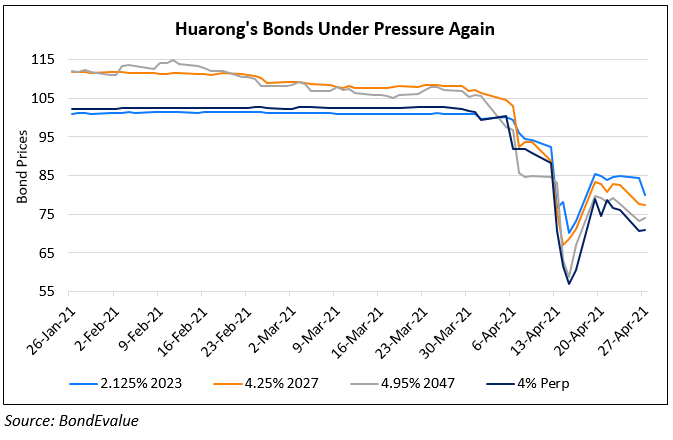

Huarong’s 2.5% 2023s traded stable at 83.875 while its 4.25% perps callable in 2025 traded at 56.25 cents on the dollar.

Go back to Latest bond Market News

Related Posts: