This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ciputra, Tower Bersama, R&F Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

January 25, 2021

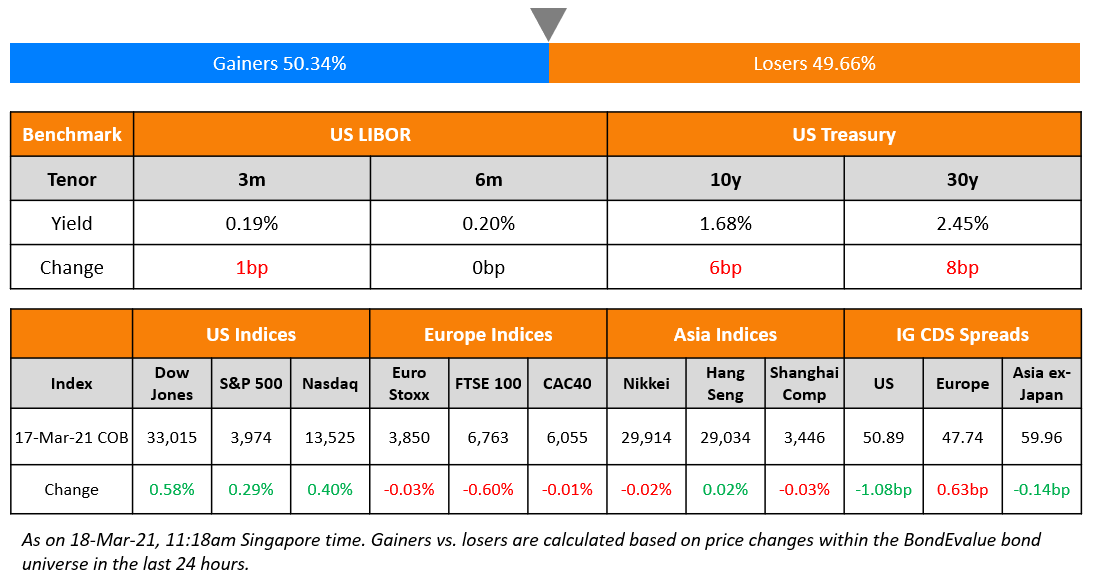

S&P ended Friday lower by 0.3% while Nasdaq was flat. US 10Y Treasury yields moved 1bp lower. Slow vaccine rollouts, fall in oil prices due to build-up in US crude inventories and valuations weighed on markets. “The pandemic seems to continue to expand into a second wave in China, with infections rising by the day and reaching again different regions such as Shanghai” said Rystad Energy oil markets analyst Louise Dickson. European economic data was mixed as UK flash PMIs and retail sales disappointed with sharp misses while German PMIs came in-line with expectations. US IG CDS spreads were 0.33bp wider and HY was 6.3bp wider. EU main CDS spreads tightened 0.1bp while crossover spreads widened 3.8bp. Asia ex-Japan CDS spreads widened 0.6bp and Asian equities have opened mixed today.

Bond Traders’ Masterclass – One Day To Go

Sign up for the upcoming sessions on Bond Valuation & Risk on Tuesday, January 26 and Bond Portfolio Optimization & Risk in Perpetual Bonds on Wednesday, January 27. These are part of the Bond Traders’ Masterclass across four sessions specially curated for private bond investors and wealth managers to develop a strong fundamental understanding of bonds. The sessions will be conducted by debt capital market bankers with over 40 years of collective experience at premier global banks. Click on the image below to register.

Register today to avail a 25% discount on the Masterclass package

New Bond Issues

- Ciputra Devt S$ 5yr @ 6.25% area

- Tower Bersama Infrastructure $ tap of 2.75% 2026, final @ 2.30%-2.40%

- Guangzhou R&F $ 2.5yr @ 12.3% area

- Modern Land (China) $ tap 9.8% 2023/11.95% 2024 @ 10.5/11.85% area

- Zhongliang $ 364-day @ 8.2% area

- Woori Bank $ 5yr sustainable @ T+75bp area; books over $ 1.3bn

- Taixing Zhiguang Environmental $ 364-day credit-enhanced @ 2.4%

AVIC International raised $200mn via a 5Y bond at a yield of 2.974%, or T+253bp, 42bp inside initial guidance of T+295bp area. The bonds have expected ratings of A- and received orders over $700mn, 3.5x issue size. The bonds will be issued by AVIC International Finance & Investment and guaranteed by the state-owned parent company. Proceeds will be used for offshore debt refinancing.

Guorui Properties raised $323.745mn via a 3Y non-put 1.25Y (3NP1.25) bond at a yield of 15.104% and 16.132% yield to put (YTP). The bonds have expected ratings of B- and came with a concurrent exchange offer for their $455mn 13.5% bonds due 2022 and a consent solicitation. Under the exchange offer, for each $1,000 in principal, bondholders will receive $1,077.041 worth of the new bonds. The bonds are puttable at par 15 months after the issue date. Proceeds will be used to refinance the 2022s and the remainder for general corporate purposes. The 13.5% 2022s issued by Glory Land (parent company) are currently at 96.25, indicating a 12% premium in the exchange offer.

New Bond Pipeline

- Hainan State Farms Investment $ bond

- Genting NY $ bond

- 7-Eleven Inc $ bond

- Jinchuan Group $ bond

- Yuexiu REIT $ bond

- China Citic Bank London branch $ bond

- GMR Hyderabad $ Yankee bond

- Hong Kong government $ 144a/Reg S green bond

- Buma $ 5NC2 bond

- Dubai Aerospace Enterprise $ bond

- Laos $ bond

- Zurich Insurance $ 30.25NC10.25

- REC $ bond

Rating Changes

- CLISA Senior Secured Debt Rating Raised To ‘CCC’ From ‘D’ By S&P On Interest Capitalization On PIK Option

- Slovakia Outlook Revised To Stable From Negative By S&P On Economic Recovery Prospects; Affirmed At ‘A+/A-1’

- Azerbaijan Outlook Revised To Stable From Negative By S&P On Receding Risks From Nagorno-Karabakh Conflict; Ratings Affirmed

- Meredith Corp. Outlook Revised To Stable From Negative By S&P On Improved Leverage Forecast; ‘B’ Rating Affirmed

The Week That Was

Overall issuances softened across markets last week. US primary market issuances were at $39.6bn vs $44.3bn in the week before – IG issuances stood at $27.5bn and HY at $13.4bn, down 1% and 22% respectively WoW. US banks Goldman Sachs and Morgan Stanley raised a combined $13bn via triple-tranchers while BNY and Citi raised a combined $3.7bn. In North America, there were a total of 102 upgrades and 68 downgrades combined, across the three major rating agencies last week. LatAm saw $7.1bn vs $9.5bn of deals in the week before led by Paraguay’s $826mn issuance. EU Corporate G3 was a massive 55% lower at $25.4bn vs $56.5bn of deals priced in the week prior – Gazprom, Total and Credit Agricole were the largest issuers with issues of over $1.5bn each. GCC and Sukuk issues were at $4.7bn, flat as compared to the previous week, led by Bahrain’s $2bn dollar deal, NCB’s Tier 1 sukuk worth $1.25bn and QNB’s $1bn issue. APAC ex-Japan G3 issuances totaled $9.5bn vs $13.9bn in the prior week, down 30% – CICC HK’s $1.5bn, Sunac’s $1.1bn, SJM Holdings’ $1bn issues followed by PFC and Fosun’s $500mn issuances. Indonesian textile producer Sritex put its expected dollar bond offering on hold after the company’s existing bonds dropped in secondary trading and rating agencies downgraded its peer Pan Brothers on a high likelihood of imminent default. Meanwhile, Mongolian Mortgage pulled its proposed dollar 3Y bond after the country’s Prime Minister and most of his cabinet resigned following protests.

Term of the Day

Credit Enhanced Bond

Credit enhancement refers to improving the credit rating of an underlying corporate bond using various structures. It gives investors additional comfort that the debt would be honoured by an additional external collateral, guarantee or insurance. Credit enhancements can come through an unconditional/irrevocable guarantee, letter of comfort, standby letter of credit, pledge of shares etc. Generally, SPVs and subsidiaries issue these bonds in order to lock-in a lower yield vs. issuing bonds without a credit enhancement.

Today, Taixing Zhiguang Environmental plans to issue a 364-day credit enhanced bond at 2.4% area. Huan Zhi is the issuer and Taixing Zhiguang Environmental is the guarantor. The senior unsecured notes are also supported by an irrevocable standby letter of credit from the Bank of Jiangsu Taizhou branch.

Talking Heads

Yield curve control “would be a rather mechanical approach” to the question of financing conditions, and “not sensible” given the euro area has at least 19 different yield curves, Rehn said. “We need certain indicators” to examine “how to retain favorable financing conditions, allowing lending to households and companies to function well,” Rehn said. But there should be “no automation” as “it’s better to leave enough room for common sense and consideration,” he said. “In that sense monetary policy is as much an art as it is a science.”

On high interest rates in Turkey – Recep Tayyip Erdogan, Turkish President

“I know our friends are getting angry but, with all due respect, if I am the president of this country, I will continue to talk about this because I don’t believe my country can develop with high interest rates,” Erdogan said.

“Any disorderly rise of interest rates could create unstable conditions for the markets which the Fed tries to avoid, especially at a time when parts of the economy are still very depressed,” said Marcelli.

“Mexico was behind in terms of investigating potential collusion among traders, but since that was already a big issue in the U.S. or the U.K, those regulators influenced the banks, and that worked toward addressing the problem in Mexico even before the antitrust agency started to look into it,” said Luna.

“Because of continuing Covid-19 disruption, the recovery in emerging-market growth will, of course, be a stop-start one,” said Malik. “But pauses in emerging-market equity performance, particularly in Asia, should be viewed as opportunities.”

“There’s a really good chance of a tremendous surprise, and a surprise in the relatively near future,” said Singer. “Bonds could have a very significant and abrupt and intense price readjustment.” “No institution can meet their goals by owning those bonds. They’re no longer a hedge against equity portfolios,” he said. “When you buy something with no yield, where you can only make money if the yield goes from zero to -5 or -10, you’re engaged in speculation, you’re not engaged in investing.”

On Bank of Japan warming to idea of wider band for yield target

Kazuo Momma, former BOJ executive with experience drafting monetary policy

“YCC wasn’t intended to last this long. With the pandemic, the BOJ must now find a way to forever sustain this policy as inflation won’t hit 2% for years,” said Momma. “The BOJ will probably come up with a package of measures which, as a whole, would appear as if it’s enhancing the effect of YCC.”

Haruhiko Kuroda, Bank of Japan Governor

“As our monetary easing is prolonged, we’ll aim to make daily operations of YCC more sustainable,” Kuroda said.

Top Gainers & Losers – 25-Jan-21*

Ratings are in the order of Moody’s/S&P/Fitch

Go back to Latest bond Market News

Related Posts: