This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

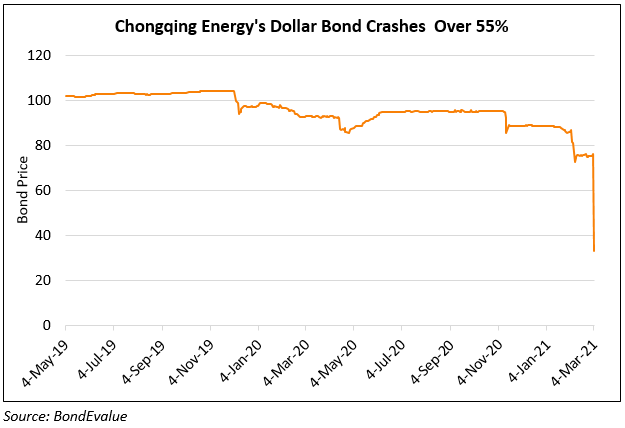

Chongqing Energy Downgraded to RD from BBB- by Fitch

March 11, 2021

Chongqing Energy’s issuer default rating has been downgraded by a massive 13 notches to Restricted Default (RD) from BBB by Fitch Ratings. While the older BBB rating is two notches into investment grade territory, indicating that expectations of default risk are low and capacity for payment of financial commitments is adequate, the new RD rating is indicative of an issuer that has experienced an uncured payment default but has not entered into bankruptcy filings. The fall from grace comes after the company’s announcement yesterday that it failed to repay its obligations under the onshore letter of credit. Chongqing’s $500mn 5.625% 2022s have also been downgraded to C. The rating agency gave a recovery rating of RR5 which is just one notch above the lowest recovery rating of RR6 and is associated with securities historically recovering only 11–30% of current principal and related interest. It also withdrew further ratings saying, “Fitch is withdrawing the ratings as Chongqing Energy has chosen to stop participating in the rating process. The company had not provided consistent and sufficient information to Fitch on key factual issues, including, but not limited to, its debt repayment status, nor has it made any public disclosure on its latest operating and financial position.” According to Fitch, Chongqing has insufficient liquidity for servicing its debt as it had a cash of CNY 10.5bn ($1.63bn) as of end-September which was insufficient to cover short-term debt of ~CNY 16bn ($2.46bn) and a negotiation with its creditors will be crucial to its debt management. Chongqing Energy’s local default includes an obligation of CNY 685mn and CNY 230mn ($106mn and $36mn) to Ping An Bank and China Zheshang Bank Co. The news of non-payment had led to a massive sell-off in the dollar bonds of the company and its USD 5.625% 2022s have dropped to 35 cents on the dollar from ~88 in January. The distressed bonds are up 0.54 points today to trade at 35.76.

For the full story, click here

Go back to Latest bond Market News

Related Posts: