This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Chinese HY Property Developers’ Bonds Fall With Greenland Severely Impacted

February 9, 2021

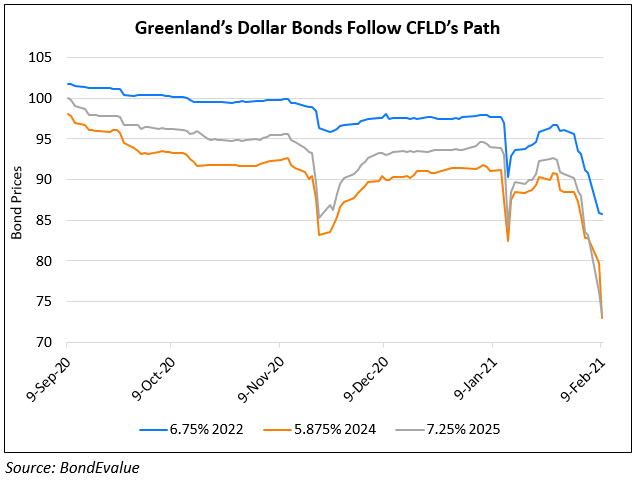

Dollar Bonds of Chinese high yield property developers fell on Monday with spreads on dollar bonds of Greenland Holdings and Fantasia widening. Greenland, whose bonds have been hit since liquidity concerns over China Fortune Land Development (CFLD), saw its bonds drop 7-9% yesterday and feature among the top losers. Other developers’ bonds also fell with some of Evergrande, Sunac, Modern Land (China) and RiseSun’s dollar bonds falling to near three-month lows. Bloomberg cites credit traders saying that selloffs are largely due to a contagion effect from CFLD’s debt woes, as well as signs that regulators are looking to curb developers’ debt metrics – measures like the three-red lines in place. Greenland already breaches two of the three-red lines drawn by the authorities, with short-term debt to cash at 1.5x and net debt to equity at 170% vs. thresholds of 1x and 100% respectively. While Z-Spreads of Greenland and Fantasia have risen, those of other high yield developers have not.

Greenland’s 5.875% 2024s saw its z-spread widen ~290bp since the beginning of the month to 1625.2bp while Fantasia’s 9.875% 2023s saw a ~150bp widening to 1192.9bp in the same time period. RiseSun’s 8.95% 2022s issued last month at par are currently trading at 91.85, down 8.1% since issuance.

Go back to Latest bond Market News

Related Posts: