This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

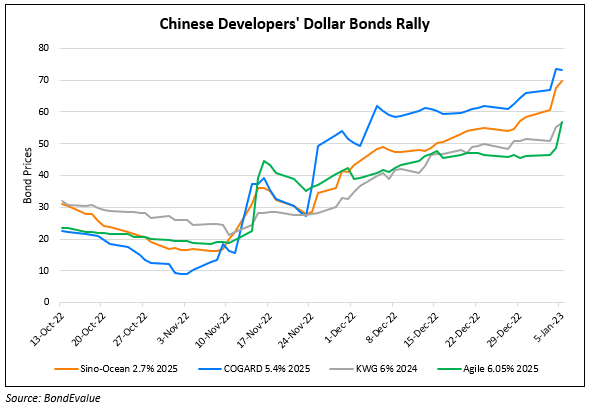

Chinese Developers’ Dollar Bonds Rally on News of Further Easing by China

January 5, 2023

Dollar bonds of Country Garden, Sino-Ocean, Agile, KWG, China Jinmao and several others rallied yesterday by over 5%. China is planning measures to further ease liquidity stresses at some of its ‘too-big-to-fail’ developers. Recently, the Financial Stability and Development Committee were said to have told the regulators to help shore up the balance sheets of some “systemically important” developers. Here, developers need to get “unqualified” auditing reviews to show they have reliable financial statements and no major violations like defaulting on public debt. Once the list is made, these developers could receive financing in the form of equity, loans, creation of REITs, acquisitions etc. This would be an addition to its existing set of measures introduced last year.

Besides, China also resumed approvals for PE funds to raise money for residential property developments to further help the sector. Sources said that the Asset Management Association of China recently started allowing PE funds to make these transaction after having halted it in 2021. Bloomberg notes that after the halt, the number of private equity property funds dropped 14% in 2021.

Go back to Latest bond Market News

Related Posts: