This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China to Crackdown on Local Government Land Buying, Depriving Developers; COGARD, Longfor to Issue State-Backed Bonds

October 19, 2022

China’s Ministry of Finance said that government-backed entities would be strictly prohibited from purchasing land by raising debt, calling it a “sham”. Tommy Wu, senior China economist with Commerzbank said that the move targets “those state-owned companies and local government financial vehicles (LGFVs) purchasing land more actively than before to support the land market” in fear of these transactions leading to hidden debts for local governments. LGFVs can borrow from local banks for land purchases and local governments may be liable due to implicit guarantees, this pressurizing the financial system in a hidden way. While private developers have been struggling to pay down debts due to a decline in land sales, down 60% YoY, SCMP notes that land acquisitions by LGFVs have risen to RMB 250bn ($34.7bn). The crackdown may lead to a further freeze in the land market in the short-run and “exacerbate mainland China’s housing crisis”, notes SCMP.

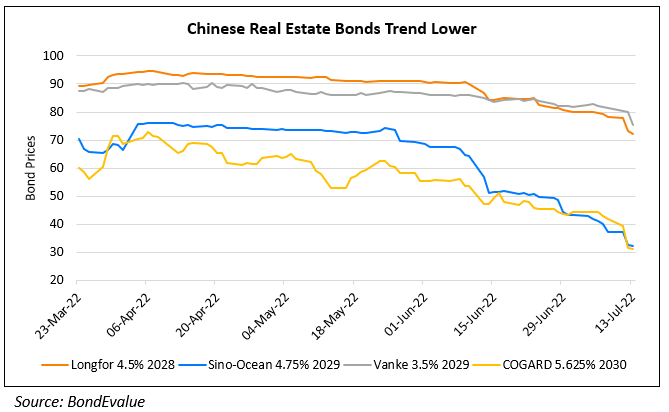

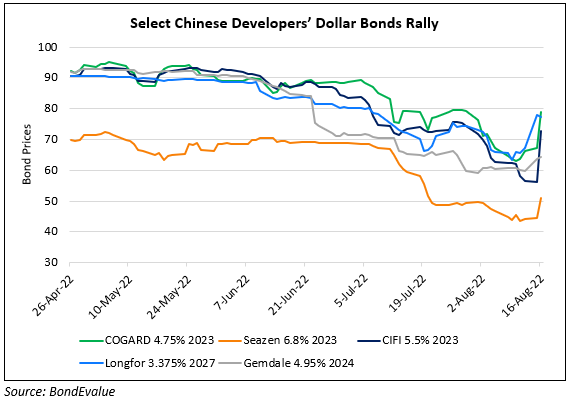

In related China property news, Longfor and Country Garden have held investor calls to raise funds via a second batch of local state-backed bonds, guaranteed by China Bond Insurance Co. The two companies sold RMB 1.5bn ($210mn) of these notes each in August and September. A representative of Longfor said that the developer does not face repayment pressure this year and is planning an early redemption of its 2023s.

Go back to Latest bond Market News

Related Posts: