This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

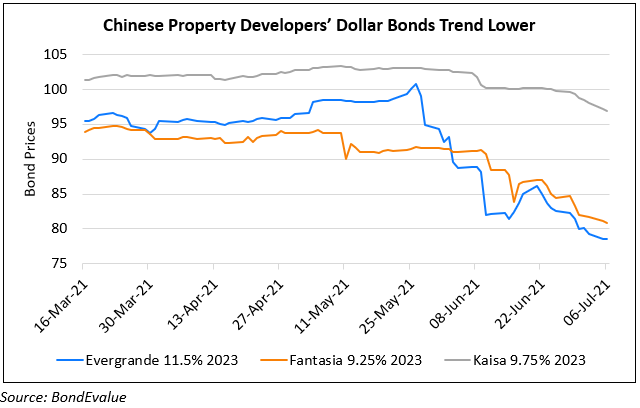

China Property Developers’ Bonds Slip

July 6, 2021

Dollar Bonds of select Chinese property developers slipped yesterday with Evergrande’s and Kaisa’s dollar bonds among the top losers. Besides, China Sunac’s 7% 2025s also fell over 1.2 cents to 97.2 cents on the dollar, closing at its lowest since November. Bonds of many Chinese developers have been on a declining trend in recent months, ever since concerns on Evergrande have increased regarding weakened funding availability, transactions with suppliers and creditors, its liquidity position and an overall crackdown on the real estate sector in China. The company was also downgraded recently by Moody’s and Fitch to B2 and B respectively.

Go back to Latest bond Market News

Related Posts:

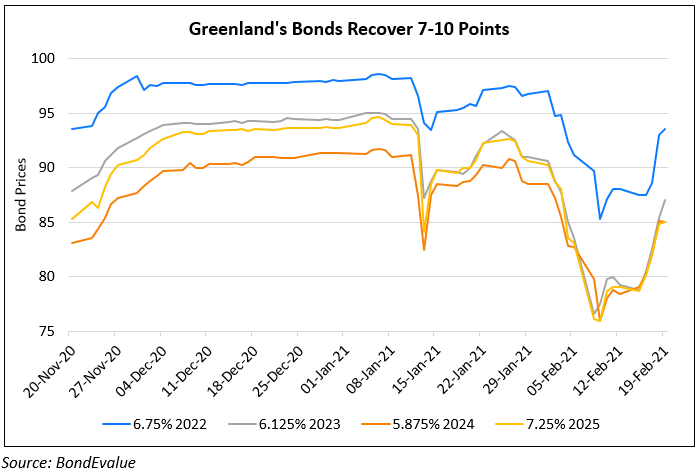

Greenland’s Dollar Bonds Recover 7-10 Points from Lows

February 19, 2021