This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

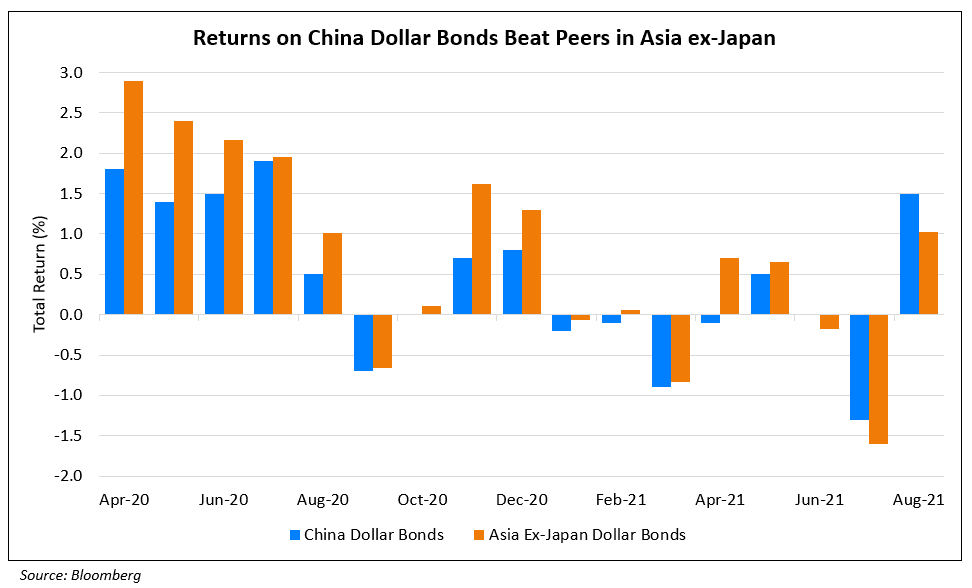

China Outperforms Asian Peers in Terms of Dollar Bond Returns in August

September 2, 2021

China saw the highest returns in Asia for corporate bonds in August after two months of losses, with total return on corporate dollar bonds at 1.5%, its best performance since July last year. This was higher than the gain of 1.1% from broader Asian emerging market bonds, the 1.0% return from Asia ex-Japan and the 0.7% return from Southeast Asian peers.

China’s strong performance last month was buoyed by the bail-out of distressed debt manager China Huarong Asset Management Co which helped to ease investor concerns, amidst a backdrop of a regulatory crackdown in the private sector and growing trouble for one of the nation’s largest property developer China Evergrande Group. According to Winson Phoon, head of fixed income research at Maybank Eng Kim Securities, the spread of China’s high-yield credit was sufficient to support “a near-term respite” but medium-term risks continue to threaten China’s high-yield market as the government looks to reform the debt-laden property sector.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Tata Motors Reports Weak JLR Sales for The December Quarter

January 13, 2022