This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Huarong Launches $ Bond; US Junk Issuance at Record High of $329.8bn; China to Ease Laws for Foreign Inv in Bonds

September 24, 2020

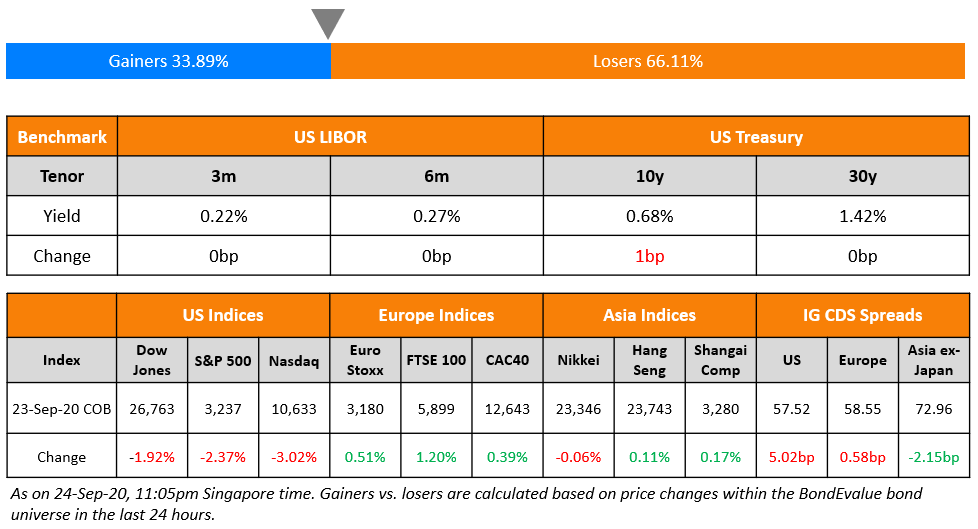

US stocks once again took a turn for the worse, falling 2.4% with tech and energy being the culprits again down over 3% and 4.5%. Apple and Amazon were both down over 4%. 10Y US Treasury yields widened by 1bp. Asian equities have followed the path of US stocks, lower by ~0.5%. On the data front, European and UK Purchasing Managers’ Index (PMIs) were mixed, with the manufacturing sectors showing positivity while the services sectors disappointed, especially Germany and France, which went into contraction. US IG CDS widened sharply 5bp while HY was flat.

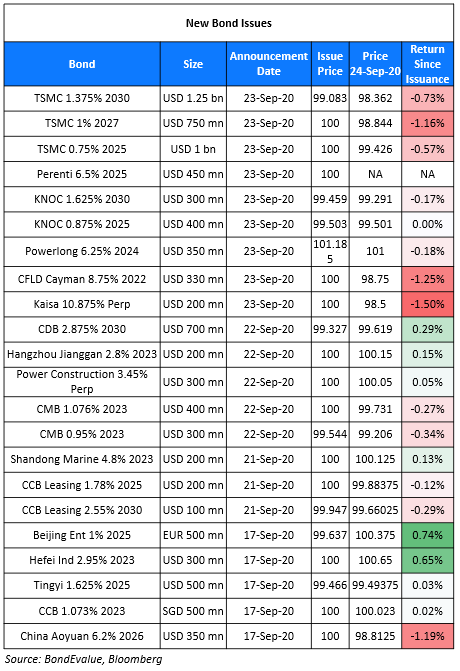

New Bond Issues

- China Huarong AMC $ 3/10yr/PerpNC5 @ T+235/325bp/4.375% area

Taiwan Semiconductor Manufacturing Company (TSMC) raised $2bn via a triple-tranche offering. It raised:

- $1bn via 5Y bonds at a yield 0.769%, 50bp over Treasuries and 30bp inside initial guidance of T+80bp area

- $750mn 7Y bonds at a yield of 1.059%, 60bp over Treasuries and 30bp inside initial guidance of T+90bp area

- $1.25bn 10Y bonds at a yield of 1.474%, 80bp over Treasuries and 30bp inside initial guidance of T+110bp area

The bonds are all rated Aa/AA- TSMC Global Ltd. is the issuer and TSMC is the guarantor.

Korea National Oil Corporation raised $400mn via 5Y bonds to yield 0.977%, 70bp over Treasuries and 40bp inside initial guidance of T+110bp area. Its also raised $300m via 10Y bonds to yield 1.684%, 100bp over Treasuries and 30bp inside initial guidance of T+130bp. The bonds, with expected ratings of Aa2/AA received orders 3x issue size.

Kaisa Group Holdings raised $200mn via a sustainable Perpetual non-call 3Y (PerpNC3) bonds to yield 10.875%, inside initial guidance of 11.125% area. The bonds have an expected rating of B2. Orders were said to be over $1bn when final guidance was announced. The bonds are callable in 2023 and if not called, the coupon will reset to an initial spread of 10.718% over 3Y Treasuries plus a 500bp step-up.

Powerlong Real Estate raised $150mn via a tap of its 6.25% 2024s at a yield of 5.9%, bringing the total amount outstanding to $350mn. The tap priced 35bp inside initial guidance of 6.25% area. The issuance has an expected rating of B2/B and received orders worth $1.7bn at the time of final guidance, 11.3x issue size.

China Fortune Land raised $330mn via 2Y bonds at a yield of 8.75%, 15bp inside initial guidance of 8.9% area. Proceeds will be used to fund its tender offer of its $920mn 6.5% bonds due December 21 this year. It is offering $1,004 per $1,000 in principal. The tender offer, capped at $300mn ends on September 30.

Perenti Global raised $450mn via 5Y non-call 2Y (5NC2) bonds at a yield of 6.50%, 25bp inside initial guidance of 6.75% area. Previously known as Ausdrill, Perenti will use the proceeds to fund an early redemption of its $350mn 6.625% 2022s.

Rating Changes

Fitch Downgrades Laos to ‘CCC’

Fitch Affirms Abanca at ‘BBB-‘; off RWN; Outlook Negative

Fitch Affirms Broadcom at ‘BBB-‘; Revises Outlook to Stable

Fitch Affirms Banco Davivienda Salvadoreno’s IDR at ‘B’; Outlook Negative

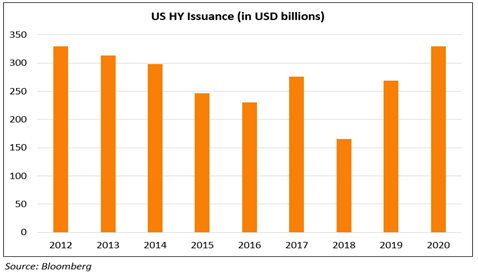

US Junk Bond Issuance Surpasses 2012 to Record High of $329.8 Billion With Over 3 Months Remaining for the Year

US Junk bond issuance hit $329.8bn yesterday with more than a quarter left till year-end, topping the previous record of $329.6bn in 2012. Junk bond issuance spiked in April with the Fed mentioning its support to buy junk bonds. Low bond yields across the globe have led investors to riskier pastures in search for return i.e. the junk bond market. The strong demand from investors have allowed junk-rated issuers to rush to the primary bond markets to secure funds at relatively low yields.

According to Barclays’ research, since July, 65% of high yield issuance have coupons of less than 6%. Investors venturing into high yield would be required to take more caution now and focus on issuer specific attributes since covenants, call protection and other qualities have favored issuers in some deals according to Bloomberg.

For the full story, click here

Gilead Raises $7.25 Billion Jumbo Issuance to Fund $21 Billion Immunomedics Acquisition

American pharmaceutical company Gilead Sciences raised $7.25bn via a seven-tranche issuance on Wednesday. Gilead will use proceeds from the issuance plus cash on its books to fund its $21bn acquisition of Immunomedics. The transaction is expected to fast track Gilead’s ambitions to build up a substantial oncology business through Immunomedics’ breast cancer antibody drug called Trodelvy. Details of the issuance are as follows:

All the bonds are expected to be rated A3/A and have a change of control put at 101. As per IFR, this is Gilead’s first issuance since 2017, which adds scarcity value to the new bonds. Gilead received strong orders worth $32bn, 4.4x issue size as at mid-day as reported by Nasdaq. Strong orders helped Gilead to upsize the deal from the $6bn indicated by CEO Andrew Dickinson in an investor call prior to the issuance announcement. S&P has placed all of Gilead’s ratings on CreditWatch Negative and plans to downgrade it by two notches to BBB+ with a negative outlook after the issuance. S&P said, “Our expectation for the rating reflects our base case for adjusted debt leverage to generally remain in the 2x-2.5x range, significantly above prior levels.”

For the full story, click here

Virgin Islands Planning $1 Billion Bankruptcy Remote Bond

Virgin Islands is planning to raise $1bn via bonds this month with a special structure – the bonds would get repaid even if bankrupt. Virgin Islands, rated Caa3 by Moody’s would make these payments by pledging ~$250mn of its excise tax revenues it gets by shipping rum to the US. Governor Albert Bryan Jr., said in an interview, “if you don’t have a better idea, then support this one”. These bonds are using a bankruptcy remote structure – routing money to a newly created company and providing a legal pledge that the cash will not be used even if they had to restructure debts in federal bankruptcy. They plan to sell the bond before October 1 when they have to make a payment. The structure has some resemblance with Puerto Rico’s (rated Ca by Moody’s) bonds issued by COFINA (Corporación del Fondo de Interés Apremiante), which are backed by sales tax revenues.

For the full story, click here

China to Ease Foreign Investment Law to Increase Participation in Its Bond Market

China is set to allow more foreign investors to make strategic investments in Chinese listed companies with an aim to increase the sales of national bonds. The cabinet aims to increase the transparency and information quality disclosed by its listed companies. The new regulations also look at making the application procedures for overseas bond investors simpler by unifying various regulations overseeing these investments. Currently, FIIs can access China’s bond markets through dollar-denominated Qualified Foreign Institutional Investor (QFII) programme, and yuan-denominated, Renminbi Qualified Foreign Institutional Investor (RQFII). Recently, in June, foreign investors were granted unlimited access to the markets when the quotas for QFII and RQFII were scrapped. China had also introduced Bond Connect in July 2017 to allow quota-free access to the interbank market through Hong Kong. The new proposal includes the following

- Relaxing limits on cross-border capital flows

- FIs investing in the onshore market through both yuan and foreign currency will need to meet capital controls imposed only on the foreign currency outward remittances

- The limit for accumulated foreign currency used for outward remittances could be increased to 120% from the existing 110%

- FIs investing through a single currency (yuan or foreign currency) will not have any limit on outward remittances

- Although, foreign institutional investors can choose various currencies to use for investment in the Chinese bond market, the yuan will be encouraged for cross-border receipts and payments, with settlement through CIPS (Cross-Border Inter-Bank Payments System)

- Foreign institutions will be allowed to trade bond derivatives to hedge risks as well as move funds across channels

The proposal comes ahead of a likely FTSE Russell decision today on the inclusion of the Chinese government bonds in its World Government Bond Index, which could pave way for more foreign participation in China’s $16tn bond market.

For the full story, click here

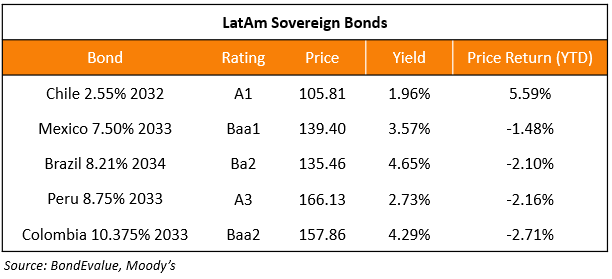

Low Rates to Help Brazil & Columbia; Low Debt Burden to Help Chile & Peru; Mexico’s Affordability to Deteriorate – Moody’s

Moody’s in a research report mentioned that Brazil and Columbia would benefit the most from low rates, while Chile and Peru would benefit from lower debt burdens, and Mexico’s affordability would deteriorate. Moody’s focused on these 5 nations in their report mentioning that the offsetting factor to lower rates would be weak growth hurting credit quality of these nations. They added that corporate local bond issuers would benefit the most. Brazil, and to an extent Mexico and Chile, have a lower share of foreign currency debt (3% for Brazil according to BIS), which could help ease currency depreciation risks. However, Brazil corporates would benefit more than the latter due to higher local debt at floating rates. Columbia and Peru could be hurt due to a large share of foreign currency debt. Mexico particularly would see interest payments rise to 15% of revenues next year with higher inflation reducing scope for rate cuts. The table below shows Chile’s outperformance over the others, given its low debt to GDP at 39%.

For the full story, click here

Kuwait Downgraded to A1 from Aa2 by Moody’s

Moody’s has downgraded Kuwait’s long-term foreign and local currency ratings to A1 from Aa2 on the back of “increased liquidity risks” faced by the sovereign over the next few months. The country has failed to pass a law, which allows legal authorization to issue debt or access the nations Future Generation Fund (FGF). In the absence of further funding, the nation is dependent on the General Reserve Fund (GRF), which is likely to exhaust by the end of this year. The credit rating agency views such stop-gap measures adversely. Although the sovereign has one of the largest stocks of sovereign financial assets in the world, the access to these is restricted by law. Till now, the government of Kuwait has not taken any visible action to access FGF assets. Any request to access these funds is also likely to be debated intensely, delaying the passage of the legislation. The draft debt law, which has a KD20bn ($65.3bn) debt ceiling adequate only for two years, has already been rejected once by the parliamentary financial and economic committee. As per the rating agency’s projections, Kuwait requires a net sovereign issuance of ~KD27.6bn ($90bn) till March 2024 and raising such an amount would be challenging. According to Moody’s, “Even if the debt law is passed — whether by parliament or by decree from Kuwait’s Amir while parliament is in recess — it will likely not provide a credible medium-term funding strategy”. Kuwait was rated AA with a stable outlook by Fitch in April this year. It was rated AA- with a negative outlook by S&P earlier this year. The bonds of the country were largely stable with the 3.5% bonds maturing in 2027 trading at ~112 cents on the dollar.

For the full story, click here

Angola’s Finance Secretary Assures Debt Repayment

Bonds of Republic of Angola erased some of their recent declines on an assurance by the country’s secretary for finance Osvaldo Joao. Africa’s second largest oil exporter is staring at an economic contraction for the fourth year in a row mainly due to the fall in crude prices. According to World Bank data, Angola has ~$3.4bn in principal repayments in 2021, mainly to UK based Mark Bohlund. Angola owed ~45% of its total debt amounting to $22.4bn to China and its commercial lenders as of the end of last year. The country is actively trying to manage its external debt and has managed to defer payments of $6bn by three years to 2023. To overcome its debt woes, the country has been negotiating the repayment terms with the Chinese as well as under the Debt-Service Suspension Initiative backed by the G-20 nations. Its debt is estimated to increase to 123% of GDP by this year end from 113% last year on the back of declining oil prices as well as currency weakness, according to secretary Joao. However, despite the struggles faced by the African nation, Joao assured lenders by saying, “We will always pay,” while adding “We haven’t missed paying wages, we haven’t missed honoring debt service, so that tells us that everything is still going alright.”

The bonds of the country had taken a hit after the IMF announced that the nation failed to achieve results in debt-relief talks with one of its creditors. The failed talks could force the country into initiating wider debt restructuring measures in case of any further downside in oil prices. The announcement by the country’s Secretary for Finance was welcomed by the market with bonds recovering some of their losses. Angola’s 9.125% 2049 traded at 77 cents on the dollar, up ~2 points while the 9.5% bonds due 2025 traded at 87.9 cents on the dollar, ~1 point higher.

For the full story, click here

Term of the Day

Spoofing

In the trading space, spoofing is a type of market manipulation practice where a trader places a large buy/sell order with no intention of making the trade. This particularly happens in the algorithmic trading space where bids/offers are placed and get removed before execution, which gives a fake interest of buying or selling a security. JPMorgan is expected to pay $1bn in penalties for spoofing, particularly in the precious metals space.

Talking Heads

“I think the challenge is that we are very likely to face a credit crunch kind of issue as we get towards the end of this year,” Rosengren said. “It would have been fine if the pandemic lasted three months, but the pandemic isn’t lasting three months,” Rosengren said. “It’s lasting much longer than that and so there’s definitely a need for more targeted spending.”

On the ECB looking towards an Amazon-style marketplace to boost liquidity of unpaid loans

Edward O’Brien, a senior ECB official involved in the plan

“The idea is to open up the market to buyers of smaller portfolios, with an Amazon or eBay-style marketplace, where you can browse … That can get the market moving,” O’Brien said. “The market for bad loans has been dominated by a few very large buyers. In a typical scenario, one of these firms may buy a very large portfolio at steep discounts,” O’Brien said.

John Fell, a second senior ECB official

“The problem is bad loans is too often understood to be one that is limited to banks. But it is far wider, it affects the whole economy,” Fell said.

“Lower rates will support debt affordability, as measured by interest payments as a percentage of government revenue, for the five sovereigns,” Moody’s said.

“It is unclear whether Mexico’s debt affordability metrics will improve sustainably given that interest rates did not fall below their long-term average until the pandemic-induced economic contraction this year,” Moody’s said.

On the increased chance of China’s WGBI inclusion – Min Dai, strategist at Morgan Stanley

“This is a material improvement to bond access, in our view, and increases the chances of WGBI inclusion on September 24 significantly,” the bank’s strategist Min Dai said.

On Argentina’s inverted yield curve reflect growing doubt over government’s ability to repay debt

Pablo Waldman, head of strategy at StoneX Argentina

“This reflects the already very high perceived chance of another default down the road,” said Waldman. “Sophisticated traders are shorting the more liquid short end of the curve to hedge their exposure to longer-dated and harder-to-sell securities.”

Alejo Costa, chief Argentina strategist at BTG Pactual

“That’s the problem with unsustainable policies,” he said. “The country can still adjust its policies, but so far nothing indicates the government will do so in the short term.”

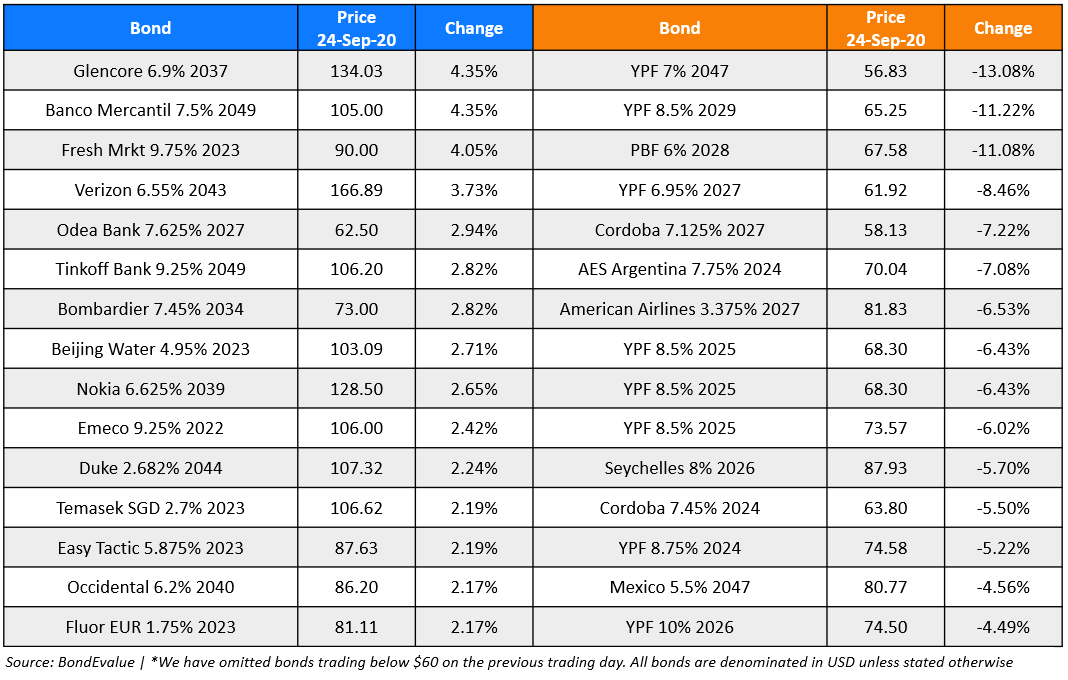

Top Gainers & Losers – 24-Sep-20*

Go back to Latest bond Market News

Related Posts: