This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Evergrande Warns of Default Risk & Rising Litigation Cases

September 1, 2021

Troubled China Evergrande Group warned that “it has risks of default and cases of litigation outside its normal business” in its 1H2021 earnings release. The property developer acknowledged that negative reports adversely affected its liquidity, which led to delays in payment to suppliers and of construction fees in its property development business, consequently leading to stoppage of certain projects. The group said that it was negotiating with suppliers and warned that “If the relevant projects do not resume work, there may be risks of impairment on the projects and impact on the Group’s liquidity.”

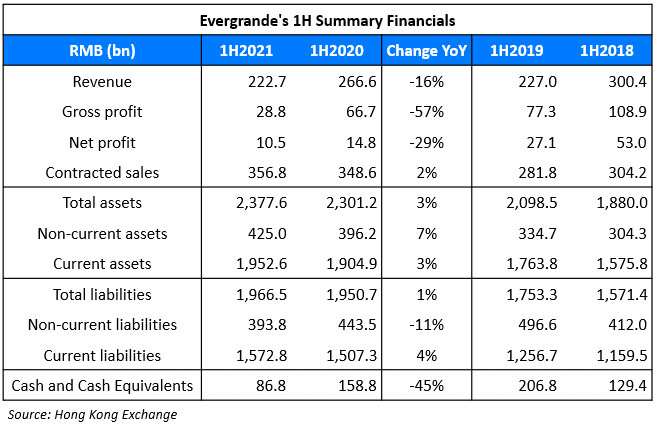

In the table below, we have summarized Evergrande’s 1H2021 numbers with comparisons with the same period for the prior three years. The group reported revenues of RMB 222.69bn ($34.46bn), 16% lower YoY and net profits of RMB 10.5bn ($1.62bn), 29% lower YoY. Both revenues and net profits were at the lowest level in the past four years. The group majorly generates revenues from its property development, which recorded revenues of RMB 211.95bn ($32.79bn), down 18.8% YoY mainly on account of 11.2% drop of average delivered price and an 8.5% decrease in delivered area. The property business of Hengda Real Estate Group and Evergrande Fairyland Group had a net loss of RMB 4.1bn ($634mn), and the new energy vehicle business had a net loss of RMB 4.9bn ($758mn). The contracted sales at RMB 356.79bn ($55.21bn) were up 2% YoY and the highest in the last four years.

On the balance sheet front, both the company’s assets and liabilities swelled up. Cash and cash equivalents were 45% lower than last year at RMB 86.77bn ($13.43bn). As at June 30, the Group had interest bearing debts of ~RMB 571.78bn ($88.47bn), of which debts due within one year are RMB 240.05bn ($37.14bn). The group has taken the following steps to deal with its liquidity:

- It sold property units worth ~RMB 25.17bn ($3.89bn) to suppliers and contractors to set-off some of the outstanding payments

- It sold 11% interest in Hengten Networks Group Limited to two buyers for ~HKD 3.25bn ($418mn), generating a net cash of ~HKD 1.18bn ($152mn) after deducting the shareholder’s loan provided by the Group to Hengten Networks Group Limited

- It sold 1.9% interest in Shengjing Bank Co Ltd for RMB 1.0bn ($155mn)

- It sold 7.08% interest in Shenzhen High and New Technology Investment Group Company Limited for ~RMB 1.04bn ($161mn)

- It sold 49% interest in Evergrande Spring Group Limited for ~RMB 2.0bn ($309mn)

- It sold interests in 5 property projects and other non-core assets for ~RMB 9.27bn ($1.43bn)

The company also repurchased shares for a total consideration of HKD 529.29mn ($68mn) and redeemed HKD 16.12bn ($2.07bn) of its 4.25% convertible bonds due 2023. Its subsidiaries Alpha Beauty Limited and New Gains Group Limited sold shares worth ~HKD 16.35bn ($2.1bn). It also placed shares of Evergrande Vehicle worth ~HKD 10.6bn ($1.36bn) to investors.

Evergrande’s 10.5% 2024s and 8.75% 2025s were down 0.76 and 0.22 to trade at 35.74 and 35.13 respectively. Hengda’s 12% 2023s were up 0.27 to trade at 34.13.

For the full story, click here

Go back to Latest bond Market News

Related Posts: