This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Drafts 16 Point Plan for Property Sector; Longfor Gets ~$2.8bn Debt Issuance Approval

November 14, 2022

China revealed its latest rescue package for the property sector across the country via a 16-point plan given below:

- Property development loans for developers – Lenders to treat developers under state or private ownership equally

- Home-buying requirements for individuals – Support local governments to set down-payment thresholds and mortgage rate floors

- Construction companies – Continuous and stable fundraising by construction companies

- Extension on developer borrowings – Extend outstanding bank/trust borrowings due in the next six months by 1Y

- Bonds – Support bond issuance by quality developers and extend repayment on bonds by negotiations

- Trust Financing – Trust companies encouraged to provide funding support for M&A, rental properties and retirement homes

- Special loans for project completion – CDB and NABARD to offer special loans in an efficient and orderly manner

- Additional support to ensure residential project completion – Financial support for residential construction delays

- Property project acquisition – Support acquisitions of property projects by stronger developers from weaker rivals; Banks/AMCs can issue bonds for real estate project acquisitions

- Market-based approaches including bankruptcy and restructuring – AMCs encouraged to deal as bankruptcy administrators and investors on restructuring of residential projects

- Homebuyers’ mortgages – Encourage banks to negotiate with homebuyers on extending mortgage repayments

- Mortgage repayment – Protect buyers’ credit scores

- Easing a major restriction on banks’ property lending – Temporarily ease restriction on bank lending to developers

- Fundraising for acquisitions – Optimize financing rules

- Lending on rental properties – Ramp up support to companies that own rental property business

- Diversify fundraising for rental properties – Banks can issue bonds dedicated to building rental properties

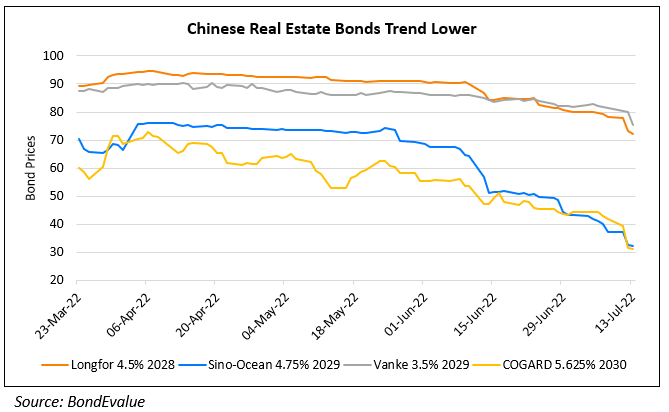

Separately, Longfor Group got approval from NAFMII, the interbank bond market regulator to issue up to RMB 20bn ($2.8bn) in state-backed debt. Longfor was the first developer to issue these state-backed bonds in late August where it raised RMB 1.5bn ($219mn) via 3Y notes. Longfor’s dollar bonds were trading flat at 47-54 cents on the dollar.

Go back to Latest bond Market News

Related Posts: