This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

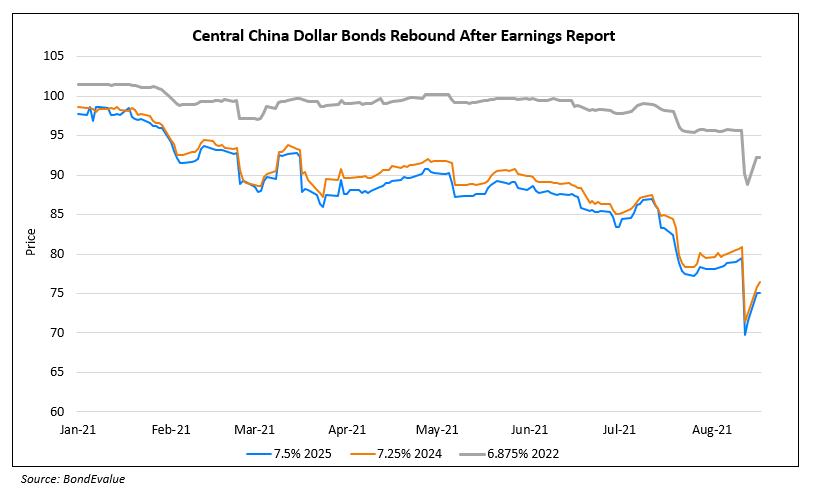

Central China’s Dollar Bonds Recover Some of Last Week’s Losses

August 24, 2021

Central China Real Estate (CCRE) saw its dollar bonds recover some of the losses last week after it reported 1H earnings last Wednesday. CCRE’s 6.875% 2022s fell ~7 points between August 18-20 after the results were announced but have now recovered some of the losses, up ~3.5 points this week to currently trade at 92.25 yielding 15.97%. Its longer dated 7.5% 2025s had a similar move, down ~10 points late last week before recovering over 5 points this week to 75 yielding 16.46%.

Go back to Latest bond Market News

Related Posts:

Country Garden Plans to Raise $1.03bn via Share Sale

November 19, 2021

Country Garden Secures $2.4bn Financing Deal

March 9, 2022