This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

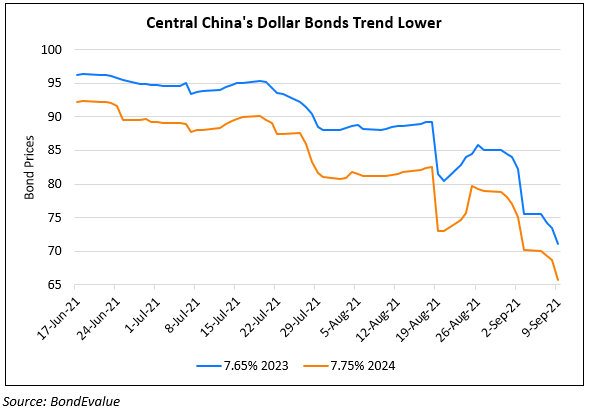

Central China Real Estate Downgraded to B3; COGARD Outlook Negative

April 5, 2022

Central China Real Estate (CCRE) was downgraded to B3 from B1 due to its “weakened liquidity and heightened refinancing risks”. As of December 2021, offshore debt amounted to 70% of CCRE’s total debt that includes $500mn due in August 2022 and $300mn due in April 2023. Its unrestricted cash dropped sharply to RMB 5.9bn ($930mn) at end-2021 from RMB 22.6bn ($3.5bn) at end-2020 as it repaid ~RMB 10bn ($1.6bn) of bonds. While its debt reduced by 30% YoY to RMB 21.9bn ($3.4bn), its unrestricted cash/short-term debt declined to 87% from 148% in the above period. Moreover, contracted sales fell 12% to RMB 60bn ($9.4bn) in 2021 and is expected to dip further in 2022. Measures like scaling down on land acquisitions and using internal cash to repay debt amid tight market conditions would weigh on its finances. On the positive side, its interest coverage is set to stay almost unchanged at 2.2-2.3x over the next 1-2 years.

CCRE’s dollar bonds were stable with its 2024s trading at 44-45 cents on the dollar.

Separately, Country Garden’s (COGARD) outlook was revised to Negative from Stable by Fitch primarily due to decreasing contracted sales and sales collection since Q3 2021 and a declining profit margin across the sector. Also its leverage is higher than that of most investment-grade peers. Contracted sales fell 19% YoY in Q3 2021, 11% in Q4 2021, followed by a 10% and 23% YoY drop in January and February 2022. It also has a high exposure to lower tier cities which tend to have weaker economies. However, Fitch expects COGARD’s margins to improve in the next 1-2 years due to lower land acquisition costs.

COGARD’s dollar bonds were trading slightly weaker with its 2030s at 68-70 cents on the dollar.

Go back to Latest bond Market News

Related Posts: