This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

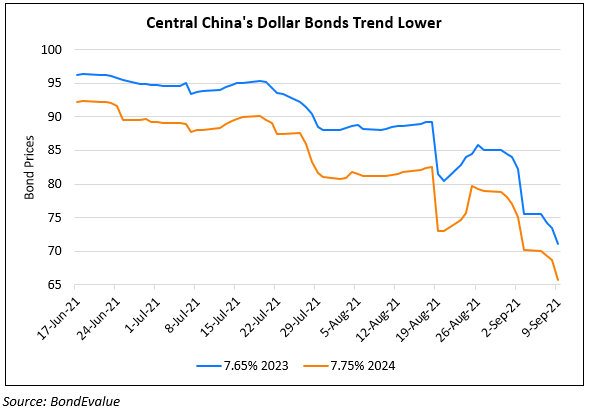

Central China Real Estate Downgraded to B from B+ by S&P

April 18, 2022

Central China Real Estate (CCRE) was cut to B from B+ by S&P, with a negative outlook. CCRE’s business strength has deteriorated due to decline in sales scale and margins and this is likely to continue over the next 12-24 months. This comes on the back of weaker local demand and volatility in Henan’s property market which can offset its market leader position, known to be a competitive advantage. CCRE conservatively expects contracted sales to fall 12% YoY to RMB 53bn ($8.3bn) in 2022. Already in Q1 2022, CCRE has a 42% YoY drop in sales to RMB 6.2bn ($970mn). S&P notes that CCRE’s liquidity buffer has also narrowed – unrestricted cash dropped 74% to RMB 5.9bn ($930mn) at end-2021 with debt also dropping 30%. At end-2021, its unrestricted cash to short-term debt stands at 0.9x vs. 1.5x at the beginning of the year. CCRE has high repayment needs in the next 1-2 years and S&P revised its liquidity to “less than adequate”.

CCRE’s dollar bonds were trading stable at 37-44 cents on the dollar.

Go back to Latest bond Market News

Related Posts: