This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CCB, Aoyuan Launch Bonds; Fed Dot Plot Shows Low Rates Through 2023; Delta Issues Largest Airline Debt; Argentina Tightens FX Policy

September 17, 2020

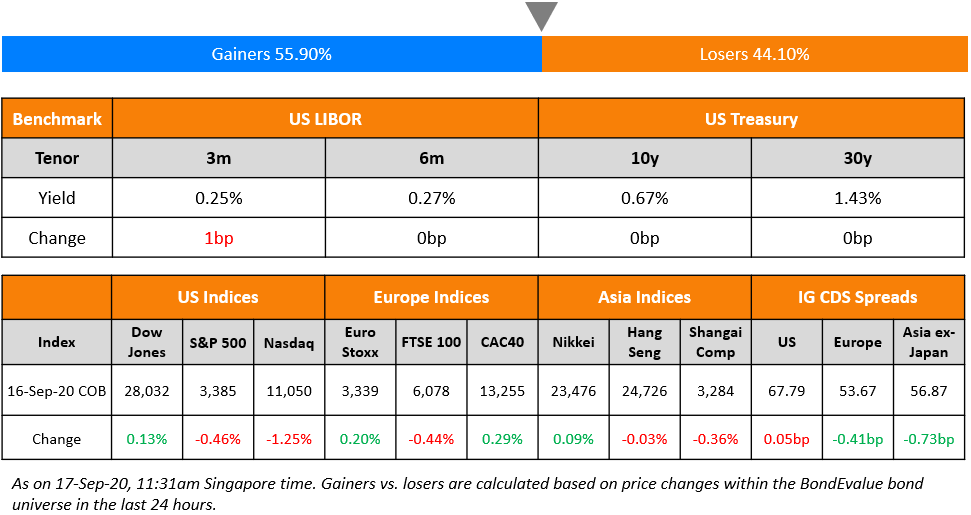

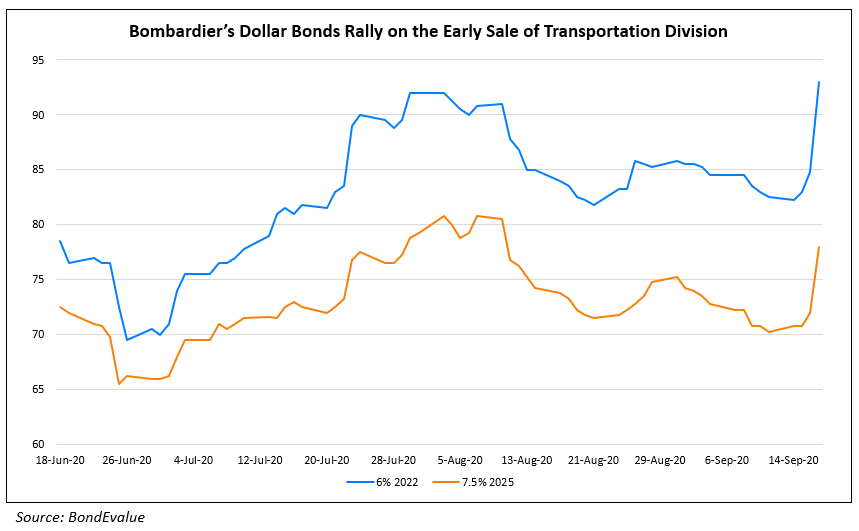

The Fed Meeting showed dot plots of 2023 for the first time (click here for the older dot plot) with rates projected to be unchanged for the next three years. FOMC mentioned they would increase holdings of Treasuries and mortgage-backed securities (MBS) at least at the current pace to keep financial conditions loose. Also, US Retail Sales decelerated to 0.6% MoM against expectations for a 1% print showing initial signs of enhanced employment benefits wearing out. Crude rallied nearly 3% with inventory drawdowns at 4.39mn, far below expectations for a buildup. Treasuries were almost unchanged, while US stocks moved lower (S&P down 0.46%) with big tech dragging the index (NASDAQ down 1.67%, Apple and Amazon down 2.95% and 2.47% respectively) keeping the Asian morning session on the backfoot, down around 0.5%. US IG CDS spreads widened by 5bp.

.jpg?upscale=true&width=1400&upscale=true&name=NL-All-Modules%20(2).jpg)

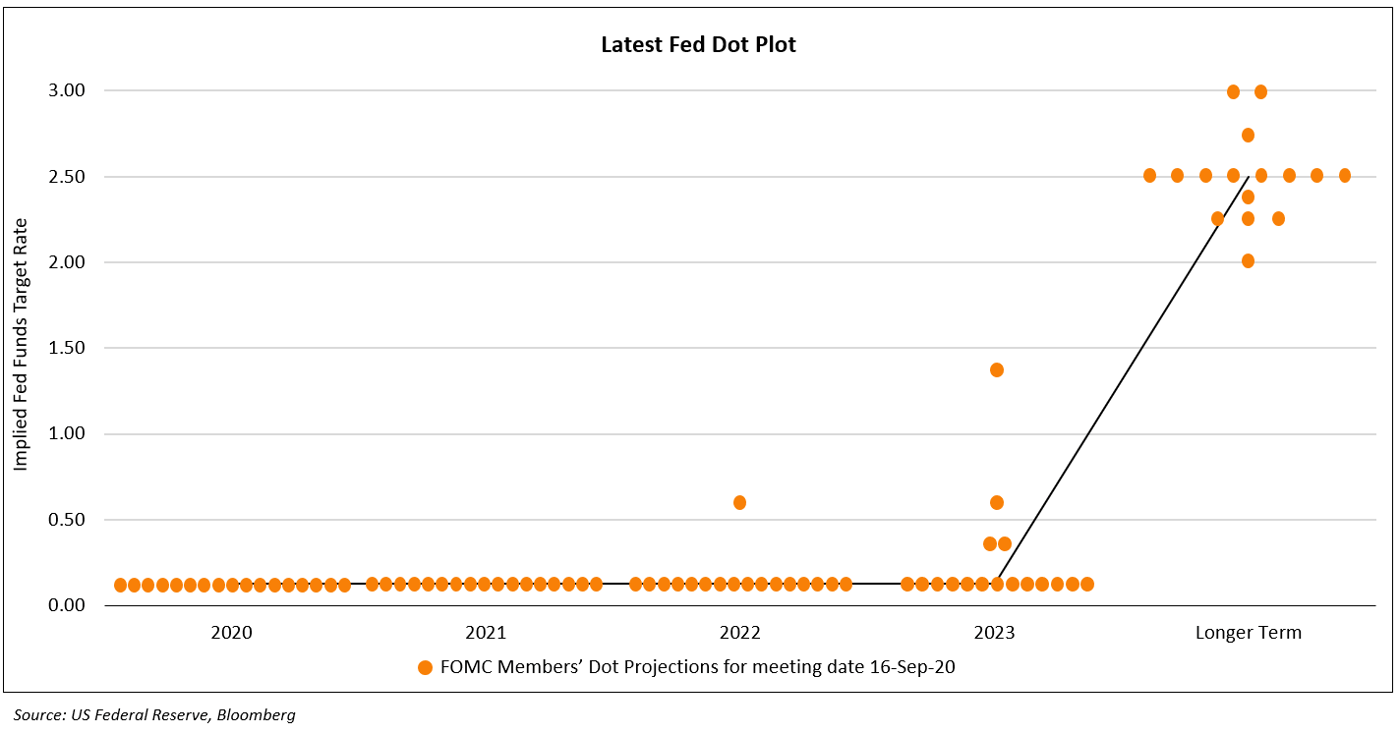

New Bond Issues

- CCB Singapore branch S$ 3yr @ SOR+90bp area

- Aoyuan Group $ 5.5NC3 @ 6.5% area

- Beijing Enterprises EUR 5yr green @ MS+190bp area

- Jining High Tech $ tap 5.5% 2023 final @ 5.5%

- Tianyi $ 5yr @ T+200bp area

- Hefei Industry Investment $ 3yr @ 3.3% area

- Concord New Energy $ 3yr @ 10.75% area

Trafigura Group raised $400mn via 5Y bonds to yield 5.875%, 50bp inside initial guidance of 6.375% area. The bonds received orders exceeding $700mn when initial guidance was announced, 1.75x issue size.

Scentre Group raised a total of $3bn via a dual-tranche bond offering. It raised $1.5bn via 60Y non-call 6Y to yield 4.75%, inside initial guidance of low 5% area. It also raised $1.5bn via 60Y non-call 10Y to yield 5.125%, inside initial guidance of mid 5% area. The bonds, with expected ratings of Baa1/BBB+/BBB+, received total orders exceeding $9.5bn, 3.2x issue size.

Rating Changes

Moody’s upgrades Eletrobras rating to Ba2 and raises its BCA to ba3; outlook changed to stable

Moody’s upgrades Jiangsu Zhongnan’s CFR to B1; outlook stable

Moody’s upgrades CEMIG and its subsidiaries to Ba3/A1.br; outlook positive

Moody’s downgrades Unibail Rodamco Westfield ratings; stable outlook

Moody’s changes Lendlease’s outlook to stable; affirms ratings

Fitch Affirms Bankia at ‘BBB’; Outlook Negative; Removed from Rating Watch Negative

GameStop Corp. Ratings Affirmed; Off CreditWatch On Expected Improved Credit Metrics; Outlook Stable

ICBC Raises $2.9bn via Additional Tier 1 Perpetual Preference Shares

ICBC raised $2.9bn via AT1 non-cumulative perpetual offshore preference shares (Term of the day, explained below) at a yield of 3.58% (dividend), 37bp inside initial guidance of 3.95% area. Moody’s has rated the securities at Ba1, three notches below ICBC’s Adjusted Baseline Credit Assessment (BCA) of Baa1 as investors risk full or partial compulsory conversion into ICBC’s H shares on the non-viability trigger event. This trigger event is based on (1) The regulator (CBIRC) determining that ICBC will not be able to exist if there is no conversion or write-off of its Capital, (2) Regulators determining that ICBC will not be able to exist without public sector capital infusion or equivalent support, whichever occurs earlier. The shares have a dividend rate reset on the 5th year and every five years thereafter to a new fixed dividend rate equal to the prevailing 5Y Treasury yield plus the initial fixed margin of 330bp. The issue has a dividend stopper. These preference shares rank senior only to common stock. ICBC last issued offshore preference shares in December 2014 and an offshore AT1 perpetual in 2016. The old AT1s, callable in July 2021 at 100 are currently trading at a yield of 3.267%. Underwriters to the deal include ICBC Standard Bank, Goldman Sachs, Deutsche Bank amongst others. The new preference shares fell on the secondary markets this morning to 99.6 cents on the dollar, down 0.40 points from issue price of 100.

Delta Raises $9bn via Jumbo Debt Sale – The Largest by An Airline on Record

Delta Air Lines raised a massive $9bn via a debt sale, the largest issuance by an airline ever, on Wednesday. The debt is backed by its frequent flier program SkyMiles and is rated Baa1, two notches higher than its issuer rating of Baa3 by Moody’s. Details of the issuance are as follows:

- $2.5bn 5Y bonds at a yield of 4.5%, 423bp over Treasuries and 25bp inside initial guidance of 4.75% area

- $3.5bn 8Y bonds at a yield of 4.75%, 422bp over Treasuries and 25bp inside initial guidance of 5% area

- $3bn 7Y loan at 375bp over Libor issued at 99

The attractive yield coupled with a relatively higher investment grade rating led investors to place orders worth $16bn for the bonds, 2.7x issue size and $10bn for the loan, 1.4x issue size. This allowed the issuer to upsize the deal from the original $6.5bn planned issuance. As per Bloomberg, the 4.75% yield on the 5Y tranche is over double the average yield of 2.31% on the lowest rated unsecured investment grade bonds based on a Bloomberg Barclays index. The previous record for the largest debt sale by an airline was held by peer United Airlines with its $6.8bn issuance, also backed by its mileage program, in June. The new 5Y bonds offer a new issue premium of 17bp vs. its $3.5bn 7% bonds issued in late April due May 2025, which are currently trading at a yield of 4.33% on the secondary markets. This is despite the older bonds’ one notch lower rating of Baa2.

For the full story, click here

Verizon Raises $1bn via 10Y Green Bond

American telecom company, Verizon Communications Inc. raised $1bn via a 10Y green bond at a yield of 1.512%, 83bp over Treasuries and 27bp inside initial guidance of T+110bp area. The bonds are expected to be rated BBB+/Baa1/A- and proceeds are to be used either for the development, construction or operation of renewable energy facilities, including wind or solar energy projects, or the purchase of renewable energy that helps bring renewable energy to the grids that power its networks, as per its SEC filing.

For the full story, click here

Novartis, Volkswagen & Burberry Join Global Push for ESG Finance with Sustainable & Green Bonds

The push for environmental, social and governance (ESG) finance is gaining steam with European corporates pricing new sustainable and green bonds on Wednesday. Swiss drugmaker Novartis raised €1.85bn via a sustainable bond with an interesting structure – the bonds’ coupon increases if it fails to expand access to medicines and programs to fight malaria and leprosy in some developing countries. This comes a week after Brazilian paper company Suzano raised $750mn via a sustainable bond whose coupon is linked to its carbon-emission targets. Novartis’ new bond, which has an 8Y maturity and a yield of 0.08% at issuance, has a coupon step-up of 25bp after 2025 if it fails to achieve either of its two targets: (a) At least 200% increase in patients reached in Lower and Lower Middle Income Countries (LMICs) with Strategic Innovative Therapies by 2025, and (b) At least 50% increase in patients reached in LMICs with the Novartis Flagship Programs by 2025, as per the company’s investor presentation.

Volkswagen AG raised €2bn via a debut green issuance in two-tranches:

- €1.25bn 8Y bond at a yield of 0.944%%, 125bp over Mid-Swaps and 55bp inside initial guidance of MS+170bp area

- €750mn 12Y bonds at a yield of 1.366%, 150bp over Mid-Swaps and 45bp inside the wide end of initial guidance of MS+190-195bp

The new bonds, expected to be rated A3/BBB+, met with strong investor demand with orders peaking at €11bn, 5.5x issue size. As per Bloomberg, the 8Y and 12Y bonds priced ~15bp and ~14bp inside its conventional bond curve indicating the strong demand for bonds that have a positive environmental impact.

British luxury brand Burberry raised GBP 300mn via the world’s first sustainable bond by a luxury company as per Burberry. The 5Y sustainable bonds priced to yield 1.223%, 135bp over UK Gilts and 45bp inside initial guidance of UKT+180bp area. The bonds, expected to be rated Baa2, received orders worth GBP 2.35bn, almost 8x issue size. Proceeds will be used towards “eligible sustainable projects” such as building energy-efficient warehouses and ensuring its cotton comes from the right sources, according to the FT.

Argentina’s Bonds Fall as Central Bank Tightens Forex Restriction

Argentine dollar bonds fell on news of tighter restrictions on foreign exchange control by the central bank as the country hustles to maintain its shrinking foreign reserves. The worst hit from the new restrictions were the corporates with high dollar debt. With the new rules, Argentina aims to reduce the loss of $800mn/month in reserves spent on corporate debt maturities. Corporates whose monthly debt expenditure in dollars exceeds $1mn/month are required to restructure their debt. These highly indebted corporates would not be provided dollars at the official rates till the time they refinance at least 60% of this outstanding debt. The restrictions could apply to as much as $3.3bn of debt and has led to a rout in the corporate bond prices as this has the potential to trigger corporate defaults. Banco Central de la República Argentina (BCRA) head Miguel Ángel Pesce also announced a 35% tax on dollar purchases by retail savers through a statement on Tuesday. This tax is over and above the 30% ‘solidarity tax’ already being levied. There is also a restriction of $200 on the purchase of dollars. The minimum holding period on the dollar assets received from outside the country will also be increased to 15 days.

Argentina has just recently completed a major debt restructuring worth $65bn and is going through a period of high inflation. The country is also in the process of seeking upto $44 billion financing from the IMF. The high inflation has led to weakening of the peso and has resulted in investors turning to the dollar bond market. According to Bloomberg, almost 10% of the country’s population purchased greenbacks in July. According to the central bank, “The initiative intends to maintain the current monthly quota of $200, but discourage the demand for foreign currency made by human persons for the purposes of hoarding and card expenses”. However, these measures may fall short as per analysts. Credit Suisse analysts including Daniel Chodos wrote in a note “These measures, in our view, will be insufficient to stabilize international reserves,” while adding “We would expect the spread between the ARS in the parallel markets and the official ARS to widen.”

Offshore corporate bonds maturing in the next six months include Banco Hipotecario (BHIP) $281mn maturing in November 2020 and energy company YPF’s debt of $413mn maturing in March 2021. Most of YPF’s dollar bonds were down ~10%. Argentina’s dollar bonds also traded lower in the secondary markets with its new 0.125% bonds due in 2030 and 2041 trading at 46.75 and 42.9 cents on the dollar down 1.31 and 1.55 points respectively.

For the full story, click here

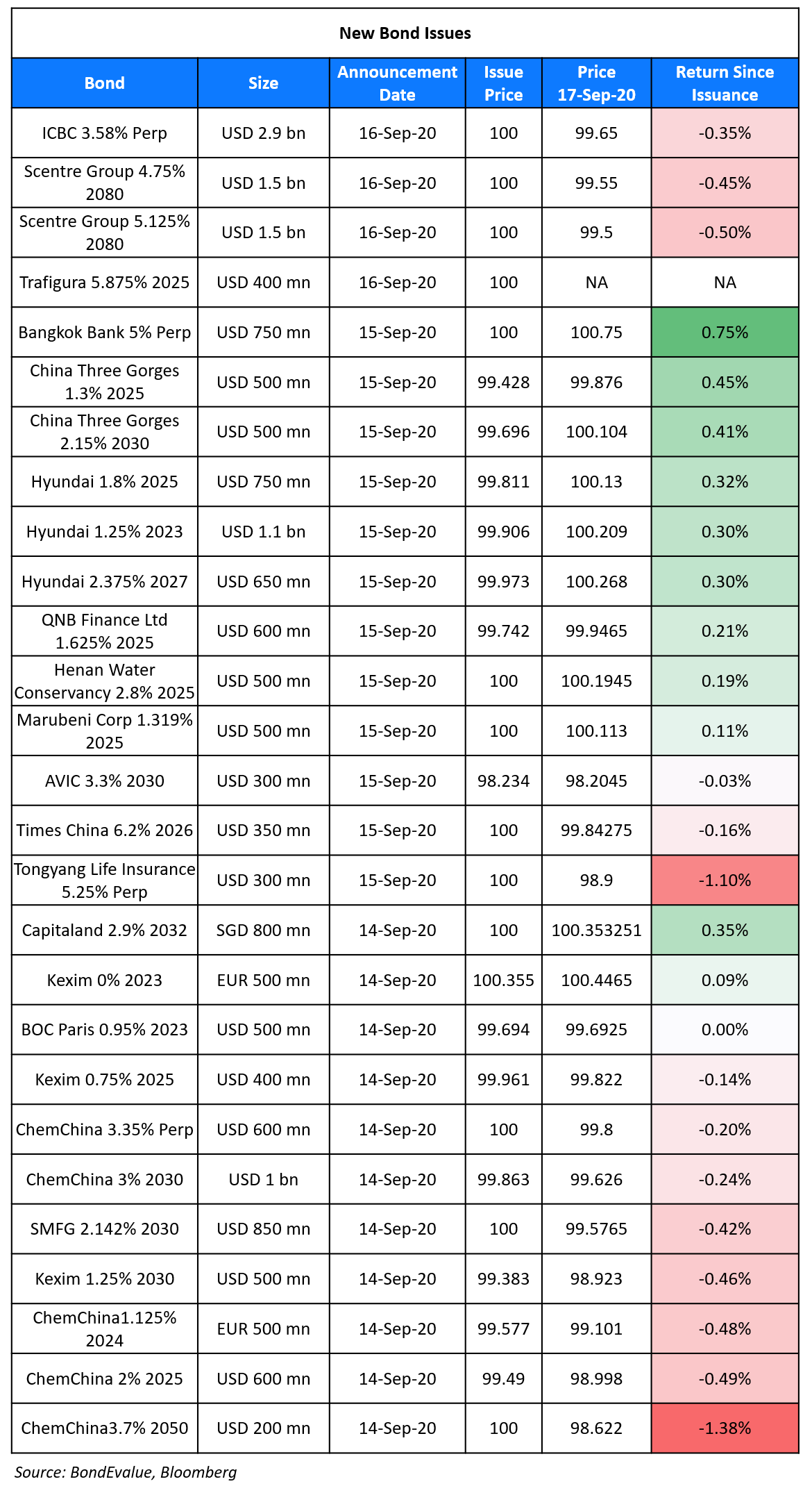

Bombardier Bonds Rally on News of Earlier Than Expected Sale of Transportation Division to Alstom

Bombardier Inc signed a definitive Sales and Purchase Agreement (SPA) with and Alstom and Caisse de dépôt et placement du Québec (“la Caisse”) for the sale of its Transportation business to Alstom. According to the SPA, both Bombardier and la Caisse will sell their shares in the rail unit to Alstom based on an enterprise valuation of $8.4bn (€7.15bn), which is lower by $350mn (€300mn) from the original MoU signed in in February. However, this amount is offset due to the improved currency exchange rate. Under the new agreement, Bombardier will receive ~$4bn and la Caisse will receive $2.2bn. Bombardier had announced its intent to accelerate its deleveraging process through the sale of its Transportation Division to Alstom in February this year at an enterprise value of $8.2bn (€7.45bn). The deal is now likely to close earlier than expected in Q1 2021 as some regulatory approvals including from the European Commission have already been obtained. However, the closing remains subject to the remaining regulatory clearances and Alstom shareholders’ approval on October 29, 2020 during the Extraordinary Shareholders’ Meeting. “Today’s announcement marks a significant milestone towards achieving our near-term priorities and repositioning Bombardier as a pure-play business jet company,” said Éric Martel, President and Chief Executive Officer, Bombardier Inc. “The proceeds from this transaction will allow us to begin reshaping our capital structure and start addressing our balance sheet through debt paydown, so that we can achieve the full potential of our incredibly talented employees and our industry leading business jet portfolio.”

The Bombardier’s bonds were up ~ 4-10% on the news with its 6% and 7.5% bonds due 2022 and 2025 trading at 93 and 78 cents on the dollar, up 8.25 and 6 points respectively.

For the full story, click here

Term of the Day

Preference Shares

Preference shares are a type of security issued by corporates that has features of both bonds and common stock. In terms of capital structure, preference shares pay dividends and have seniority over common stock but are subordinated to bonds. They do not have voting rights unlike common equity and pay dividends out of each year’s net profits. There are various types of preference shares – non-cumulative, redeemable/irredeemable, convertible, participating etc. In the case of cumulative preference shares, the company can pay cumulative dividends in the following year if the particular year’s profits are not enough.

Convertible preference shares have some similarities to CoCo bonds in that both are considered Additional Tier 1. The conversion ratio though is pre-determined for the preference shares while for CoCos it is based on the prevailing ratio at the time. Also, preference shares are based on the income statement while CoCos are balance sheet based. For example, a bank making a loss after tax in a year may be able to pay interest on CoCos if capital levels are satisfactory but not dividends on preference shares. Alternatively, a bank making some profits could pay preferred dividends but may not be able to pay up on CoCos if capital levels are unsatisfactory and thus may get triggered. Differences of preference shares as against perpetual bonds, may include characteristics like step-ups etc. besides capital structure seniority of the latter.

Talking Heads

On monetary policy in the near future – Jerome Powell, Fed Chairman

“Rates will remain highly accommodative until the economy is far along in its recovery “

On the EU to raise 30% of stimulus plan through green bonds

Ursula von der Leyen, European Commission President

“We are world leaders in green finance and the largest issuer of green bonds worldwide,” von der Leyen said. “And I can today announce that we will set a target of 30% of NextGenerationEU’s 750 billion euro to be raised through green bonds,” she said.

Guntram Wolff, director of the Brussels based think tank Bruegel

“I haven’t heard much from the Commission president today on that,” said Wolff. “In all those areas the technology is starting to be there, but it is not yet fully competitive. If you want to make it competitive, you have to price very heavily emissions and that’s gonna be a drag on economic growth,” Wolff said.

Powell “did emphasize that purchases will continue at ‘at least’ the current pace, and noted that they could change the composition,” said Garretson. “Perhaps there was some chance that the market was looking for the pivot toward longer-dated Treasury purchases,” and the lack of that is one factor “driving modest curve steepening.”

“So as long as the Fed is signaling that it’s at least thinking about thinking about doing more, that’s likely to be sufficient for markets, and will probably place a speed limit on further yield-curve steepening,” he said.

On the Fed’s possible intentions for leaving rates unchanged

David Kelly, chief global strategist at JPMorgan Asset Management

“Low long-term interest rates aren’t going to stimulate anything. But now what we’re doing is essentially monetizing the debt. The Federal Reserve has already lent the federal government over $2 trillion this year. … And regardless of who wins the next election, you could have deficits of between $1.5 [trillion] and $2 trillion over the next two years after this fiscal year. If you’ve got that kind of fiscal stimulus and the government’s able to do it essentially for free because the Federal Reserve’s lending the money, that is very stimulating.”

John Bellows, portfolio manager at Western Asset

“I think the reason that the Fed did it today was precisely to tell you what the policy would be even after Covid and that the policy would be easy, the policy will be at zero. And I think the Fed went out of their way to speed up the announcement; they did not wait for the all-clear. … Instead they’re telling you now, they’re telling you now what the policy is going to be after Covid, and it’s going to be easy. And the reason it’s going to be easy is because they need to get inflation back up. They need to address this unevenness in the recovery.”

“Pushed too far… the programmes may impair the ability of central banks to respond to future crises, with rating implications for the respective sovereigns. If investors begin to view government reliance on central bank funding as a long-term, structural feature of the economy, these monetary authorities could lose credibility.”

“The relatively mild market impact of central bank purchases of government bonds in these countries could change if the institutions increased their purchases, or if investors no longer saw the buying as temporary,” S&P said.

“We assign a subjective 60-70% probability of inclusion this September and forecast WGBI-related inflows to be US$60-90 billion,” Morgan Stanley’s analysts wrote. “This supports our view that China will continue to reform its financial market and attract $3 trillion of inflows in the next decade.”

Top Gainers & Losers – 17-Sep-20*

Go back to Latest bond Market News

Related Posts: