This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Capitaland Launches S$ Bond; Macro; Rating Changes; New Issues; Gainers and Losers

June 8, 2023

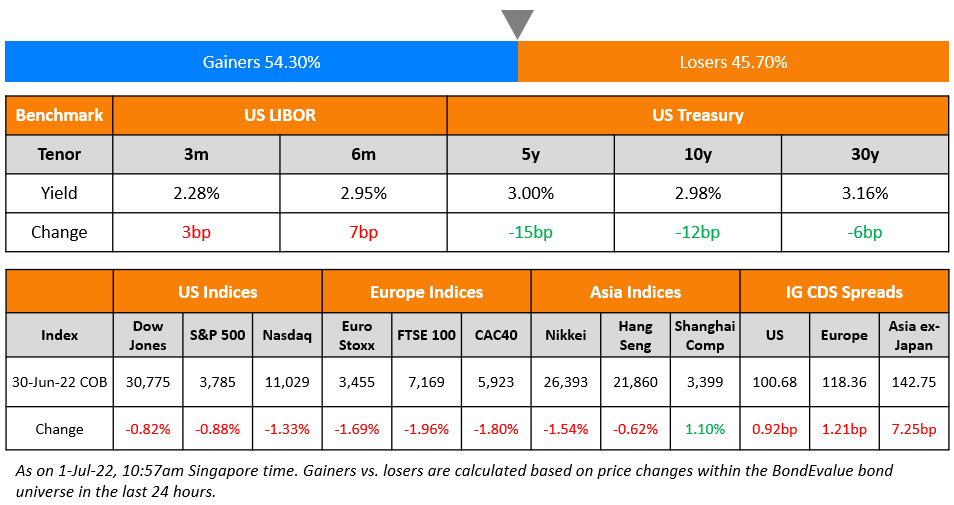

US Treasury yields jumped higher on Wednesday led by the 5Y and 10Y yields that rose 11-13bp. Expectations are for a status quo at the June FOMC meeting with a 67% probability. However, markets are instead pricing-in either a 25bp or 50bp rate hike in the July meeting with a 68% combined probability, according to the CME FedWatch tool. The peak Fed Funds Rate moved 2bp higher to 5.28% for July. Equity indices ended lower yesterday with the S&P and Nasdaq down by 0.4% and 1.3%. US IG and HY CDS spreads widened 0.7bp and 1.5bp respectively. The Bank of Canada surprised markets by raising its target policy rate by 25bp to 4.75% citing an overheating economy. After having said that it would likely hold off on further rate increases in its January meeting, the above move came as a surprise.

European equity indices closed higher too. European main CDS spreads widened 0.5bp and Crossover spreads were 3.5bp wider. Asia ex-Japan CDS spreads saw a 0.9bp widening and Asian equity markets have opened with a negative bias this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

-

Capitaland S$ 7Y Green at 4.2% area

.png)

BBVA raised €750mn via a 10.25NC5.25 Tier 2 bond (Term of the Day, explained below) at a yield of 5.901%, 25bp inside initial guidance of MS+305bp area. The bonds have expected ratings of Baa2/BBB/BBB-, and received orders over €1.25bn, 1.7x issue size. Proceeds will be used for general corporate purposes. The new bonds are priced 18.1bp wider than SOCGEN’s recently issued 5.625% Tier 2s (rated Baa3/BBB-/BBB) that mature in 2033.

Commercial Bank of Dubai raised $500mn via a 5Y debut green bond at a yield of 5.319%, 35bp inside initial guidance of T+175bp area. The senior unsecured bonds have expected ratings of Baa1/A- (Moody’s/Fitch), and received orders over $1.4bn, 2.8x issue size. Proceeds will be used to finance/refinance eligible projects (as defined in the Sustainable Financing Framework), which may include: green buildings; renewable energy; clean transportation; access to education; and pollution prevention and control.

Vale raised $1.5bn via a 10Y bond at a yield of 6.245%, 30bp inside initial guidance of T+275bp area. The senior unsecured notes have expected ratings of Baa3/BBB-/BBB. Proceeds will primarily be set aside to fund the concurrent tender offers, while the remainder will be used for general corporate purposes.

ASB Bank raised $650mn via a 3Y bond at a yield of 5.346%, 15bp inside initial guidance of T+130bp area. The bonds have expected ratings of A1/AA-. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- EDF hires for bond

- SK Broadband hires for $ 3Y or 5Y bond

- Pertamina Geothermal hires for bond

- H&H International hires for $ 3Y bond

Rating Changes

- Fitch Upgrades eHi’s Ratings to ‘B’; Outlook Stable

Term of the Day

Tier 2 Bonds

Tier 2 bonds are debt instruments issued by banks to meet their regulatory tier 2 capital requirements. Tier 2 capital (and thus tier 2 bonds) rank senior to tier 1 capital, which consists of common equity tier 1 (CET1) and additional tier 1 (AT1) capital. CET1 consists of a bank’s common shareholders’ equity while AT1 consists of preferred shares and hybrid securities or perpetual bonds. Tier 2 capital consists of upper tier 2 and lower tier 2 wherein the former is considered riskier to the latter. From a bond investor’s perspective, tier 2 bonds are senior, and therefore less risky compared to AT1 bonds as AT1s would be the first to absorb losses in the event of a deterioration in bank capital, as was the case with Credit Suisse.

Talking Heads

On Central Banks’ Impact on Inflation – Man Group Chief Executive Luke Ellis

“The bigger picture is that central banks think they’ve done a lot but they haven’t really made much difference to inflation at all. Rate rises have made a dent in manufacturing but not in services.”

On a Fed Interest Rate Hike Pause in June

Philip Marey, senior U.S. strategist at Rabobank

“Powell expressed his bias in favor of remaining on hold in June…he’s going to stick with that as it gives them an additional month of data to look at, although I seriously doubt whether that will give them any new insights.”

Andrew Hollenhorst, chief U.S. economist at Citi

“There is not a substantial economic difference between raising policy rates in June or doing so in July. But communicating why rates should not rise in June, despite data to the contrary will be challenging…If most Fed officials feel at least another 25-basis-point hike will be necessary, it seems simplest to deliver that hike in June rather than skip.”

Oscar Munoz, chief U.S. macro strategist at TD Securities

“The longer they don’t hike, the longer the economy is going to continue expanding above trend … the longer you postpone that decision, the harder it is going to be to bring inflation lower.”

On Interest Rate Hikes around the World

Colin Graham, head of multi-asset strategies at Robeco

“Expectations for July have now shifted from an expected cut to an expected rise (for the Fed).”

Diana Iovanel, economist at Capital Economics

“With inflation having proved more stubborn than we’d thought, we now think the central bank will keep its policy rate higher for longer than we had previously projected,”

Guy Stear, head of fixed income research at Societe Generale SA

“(The ECB is) behind the curve in terms of inflation pressure, in terms of rates…They have to keep going.”

On the Fall in Wall Street’s Once-Hot Trades of 2023

Mark Freeman, chief investment officer at Socorro Asset Management LP

“Investors underestimated the growth profile of the US and overestimated the pace of recovery in China…(They) did not have AI on their radar at that point, which has easily been the biggest factor driving the markets.”

Tony Pasquariello, head of hedge-fund coverage at Goldman Sachs

“There are still detectably strong and fairly widespread expectations of a US recession (for the next 12 months)…That view — if more psychological than currently positioned for — has been challenged by the recent macro data set and equity market price action.”

Kristen Bitterly, head of North America investments at Citi Global Wealth Management

“The reality of it — we’re still in tighter financial conditions.”

Ricardo Bonilla, Colombian Finance Minister

“Colombia’s message of economic stability has provided calm to financial markets, and investors have responded by accepting lower yields in local bond sales offered by the government.”

Alejandro Arreaza, Sebastian Vargas and Badr El Moutawakil, strategists at Barclays

These Barclays strategists upgraded their recommendation on Colombia’s dollar debt to overweight from market weight, and recommended buying Ecopetrol bonds maturing in 2030 as Petro loses political support and economic fundamentals improve.

Top Gainers & Losers – 08-June-23*.png)

Go back to Latest bond Market News

Related Posts:-1.png)