This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

C-Rated Bonds Account for Largest Share of Junk Issuance Since 2007

February 16, 2021

Issuers rated CCC and lower have accounted for the largest chunk of US junk bond issuances since 2007, as per the FT. FT notes that more than 15% raised in the US high yield bond markets have been issued by CCC and/or below issuers. Junk rated categories begin from BB+ with only CC rating separating CCC from default going by S&P’s issuer rating scale. From the rating agencies point of view, 21% and ~15% of high yield issues rated by Moody’s and S&P were rated CCC and/or lower. “Last year it was the strongest companies that reacted to unprecedented events by shoring up their balance sheets in case cash was needed…Now we are deep at the bottom of the barrel in terms of the weakest and most fragile issuers finally being able to fund themselves in this market”, said Oleg Melentyev, a BofA analyst. Over the last quarter, Melentyev says that bond sales by CCC rated companies have hit a record pace – they raised $3.5bn in three separate weeks last month, something that has happened only seven times in the last two decades. The ICE BofA CCC & Lower US HY effective yield is at its lowest ever, currently at 7.2%. But it should be noted that the OAS (Term of the day, explained below) in this category, a measure of credit risk, is not at all-time lows, currently at 677bp.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

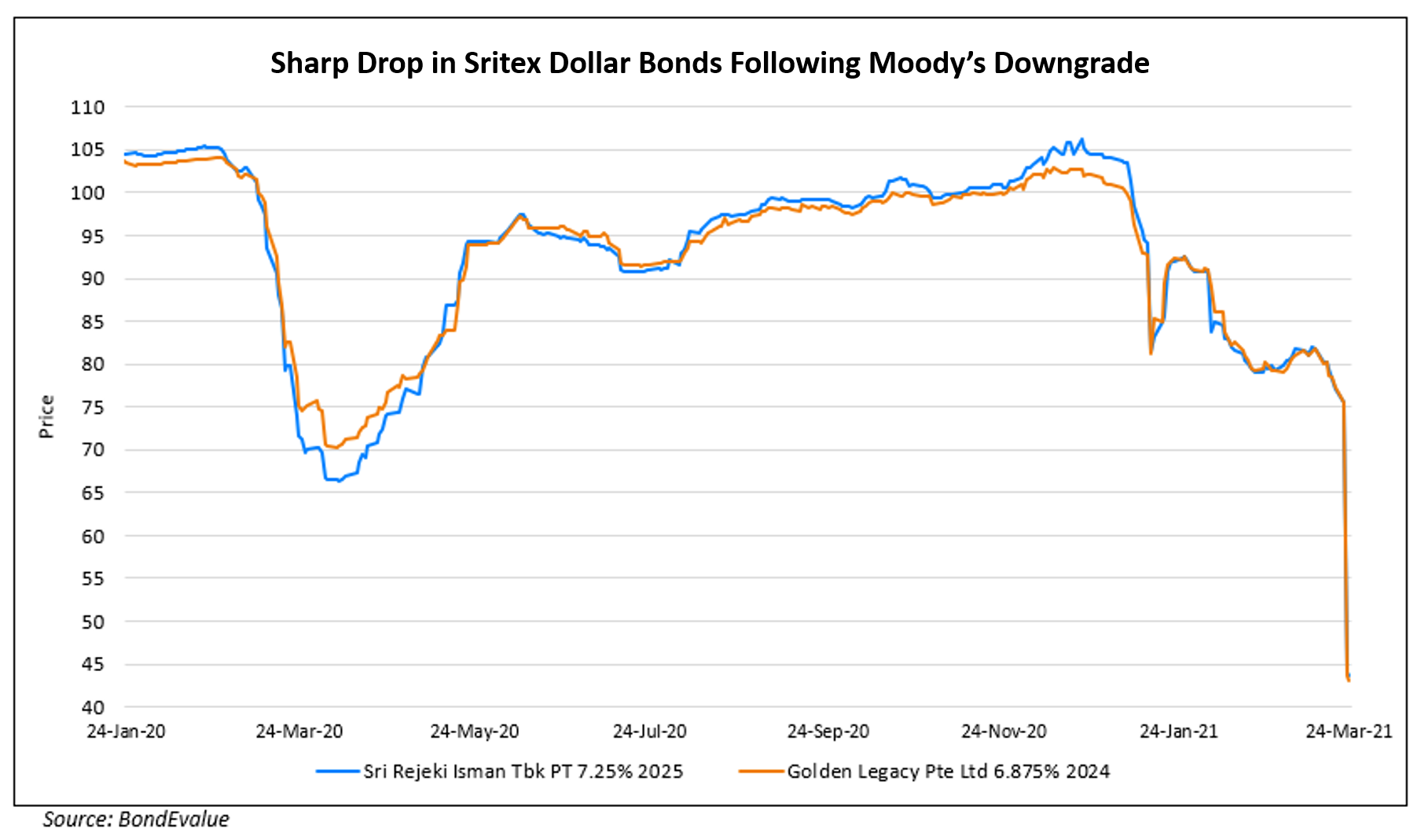

Sritex’s Dollar Bonds Nosedive Over 40% Post Downgrade

March 24, 2021

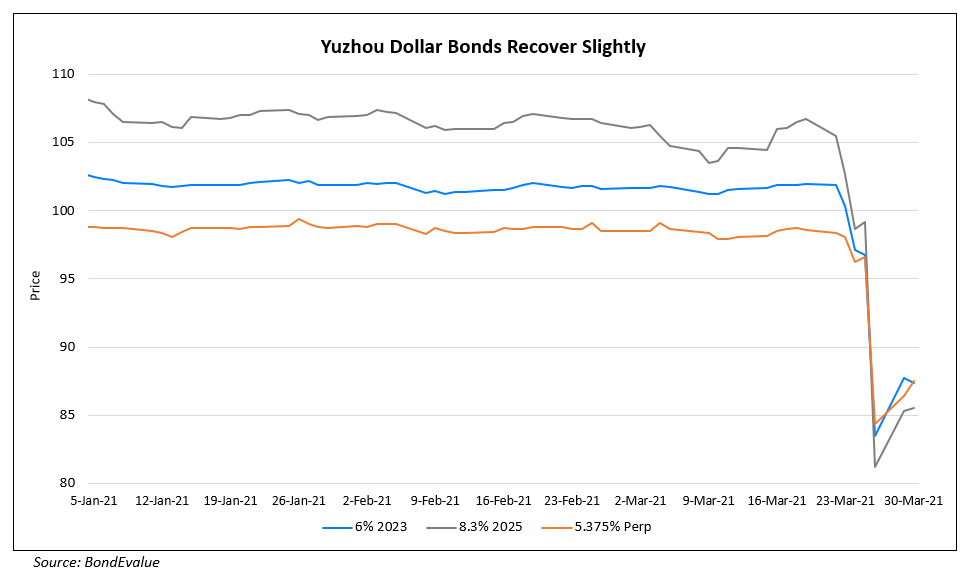

Yuzhou’s Bonds Recover Slightly

March 30, 2021