This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BNP Paribas’ Profits Jump, To Lift Payout Target

February 9, 2022

BNP Paribas reported a jump in its annual 2021 profits by 34.3% to €9.5bn ($10.9bn). The group’s revenues rose 4.4% to €46.2bn ($52.8bn). Profits were helped by its cost of risk falling 49% through the year to €2.9bn ($3.3bn) alongside a sharp 46% rise in operating income to €12.2bn ($13.9bn). Its cost of risk (Term of the Day, explained here) dropped due to the limited number of new defaults and a high basis of comparison with respect to 2020. Growth was visible across its domestic, international financial services, and investment banking divisions. BNP Paribas lifted its shareholder payout target to 60% of profits via a combination of cash dividends and share buybacks as compared to its prior 50% policy. Its CET1 ratio stood at 12.9% as of end-December 2021, up 10bp YoY.

BNP’s dollar bonds were trading steady with its 7% Perp at 110.97, yielding 5.01%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

BNP Paribas Prices PerpNC5 AT1 Bond at 8.5%

August 8, 2023

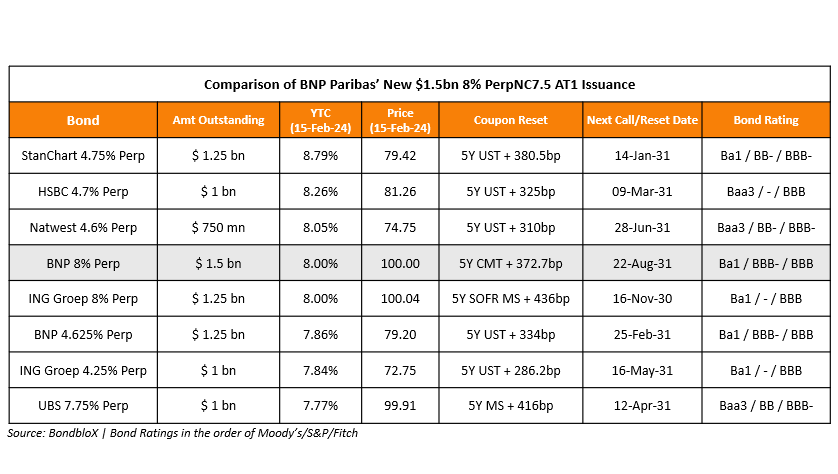

BNP Paribas Prices $ PerpNC7.5 at 8%

February 15, 2024