This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Biden-McCarthy Reach Debt Ceiling Deal; Macro; Rating Changes; New Issues; Talking Heads

May 29, 2023

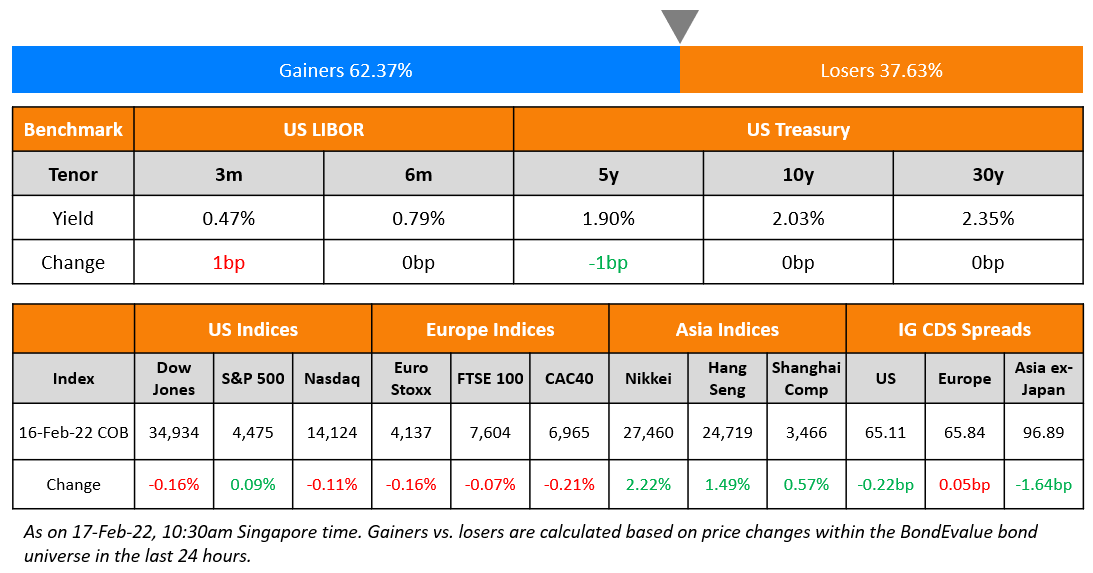

US Treasury yields were mixed, with the 2Y and 5Y up 3-4bp while back-end yields were 1-3bp lower. US President Joe Biden and House Speaker Kevin McCarthy have reached a tentative deal to raise the debt limit for two years and avert a US debt default. Biden and McCarthy now have to convince their respective parties to support the package to get sufficient votes to pass the deal.

Separately, in terms of economic data, US Core PCE rose by 4.7% in April, higher than the estimate and prior month’s 4.6%. Economic strength continues to be seen with Durable Good Orders rising by 1.1% vs. estimates of a 1.1% drop. Markets now expect a 62% chance of a 25bp rate hike in June as per CME probabilities. This compares to just about an 8% chance of a rate hike a month ago. The peak Fed Funds Rate remains unchanged at 5.31% for July. Equity indices closed higher on the back of debt ceiling optimism with the S&P and Nasdaq higher by 1.3% and 2.2% respectively. US IG CDS spreads tightened by 2.1bp and HY CDS spreads tightened by 9.4bp.

European equity markets ended lower too. European main CDS spreads tightened 2.7bp and crossover CDS spreads were 11.5bp tighter. Asia ex-Japan CDS spreads also tightened by 0.5bp. Asian equity markets have opened slightly in the green today.

New Bond Issues

.png)

Allianz raised €1.25bn via a 30.1NC10.1 Tier 2 bond at a yield of 5.824%, 20bp inside initial guidance of MS+285bp area. The bonds have expected ratings of A2/A+, and received orders over €2.9bn, 2.3x issue size. Proceeds will be used for general corporate purposes, including the refinancing of existing debt, which comprise the tender offer for its outstanding 4.75% Perps, callable in October 2023.

New Bonds Pipeline

-

Kexim hires for $/€ bond, including green tranche

- BGK hires for $ 10Y bond

- GS Caltex hires for bond

Rating Changes

- Moody’s downgrades NEP’s CFR to Caa1; outlook is stable

- Fitch Downgrades Unigel to ‘B’ on Rating Watch Negative

- Moody’s changes Tata Motors’ outlook to positive from stable, affirms B1 ratings

- Moody’s changes Jaguar Land Rover’s outlook to positive from stable; B1 ratings affirmed

Term of the Day

Payment-in-kind Bonds

Payment-in-kind (PIK) is a type of bond for which, on each coupon payment date, the accrued coupon is capitalized and fully or partially paid in the form of additional bonds or added to the principal amount. PIK bonds are typically bonds with deferred coupons. These are riskier for investors due to more credit risk with respect to the PIK interest amount, payment of which can be deferred until maturity. Given this inherent higher risk, interest rates for PIK bonds are higher than for conventional bonds. Generally, issuers with liquidity stresses that are able to pay coupons in non-cash form issue these notes.

Talking Heads

On not prejudging June rate decision – Fed’s Goolsbee

“We are going to get a lot of important data between now and then. The actions that the Fed takes take months or even years to work their way through the system…there’s no doubt inflation is too high, still — it has come down — and we are just trying to manage, can we get inflation down without starting a recession”

On Program Seen to be Restoring Confidence in Economy – Ghana’s President

“The fact that we’ve been able to negotiate such a deal sends a positive message to our trading partners, creditors and investors… will be underpinned by the discipline, hard work and enterprise with which we execute the program”

On Investors reacting to tentative US debt ceiling deal

Bob Stark, Global head of Market Strategy, Kyriba

“The debt ceiling agreement is only the first step in saving the government from the brink of illiquidity… What investors will now focus on is the cost of the spending cuts to the health of the American economy”

Stuart Kaiser, Head of Equity Trading Strategy, Citi

“Deal removes a tail risk to economic growth but doesn’t meaningfully shift the base case.”

Vishnu Varathan, Head of Economics, Mizuho Bank

“There may be an initial sliver of relief that may send yields a tad lower along with some U.S. dollar bump-up, alongside equities. But the vagaries of pushing the deal through Congress may hold back.”

Top Gainers & Losers – 29-May-23*

Go back to Latest bond Market News

Related Posts: