This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Belarus Downgraded to RD by Fitch

Belarus was downgraded to RD (restricted default) from C by Fitch due to a default following the end of a 14-day grace period on its 2027s’ dollar bond coupon payment on 13 July 2022. In June, the Ministry of Finance announced that USD and EUR bond payments will be transferred in Belarussian rubles (BYN). On July 8, Fitch downgraded Belarus to C from CCC as the nation had made local currency payments for dollar bonds on June 29, 2022. Those payments contravened the bond documentation which did not allow for settlement in alternative currencies. Fitch has downgraded Belarus’s 2027s to D from C and and affirmed its other four issue ratings at C.

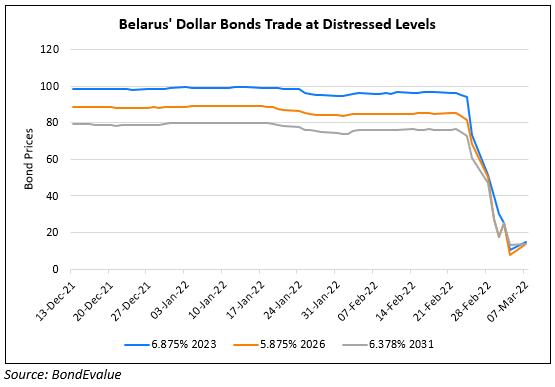

Belarus’s dollar bonds were trading at distressed levels of 15-16 cents on the dollar.

Go back to Latest bond Market News

Related Posts: