This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

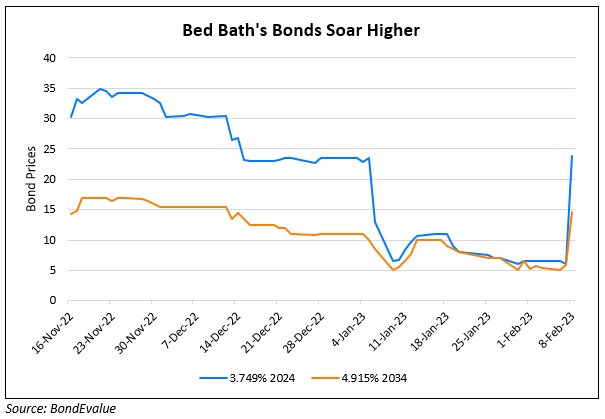

Bed Bath’s Bonds Shoot Higher on $225mn Share Sale to Stave off Bankruptcy

February 8, 2023

Bed Bath & Beyond’s bonds jumped after the distressed retailer staved off bankruptcy with a $225mn share placement. It added that it may get another $800mn over the next 10 months in order to avoid bankruptcy. Sources said that Hudson Bay Capital Management is the lead investor in the share sale. Bed Bath said that it planned to raise ~$1bn in a complex deal where it offered preferred stock and warrants. However, some analysts noted that the deals may only buy time time for a few quarters to revive its business, where a weak economy would diminish any chance of a successful turnaround. Early last month, Bed Bath’s bonds plummeted over 70% to trade at ~6 cents on the dollar after it warned of filing for bankruptcy. Besides, its distressed debt exchange was terminated as the conditions of the offer were not satisfied.

Go back to Latest bond Market News

Related Posts:

Bed Bath & Beyond Downgraded to CC by S&P

October 19, 2022

S&P Cuts Bed Bath & Beyond to SD on Debt Exchange Programme

November 15, 2022

Bed Bath Bonds Plummet on Bankruptcy Filing Warning

January 6, 2023