This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BCT’s Offshore Bonds Rally As World Bank Moves to Restore Tunisia Aid Program

June 1, 2023

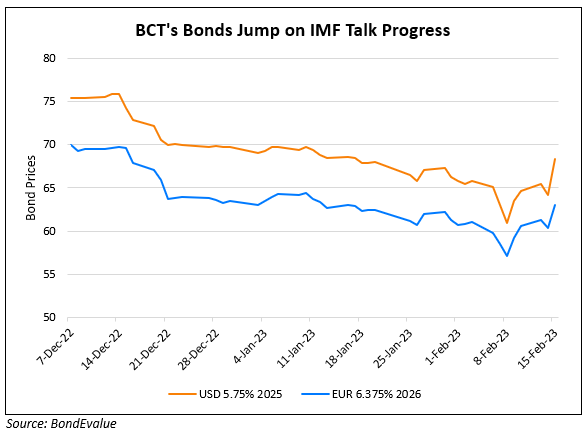

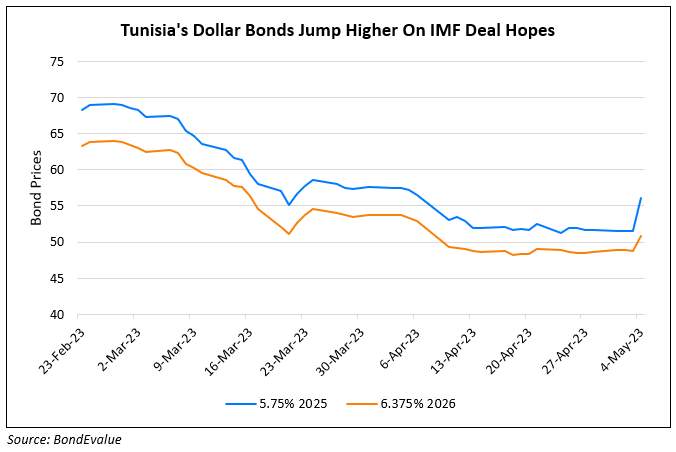

Dollar and Euro denominated bonds of the Central Bank of Tunisia (BCT) rallied by 2-4% across the curve. This comes after the World Bank and the Tunisian government agreed on a new partnership framework which will go up to the multilateral lender’s board for approval. If approved, this would provide a relief to the nation amid a decline in living standards, poverty and financial stresses due to subsidies on basic goods, especially fuel. In October last year, Tunisia had reached a staff-level agreement with the IMF, but its directors have yet to review and approve the deal.

BCT’s bonds have been trending higher over the last month, up by ~15% amid positive talks with the IMF. BCT’s 5.624% 2024s were up 3.7 points to trade at 81.

Go back to Latest bond Market News

Related Posts: