This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BCT’s Dollar Bonds Rally on Minister Saying No Plan to Curb Central Bank Independence

May 26, 2023

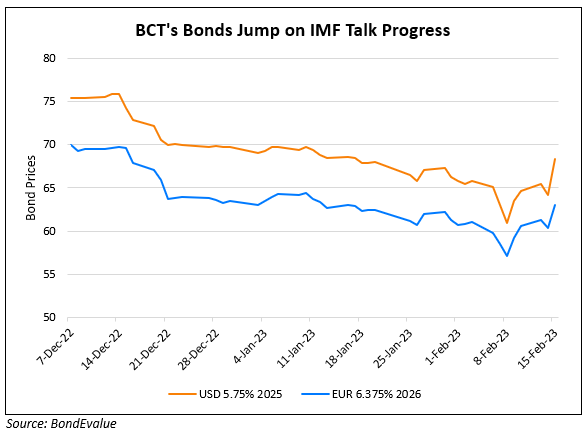

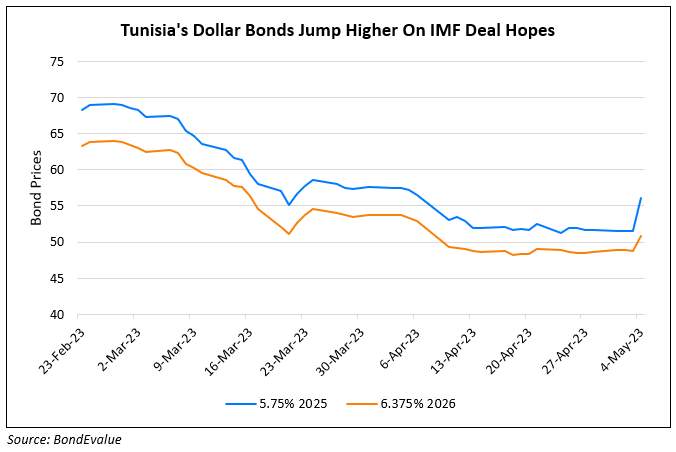

Dollar bonds of the Central Bank of Tunisia (BCT) rallied by over 2.5% across the curve after its Economy and Planning Minister Samir Saied said, “The independence of the central bank will remain respected as it is without any modifications”. This comes after questions were raised about the central bank’s independence especially after the deputy speaker of the parliament said that it was among issues that would be covered in planned drafts. Tunisia is trying to strengthen its economy following years of tepid growth. They are currently in talks with the IMF to reach a final agreement on a $1.9bn bailout. Bloomberg notes that in 2016, a parliamentary vote to strengthen BCT’s independence was instrumental to the nation securing a $2.9bn 4Y IMF loan at the time.

BCT’s 5.75% dollar bonds due 2025s were up 1.5 points to trade at 57.8.

For more details, click here

Go back to Latest bond Market News

Related Posts: