This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BAIC, Woori Card Launch $ Bonds; Macro; Rating Changes; New Bond Issues; Talking Heads; Top Gainers & Losers

March 10, 2021

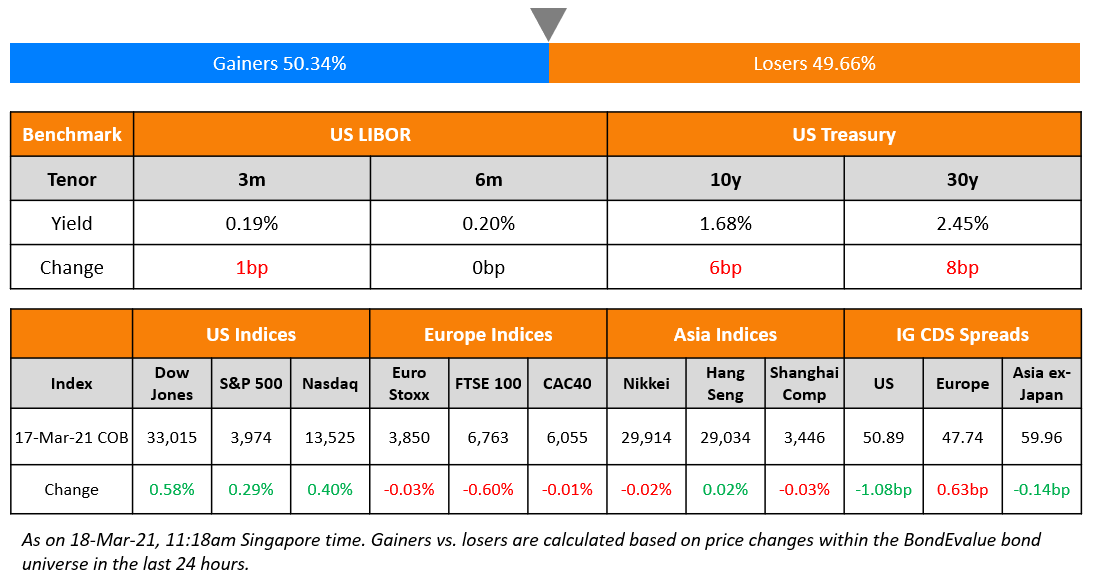

US equities rebounded on Tuesday with the S&P up 1.4% and the Nasdaq 3.7% higher. Tesla jumped 19% higher after upbeat China car sales data. US 10Y Treasury yields eased to 1.53%. European equities were more muted with the DAX and CAC up 0.4% while the FTSE was up 0.2% with Eurozone GDP shrinking 0.7% QoQ in Q4, down 4.9% YoY. US IG CDS spreads were 1bp tighter and HY was 2.6bp tighter. EU main CDS spreads were 0.8bp tighter and crossover spreads tightened 4bp. Primary markets in Asia remain relatively quiet despite many deals in the pipeline. Asian equity markets are up 0.5% and Asia ex-Japan CDS spreads were up by 1.5bp.

Bond Traders’ Masterclass | 25% Discount on a Bundle of Five Sessions

Keen to learn bond market fundamentals from industry professionals? Sign up for our Bond Traders’ Masterclass that consists of five modules starting on March 24.

The modules are specially curated for private bond investors and wealth managers to develop a strong fundamental and practical understanding of bonds. Given the ultra-low interest rate environment, flurry of new bond deals particularly from junk-rated issuers and tightening credit spreads, it is now more important than ever for investors to understand bond valuation, portfolio construction and new bond issues to help them get better return for risk. The sessions will be conducted by debt capital market bankers who have previously worked at premier global banks such as Credit Suisse, Citi and Standard Chartered.

*Avail a 25% discount on a bundle of five sessions!

New Bond Issues

- BAIC Motor $ 3Y at T+220bp area

- Zhejiang Provincial Seaport Investment $ 5Y at T+170bp area

- Woori Card $200mn 5Y social Formosa at T+125bp area

JPMorgan raised $3bn via a two-part issuance. It raised:

- $2bn via a 3Y non-call 2Y (3NC2) bond at a yield of 0.697%, or T+53bp, 12bp inside initial guidance of T+65bp area

- $1bn via a 3Y non-call 2Y (3NC2) at SOFR+58bp as against initial guidance of SOFR equivalent

Proceeds from the SEC-registered bonds will be used for general corporate purposes.

Shoe maker Crocs raised $350mn via a debut 8Y non-call 3Y (8NC3) bond at a yield of 4.25%, or T+300bp, 25bp inside the wide end of initial guidance of 4.25%-4.5%. The bonds have expected ratings of B1/BB-. Proceeds will be used to repay up to $180mn of outstanding borrowings under Crocs’ revolving credit facility and the rest for general corporate purposes.

The EU raised €9bn ($10.7bn) via a 15Y SURE bonds at a yield of 0.228%, or Mid-Swaps minus 4bp, inside initial guidance of MS-2bp area. The bonds received orders over €86bn ($102bn), 9.5x issue size. “There is strong appetite for its name out there” said Piet Christiansen, chief strategist at Danske Bank.

CaixaBank raised €1bn ($1.19bn) via a 10.25Y non-call 5.25Y (10.25NC5.25) green tier 2 bond at a yield of 1.335%, or MS+163bp, 32bp inside initial guidance of MS+195bp area. The bonds have expected ratings of Ba1/BBB-/BBB- and received orders over €2.2bn ($2.6bn), 2.2x issue size. The bonds pay a coupon of 1.25% until the first reset date of June 18, 2026 and if the bonds are not called, the coupon resets to MS+163bp. The issuer can call the bonds from March 18, 2026 to June 18, 2026.

Intesa Sanpaolo raised €1.25bn ($1.48bn) via a 7Y green bond at a yield of 0.757%, or MS+93bp, 27bp inside initial guidance of MS+120bp area. The bonds have expected ratings of Baa1/BBB/BBB- and received orders over €3.4bn ($4bn), 2.7x issue size. Proceeds will be used as a green bond loan.

China Zheshang Bank Hong Kong branch raised $500mn via a 3Y bond at a yield of 1.131%, or T+80bp, 40bp inside initial guidance of T+120bp area. The notes have expected ratings of BBB- and received orders over $2.3bn, 4.6x issue size. The bonds will be issued off the lender’s $2bn MTN programme with proceeds being used for general corporate purposes.

Housing and Development Board (HDB) raised S$900mn ($519mn) via a 7Y bond at a yield of 1.37%. This is HDB’s second deal this year after an S$800mn ($594mn) 5Y bond issued in January at 0.635% and currently yielding 1.2%. The new deal size was upsized from S$700mn ($520mn) on robust demand.

Shaoxing Shangyu State-owned Capital Investment and Operation raised $500mn via a dual-trancher. It raised $300mn via a 3Y bond at a yield of 2.95% and $200mn via a 5Y bond at a yield of 3.55%, 35bp each inside initial guidance of 3.3% and 3.9% areas respectively. the bonds have expected ratings of BBB- and received orders over $2bn, 4x issue size. Proceeds will be used for refinancing, project construction and general corporate purposes.

New Bond Pipeline

- Shaanxi Financial Asset Management $ bond

- Sumitomo Mitsui Trust Bank $ bond

- Zhejiang Provincial Seaport Investment & Operation Group $ bond

- PTTGC $ bond

- Delhi International Airport $ bond

- Japfa Comfeed $ bond

- Meinian Onehealth Healthcare $ bond

- JSW Steel $ bond

Rating Changes

- Range Resources Corp. Outlook Revised To Positive From Negative On Improved Credit Measures And Maturity Profile

- Athene Holding Ltd. Ratings Affirmed, Holding Company Outlook Revised To Positive On Merger Announcement

- Aeropuertos Argentina 2000 ‘CCC+’ Ratings Affirmed, Off CreditWatch Negative On Debt Refinancing, Outlook Negative

- Moody’s revises outlook on KORES to stable from negative; affirms A1 ratings

- Moody’s upgrades Benin’s ratings to B1, outlook changed to stable

- Moody’s changes outlook for Yanlord to stable from negative

Term of the Day

Collateralized Loan Obligations (CLO)

Collateralized Loan Obligations (CLO) are securities backed by a pool of underlying loans. The loans are packaged together by a process of securitization. The loans are bundled together in tranches in an order of risk – for example, the AAA rated tranche comes with the lowest default risk while a BB tranche has a higher default risk. Investors can choose the tranche they prefer based on risk appetite. Given that the underlying loans are floating rate loans, they are also considered a hedge against inflation. Bloomberg reported that CLO deals hit a record as inflation fears have fueled a bond rotation trade.

Talking Heads

“The extent of the bond market sell-off in early 2021 suggests inflation expectations may have run too far, too fast…there may be limitations on how much further yields can climb for now,” Seidner wrote.

On ECB’s bond-buying restraint rings alarm for Citi and Commerzbank

Jamie Searle, Citigroup rates strategist

“Longer-term, the real cost of any inaction is the credibility of the policy framework,” Searle said. “Investors may think twice about buying record issuance if the ECB allows confusion about its aims to fester.”

Christoph Rieger, Commerzbank AG strategists

“The numbers still don’t suggest that the ECB is aggressively leaning against U.S. spillovers into Europe’s long end,” Rieger said. “The ECB seems to be quite anxious about its data sending the wrong signals.”

On US yields falling as market turns to 10-year, 30-year auctions

According to Action Economics LLC

“The relatively solid 3-year sale brought a big sigh of relief to the Treasury market and yields are moving back down to or near their richest levels of the day.” “After the dog of a 7-year sale, there were fears developing that demand for Treasuries is eroding. But this sale dispensed with that notion, at least for today.”

Guy LeBas, chief fixed income strategist at Janney Montgomery Scott

“This the first time since the last few hours of February that we’ve had four consecutive four-hour periods of stronger prices in the Treasury market,” said LeBas. “So there’s a good amount of oomph behind the move in prices.” “The auction will probably be a time to close the shorts because the cost of shorting on-the-run 10s are pretty high,” he added.

On Asian bonds providing refuge for investors fleeing Treasuries turmoil

JC Sambor, head of emerging markets fixed income at BNP Paribas Asset Management

“Emerging markets Asia is attractive from a relative value perspective,” said Sambor. “We think there is more value in high yield. We think it is fundamentally mispriced,” he said, referring to the cheapness of bonds in markets such as China.

Justin Onuekwusi, portfolio manager at Legal & General Investment Management

“Given the levels of yields in places like Germany, it doesn’t make sense to hold them in any decent size if the aim is to protect against volatility. For this, we have a positive view on bonds from Korea and China,” said Onuekwusi.

“The Q4 data is already quite old, but it might act as a reminder that the euro zone is going to be a laggard in terms of growth in 2021,” said Bouvet.

“India’s markets are likely to be relatively immune to higher U.S. yields in the weeks ahead,” said Kotecha. “India has been a key beneficiary of equity inflows into Asia and we do not see outflows persisting.”

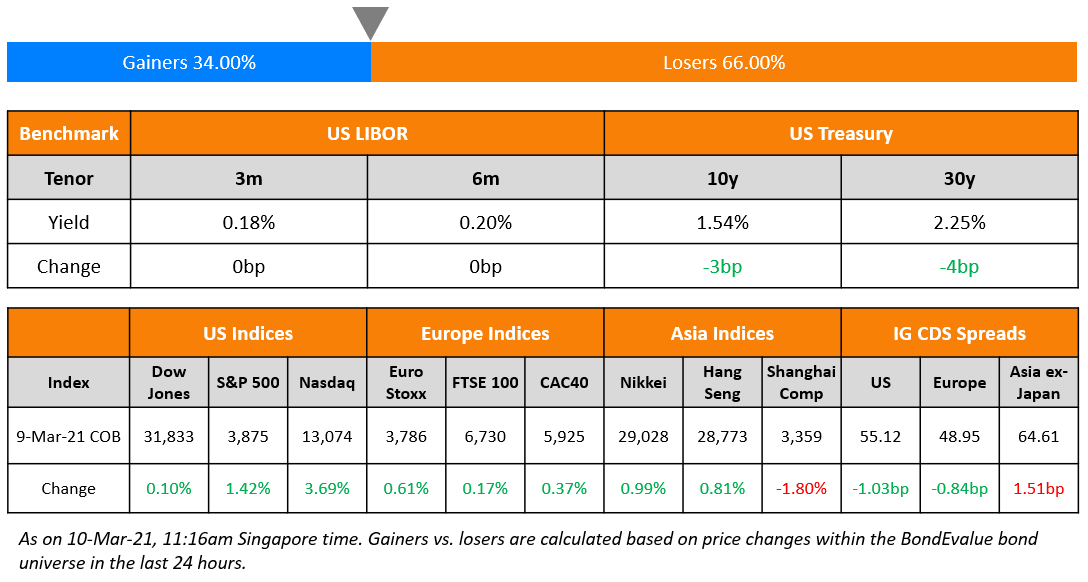

Top Gainers & Losers – 10-Mar-21*

Go back to Latest bond Market News

Related Posts: