This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

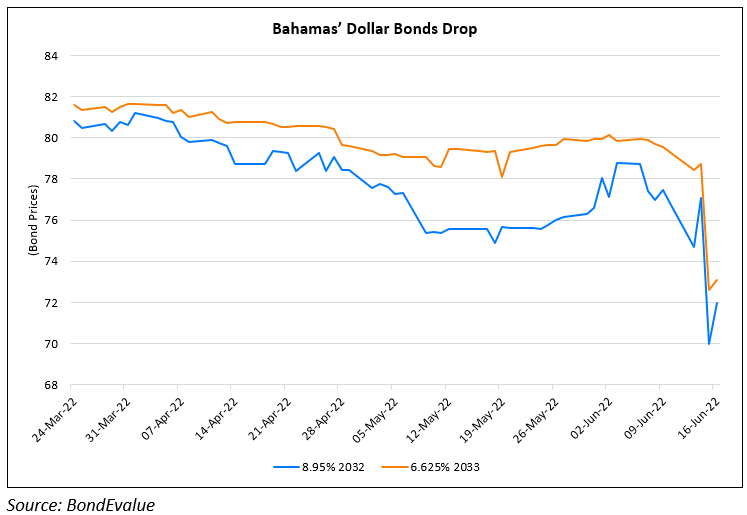

Bahamas’ Dollar Bonds Drop Despite Recent Oversubscribed Bond Issuance

June 16, 2022

Dollar bonds of Bahamas bond fell over 7-10% on Thursday despite its recent oversubscribed bond issuance. Last week, Bahamas issued two tranches of offshore bonds of $385mn, including a $250mn 7Y bond at a yield of 13.5%. It also issued a $200mn bond partially backed by the supranational entity, Inter-American Development Bank (IADB). Analysts cite an article by Global Capital that questioned the bonds’ complicated structure, and also expressed worry over the nation’s ability to increase revenue alongside its “overly optimistic” projections, akin to the IMF’s understanding of the sovereign. The article noted that the partial guarantee by the multilateral lender shows its stressed funding Bahamas’ government is reluctant to raise taxes and sees it as a last option for fiscal adjustments. Columbia Threadneedle Investments Kate Moreton said, ““I think there is a willingness to pay in The Bahamas, but they are struggling fiscally… as an importer of basically everything, they are dealing with severe inflation”.

For the full story, click here

Go back to Latest bond Market News

Related Posts: