This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Asian Dollar Bond Market Seeing Tremendous Interest for the First Time in Years

March 7, 2019

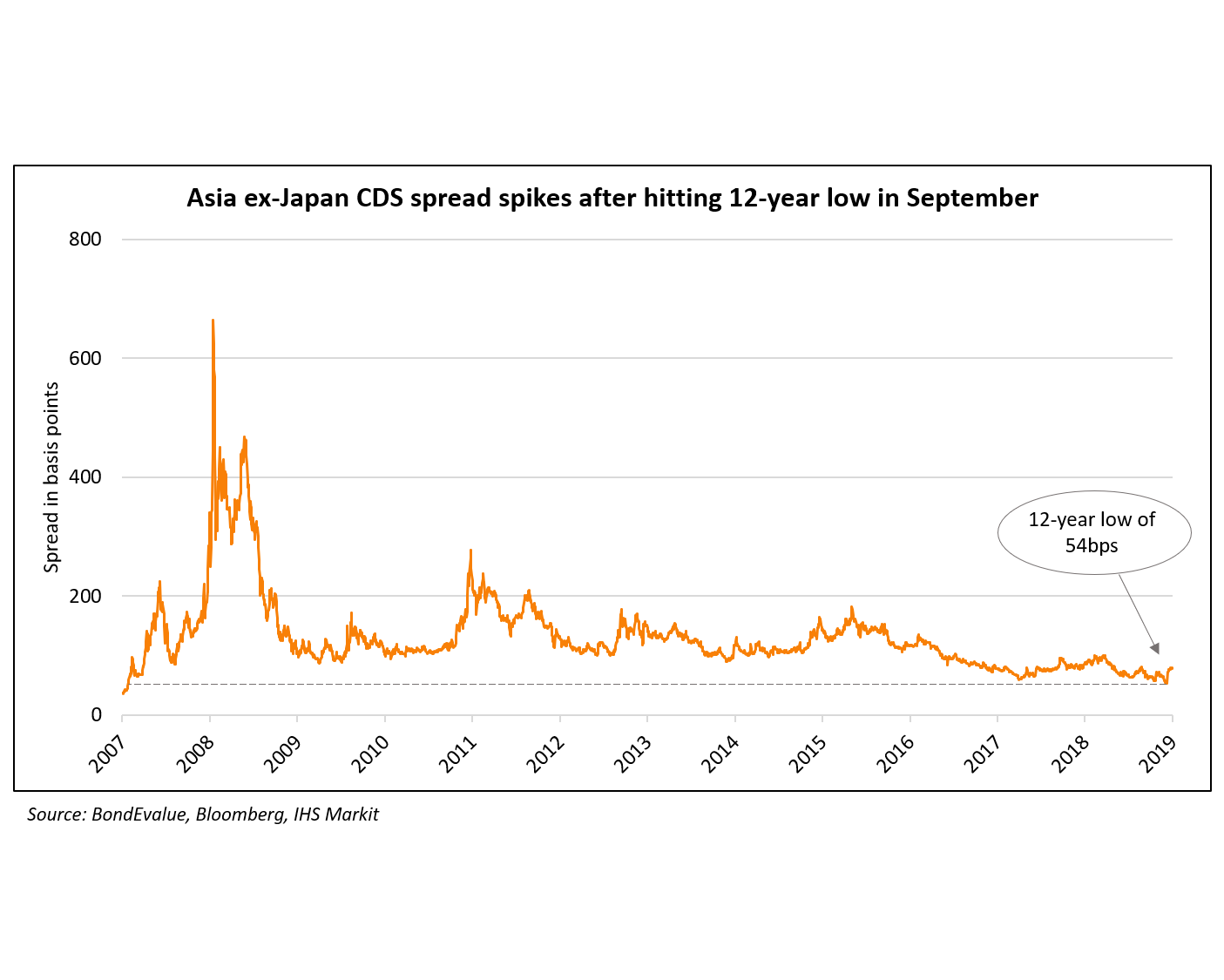

Bond orders for primary issuance of Asian dollar bonds hit a record 6.7 times of their issuance sizes in February, the highest since January 2016. This statistic is in line with the record demand for bond sales in Asia ex-Japan of $64.5 billion since the start of 2019. It appears investors have moved past last year’s underperformance in Asian bonds, where the product sold off the most ever in a decade, to support this market’s best start in 7 years. Reasons for the change in sentiment include recent dovish signals from the Federal Reserve and policy loosening out of China.

Driving this demand is the robust investor interest in the bonds of Chinese property developers, where the ratio of orders to actual deal sizes hit 7.6 times, also in February. Chinese builders have sold a record bond market $22.7 billion dollar-denominated bonds since the start of the year. Investors are also piling into longer-dated notes amid dampened expectations of interest rate hikes in 2019, with the result that bonds maturing beyond 5 years are outperforming the short end of the curve.

Go back to Latest bond Market News

Related Posts:

HY Bonds Outperform in Sept Amid Record 9M19 Issuance

October 14, 2019