This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

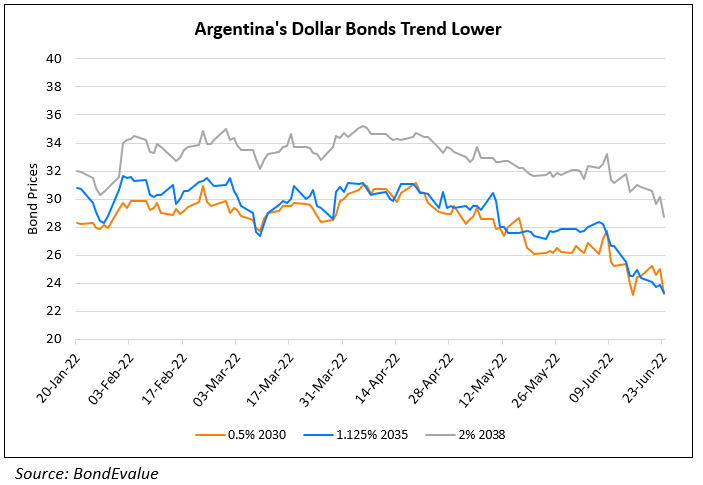

Argentina’s Planned Buyback Considered Equivalent to Default, Says Moody’s

January 27, 2023

Argentina’s planned $1bn bond buyback that was announced last week, would be tantamount to a “distressed exchange and hence a default” as per note by rating agency Moody’s. It noted that Argentina’s buyback would “at the cost of scarce foreign currency that is pressuring the country’s external finances, while doing little to support the sovereign’s repayment capacity in 2024 and beyond”. Moody’s added that there were not details yet on how the $1bn would be allocated to purchasing each bond, nor the target date of when the buyback process would end. Moody’s currently rates the sovereign at Ca. On the news of Argentina’s planned buyback, its sovereign dollar bonds rallied by over a point across the curve.

Argentina’s dollar bonds were trading at 30-35 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Argentina Due to pay $730mn to the IMF as Uncertainty Looms

January 28, 2022

Argentina Says $2bn Agreement Reached with Paris Club

October 31, 2022