This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Argentina Downgraded to CCC- by Fitch

October 27, 2022

Argentina was downgraded to CCC- from CCC by Fitch on the back of several factors. Fitch believes that the nation’s external liquidity position is weak and even its local-currency repayment capacity stands compromised. Its forex reserves have been under pressure with its net international reserves at just $1.3bn in August vs. $2.3bn at end-2021. Besides, its current account is projected to be at a deficit of 0.4% of GDP in 2022. Inflation is expected to hit 100% in 2022, from 51% in 2021 with global price pressures, “monetary overhang” and expectations of a currency devaluation working against the sovereign. Fitch notes that while the budget deficit has been on the decline in H2 this year, the fiscal consolidation process has been slow. Besides, Argentina’s financing and debt sustainability risks are set to rise. Financing needs have mainly been met in the local peso market which has seen shorter tenors and higher rates, “resulting in a clustering of maturities in mid-2023 that could be difficult to roll over amid possible election jitters”. Also, government debt is projected to rise to 84% of GDP in 2022 from 81% in 2021 with a slowdown in GDP growth momentum.

Argentina’s dollar bonds are trading at over 20 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Argentina Closes $45bn Deal with IMF

March 4, 2022

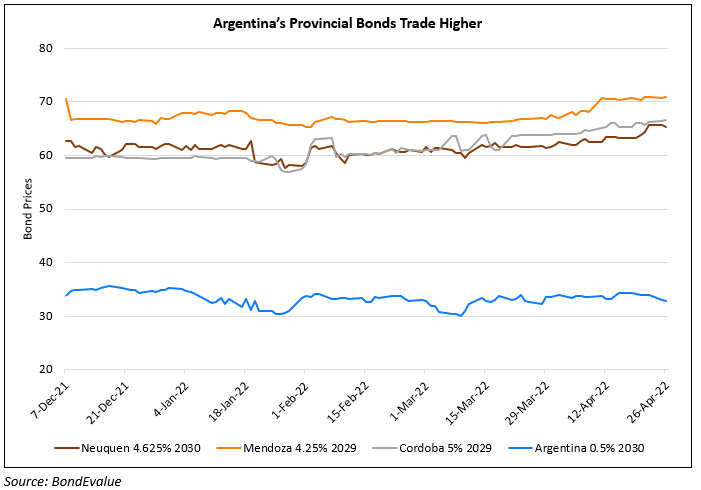

Argentina’s Province Bonds Outperform Sovereign Bond

April 26, 2022

IMF Reaches Staff Level Agreement with Argentina

June 9, 2022