This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Apple Raises $6.5bn Via Four Part Offering

July 30, 2021

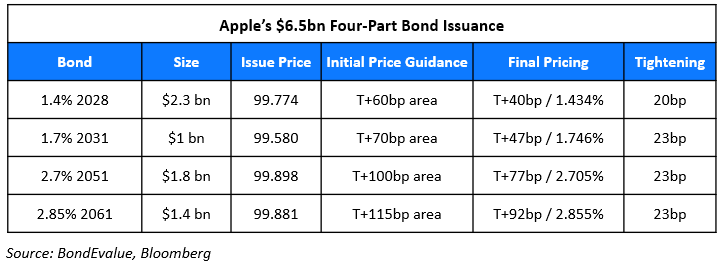

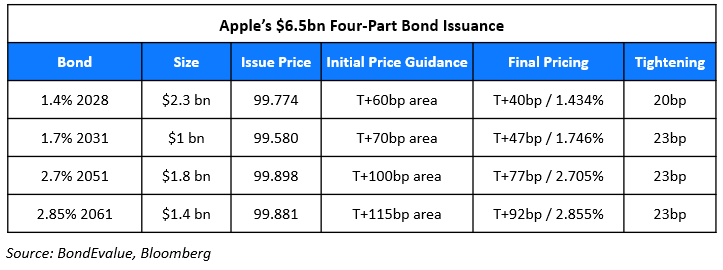

Apple raised $6.5bn via a four-part offering:

The SEC registered bonds are rated Aa1/AA+. Proceeds will be used for general corporate purposes, including share repurchases and payment of dividends to return capital to shareholders, funding for working capital, capital expenditures, acquisitions and repayment of debt.

- The new 2028s were priced 9bp over its existing 1.2% 2028s that yield 1.34% in secondary markets.

- The new 2031s were priced in-line with its existing 1.65% 2031s that yield 1.74% in secondary markets.

- The new 2051s were priced 2bp wider than its existing 2.65% 2051s that yield 2.8% in secondary markets.

- The new 2061s were priced just 3bp over its existing 2.8% 2061s that yield 2.82% in secondary markets.

Go back to Latest bond Market News

Related Posts: