This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ahli Raises $600mn via AT1 at 3.875%

June 10, 2021

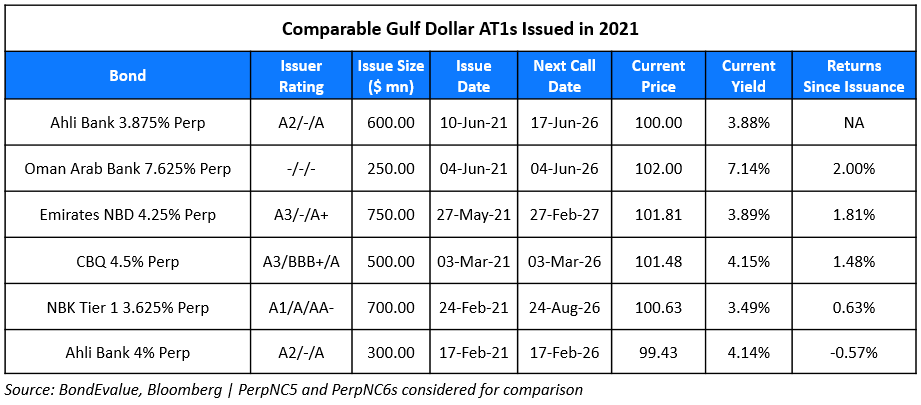

Ahli United Bank raised $600mn via a Perpetual non-call 5.5Y (PerpNC5.5) AT1 Sukuk at a yield of 3.875%, 50bp inside initial guidance of 4.375% area. The bonds are unrated. Ahli United Perpetual Sukuk is the issuer and Ahli United Bank KSCP is the obligor. The bonds are callable daily from June 17, 2026 to December 17, 2026, then every 5 years thereafter starting June 17, 2031. The coupon resets to the 5Y US Treasury yield + 301.1bp. Proceeds will boost capital and fund a tender offer for its $200m 5.5% perpetual Sukuk. The bonds were priced 26.5bp inside their 4% Perps callable in February 2026 that currently yield 4.14%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: