This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

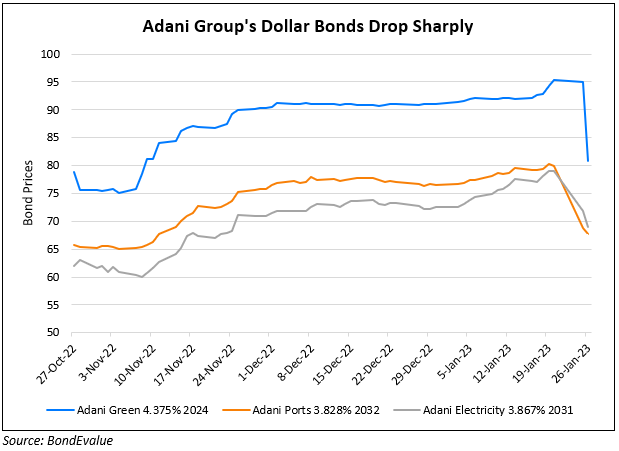

Adani Group Cites Improving Debt Metrics to Boost Market Confidence

June 6, 2023

Adani Group reported some of its financials in a credit note to help boost market confidence. The Gautam Adani-led conglomerate said that the group’s net debt-to-EBITDA improved to 3.27x at end-March vs. 3.81x a year ago. This comes as part of its deleveraging program after it prepaid share-backed loans and a loan taken to acquire Ambuja Cements. It paid $2.15bn in share-backed financing and also $700mn in debt taken for the acquisition alongside $203mn in interest payments. Besides, debt buybacks at its issuing units also contributed to the deleveraging. It also said that its cash balances improved markedly to $4.9bn vs. $3.5bn a year ago. Its debt service coverage ratio improved to 2.02x from 1.47x last year. The Indian corporate also said that it has now slowed down on M&A activity in order to conserve liquidity. Last year, research firm CreditSights said Adani Group was “deeply overleveraged” post which Hindenburg alleged the company was involved in manipulation and fraud.

Adani companies’ dollar bonds were trading stable. Adani Green’s 4.375% 2024s are trading at 93.73, yielding 9.82%.

For more details, click here

Go back to Latest bond Market News

Related Posts: