This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Adani Group Dollar Bonds Trade Steady – Track Adani Group’s Bond Prices

February 21, 2023

February 20, 2023: Adani Group Cancels Bid for PTC India, Say Sources; Adani Ports to Prepay $121mn Local Bond

Adani Group has stalled plans to bid for state-backed electricity company PTC India, formerly Power Trading Corporation of India, as per sources. They noted that the conglomerate planned to preserve cash. Adani Group was said to be one among the possible bidders for PTC India. This follows Adani's calling off an $848mn deal to acquire a coal plant project last week in an effort to manage its current saga. Separately, Adani Ports and SEZ will prepay a short-term local bond due in March of INR 10bn ($121mn). It said that it will prepay the debt by financing it using commercial paper. Adani companies' dollar bonds were trading flat.

February 19, 2023: Adani Group Hires PR Firm, Lawyers; Government Asks Supreme Court to Examine Claims

In the wake of the Adani Group saga, the conglomerate has now hired PR firm Kekst CNC as a global communications advisor to help the group regain investor trust. Adani Group has also has also hired American law firm Wachtell, Lipton, Rosen & Katz to counter Hindenburg's claims. Besides, as per Reuters, the Indian government has told the Supreme Court that the "truthfulness", including the legality of Hindenburg's allegations and short positions against the Adani Group should be examined. The group companies' dollar bonds were trading stable.

February 16, 2023: Adani Green's Dollar Bonds Due 2024 Jump on Refinancing News

Adani Green's dollar bonds jumped by over 3-4 points after sources said that the company’s management said it will come up with a plan to refinance its bonds due 2024 by the end of June. Sources said that the bonds will likely be refinanced with a long-term private placement bond offering, with a potential maturity of 15 years. Bloomberg said that Adani Green, Adani Ports SEZ and Adani Transmission could raise as much as $1.5bn by April or May this year with a tenor of up to 20 years. Adani Group further added that it plans to cut its net debt-to-EBITDA to under 3x next year from the current 3.2x.

Separately, the conglomerate also halted an $847mn acquisition of a coal-fired power station in India. Adani Power in August agreed to buy DB Power, a company that owns and runs a profitable coal-fired power plant. The deal was approved by the competition regulator in September but has been extended four times since its completion's end-October deadline.

February 14, 2023: Adani Publishes Credit Report to Reassure Investors on Finances

Adani Group published its much awaited credit report yesterday where it tried to reassure investors about its financial position. It said that it has adequate cash reserves and that its listed companies are able to refinance their debts. Its gross debt stood at $27.3bn as of end-September 2022 and is forecasted to stay there through March. The group's cash reserves stood at ~$3.8bn. Adani Group said, "“Our businesses operate on long-term annuity contracts generating assured and consistent cash flows with no market risk". The report noted that more than 81% of its EBITDA came from infrastructure businesses that generate a steady cash flow. Regarding overall financing, it said that it was a “conservative” mix of debt and equity.

February 13, 2023: Adani Group Said to Halve Revenue Growth Target and Hold Back on Capex

Adani Group has halved its revenue growth target and plans to defer fresh capex, as per sources. The group is said to have slashed its revenue growth to 15-20% for the next financial year vs. the 40% growth they initially targeted. Another source noted that holding back on investments for even three months could save Adani Group about $3bn, which can be deployed to pay down debt or boost cash resources. Barclays analysts said, "The scale and economic inter-linkages of the Adani businesses make it relevant to discuss what any pullback in the group’s investments could entail for the economy as a whole. A disruptive outcome of the situation or a sharp pullback in the group’s investments could have implications for India’s capex cycle."

For the full story, click here

February 7, 2023: Adani Family Prepays $1.1bn Debt Backed by Shares

Adani Group's Chairman Gautam Adani and family prepaid $1.11bn of borrowings backed by shares, in an effort to restore confidence in the group. The prepayment of debt will help release 11.77mn shares in Adani Transmission, about 168.27mn shares of Adani Ports & SEZ and 27.56mn shares of Adani Green. Last week, Bloomberg reported sources saying that the Adani Group was in talks with creditors to prepay some loans backed by pledged shares in order to remove concerns about margin calls.

February 6, 2023: Adani Bondholders in Talks With Advisers; StanChart Stops Accepting Adani Bonds as Collateral

Adani Group's bondholders are said to have reached out to financial advisers and lawyers to evaluate their options following losses in the conglomerates' dollar bonds after Hindenburg's report, as per sources. Sources noted that holders were seeking to know how the group and its subsidiaries' debt/capital structure would be impacted under various scenarios, the seniority of debt and financial recourse including the prospect for regulatory and legal redressal. Newspaper Mint reported that the group plans to trim its capital spending plans in some of its businesses. Mint added that Adani might look at a 16-18 month growth period in certain businesses, instead of a 12-month target. It further noted that Adani group will use alternative funding channels ranging from internal accruals, promoter equity funding and private placements to fund projects.

Separately, ET reports that StanChart has joined Credit Suisse wherein they have stopped accepting Adani Group companies' bonds as collateral on margin loans. StanChart is said to have asked its private banking clients to top up their collateral to cover for any shortfall.

Across rating agencies, S&P Global cut its outlook on Adani Ports and SEZ and Adani Electricity to negative from stable. This was on the back of a "risk of a deterioration in the credit profile" due to the group's governance risks and funding challenges. Moody's warned that the recent sell-off in Adani shares could hurt its ability to raise capital. Fitch said there is no immediate impact on Adani entities' ratings and that it will closely monitor major changes regarding financing access or cost of financing on a long-term basis.

Adani Group's dollar bonds have inched higher by over 3 points across the curve, following the sell-off early on Friday.

February 3, 2023: Adani Pays Coupons on Dollar Bonds; Expected to Publish Credit Report Today

Adani Ports and SEZ paid $24.7mn of coupons on Thursday on three of its dollar bonds, said sources. Adani Transmission has a $10mn coupon payment due today. The sources added that the conglomerate plans to release a credit report by Friday where it will address concerns raised by Hindenburg Research about its liquidity. CLSA in a note reported that the group has about $25.6bn in total debt of which bank debt forms 38% of the total debt, while bonds/CP form 37%. Separately, Adani is also in talks with creditors to prepay some loans backed by pledged shares in an effort to restore confidence in his conglomerate’s financial health.

Adani dollar bonds were trading stable after it had retracted the gains made on Tuesday when it completed its FPO. As per Bloomberg, Goldman Sachs trading executives said that Adani debt had hit a floor in the short-term and bonds of Adani Ports & SEZ have become interesting at the current price. Goldman added that Adani Ports’ debt is well capitalized with cash, and its liquid enough to trade. They expect Adani Ports to be able to refinance its bonds while having the prospect of attracting equity investors and selling assets. Similarly, JPMorgan is said to have told some clients that they are seeing value in debt of some Adani operating companies.

February 2, 2023: Adani Group Cancels FPO , Dollar Bonds Pull Back

Adani Group called off its FPO that was fully subscribed and completed on Tuesday, saying it will return the money to investors. The conglomerate said, “Today the market has been unprecedented, and our stock price has fluctuated over the course of the day. Given these extraordinary circumstances, the company’s board felt that going ahead with the issue will not be morally correct".

February 1, 2023: Credit Suisse Private Bank Stops Accepting Adani Group Bonds as Collateral

Credit Suisse's private bank has stopped accepting bonds of Adani’s Group companies as collateral for margin loans to its private banking clients. Sources note that the swiss-banking major has halted accepting bonds of Adani Ports and SEZ, Adani Green Energy and Adani Electricity Mumbai by giving them a zero lending value. Bloomberg notes that CS had earlier given a 75% lending value to Adani Ports' bonds. However, it was reported that other banks continue to lend against Adani Group's notes where at least two European private banks have kept the level unchanged currently. A source reports that one of these private banks is still offering lending of between 75-80% for Adani Ports' dollar bonds.

January 31, 2023: Adani Group's Dollar Bonds Recover On Completion of $2.5bn Share Sale

Dollar bonds of Adani Group rallied by up to 6 points across the curve after the successful completion of Adani Enterprises' $2.5bn FPO. The offer was fully subscribed and was India’s largest follow-on share sale. Besides, the group also put up about $300mn worth of shares to maintain its collateral cover on a $1bn loan by a group of banks after the selloff in its shares. Both of the above are expected to help ease some pressure on the company that has been in the limelight due to Hindenburg Research's allegations that they were involved in fraud and stock manipulations, amongst several other concerns.

January 30, 2023: Adani Group's Dollar Bonds Continue to Drop; IHC to Invest $400mn in Adani Enterprises FPO

Abu Dhabi’s International Holding Company (IHC) announced that it will invest about $400mn in Adani Enterprises' FPO, representing about 16% of the offering. The investment follows a ~$2bn investment in Adani’s companies last year and is a vote of confidence from the Royal family. Adani Enterprises' $2.5bn FPO will close on Tuesday and is expected to be a key indication of confidence in the company after Hindenburg Research's allegations on the group. While investors in India typically tend to subscribe to offerings on the last day, Adani's FPO subscription stood at 3% as of Monday. Most noteworthy was the tepid demand from institutional investors, where subscription stood at just 0.004%.

Separately, some activists have urged bond investors including the likes of BlackRock, Allianz and Pimco to shun Adani Group due to governance and climate related issues. Nick Haines, campaign manager for SumOfUs, an investor advocacy group said that Hindenburg's research "undermine any confidence investors could have that proceeds from Adani's planned green issues this year would be adequately ringfenced". He added that buying debt from any of Adani's subsidiaries is an extension of support to the conglomerate's mining business.

While the group does not have any dollar bond maturities due this year, it has about $289mn in dollar bond coupons due this year, with the first payment on Thursday, worth $24.7mn.

January 29, 2023: Adani Dollar Bonds Pullback Despite 413-Page Rebuttal

Adani Group's dollar bonds dropped by 5-8% across the curve despite the company providing a 413-page calling Hindenburg Research the “Madoffs of Manhattan” and added that it was an attack on the nation and the integrity of institutions.

Immediately in response, Hindenburg Research said that the statement by Adani "ignores key allegations" and that the conglomerate's response failed to "specifically answer" 62 of 88 questions. It added, "Fraud cannot be obfuscated by nationalism or a bloated response that ignores every key allegation we raised". It further noted that there was no concerns on the nation and that Adani Group was trying to "lead the focus away from substantive issues and instead stoked a nationalist narrative".

January 27, 2023: Adani Dollar Bonds Show Recovery after Response to Hindenburg Report

Adani Group responded to Hindenburg Research’s note with its dollar bonds recovering by ~5%. Adani Group dismissed the claims as baseless, saying that it was timed to damage its reputation ahead of the planned $2.5bn share issuance of Adani Enterprises. Besides, it added, “We are evaluating the relevant provisions under U.S. and Indian laws for remedial and punitive action against Hindenburg Research”… The report has “adversely affected the Adani Group, our shareholders and investors. The volatility in Indian stock markets created by the report is of great concern”

Retorting to Adani Group’s response, Hindenburg Research said, that they would “welcome” threats of legal action, adding that they fully stood by their report and believed that any legal action taken would be “meritless”. Further, Hindenburg added, “If Adani is serious, it should also file suit in the U.S. where we operate. We have a long list of documents we would demand in a legal discovery process”

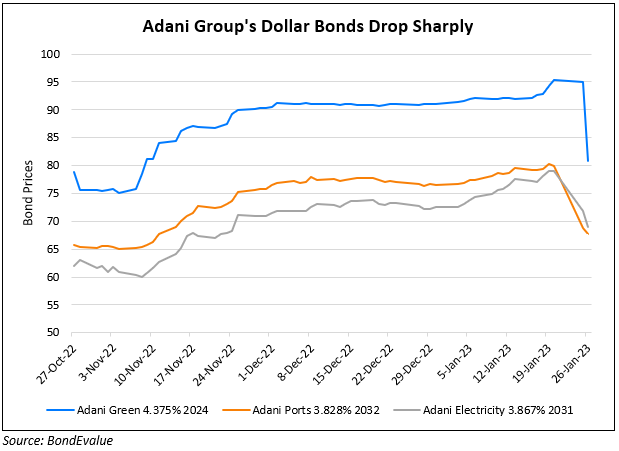

January 26, 2023: Adani Dollar Bonds Plummet as Hindenburg Reveals Short Positions on Frauds, Manipulations

Dollar bonds of Adani Group dropped sharply by over 10 points after Hindenburg Research said that it held short positions in the group via its dollar bonds and non-Indian-traded derivative instruments. Hindenburg is popular in the markets as a short-seller with one of its recent famous disclosures being exposing automaker Nikola’s operations. In a thread of tweets, Hindenburg Research said that the findings of its “2-year investigation” in addition to speaking with dozens of individuals, including former Adani Group executives as well as a review of documents showed that the group “engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades”. It added, “Adani family members allegedly cooperated to create offshore shell entities in tax-haven jurisdictions like Mauritius, UAE & the Caribbean to generate forged import/export documentation, generate fake or illegitimate turnover and siphon money from the listed companies”. It also said that key listed Adani companies had “substantial debt” that has put the group on a “precarious financial footing”.

Adani Group in response, dismissed the claims as baseless, saying that it was timed to damage its reputation ahead of the planned $2.5bn share issuance of Adani Enterprises.

Separately, UAE investors International Holding Co. (IHC), Abu Dhabi Investment Authority (ADIA) and Mubadala Investment are said to be bidding for a stake in the $2.5bn share issuance by Adani Enterprises, as per sources.

Track Adani Group's bonds now on the BondEvalue App by clicking here

Track the latest bond prices of Adani Group by clicking on the bonds below

| Bond | Bond Price (10-Feb-2023) |

| Adani ICT 3% 2031 | 72.2 |

| Adani Transmission 4.25% 2036 | 71.2 |

| Adani Ports and SEZ 5% 2041 | 66.6 |

| Adani Ports and SEZ 3.1% 2031 | 69.1 |

|

69.1

|

|

| Adani Transmission 4% 2026 | 78.6 |

| Adani Ports and SEZ 4.375% 2029 | 76.9 |

| Adani Ports and SEZ 4.2% 2027 | 78.7 |

| Adani Ports and SEZ 3.375% 2024 | 89.1 |

| Adani Ports and SEZ 4% 2027 | 79.4 |

| Adani Electricity 3.949% 2030 | 73.6 |

| Adani Electricity 3.867% 2031 | 71.7 |

| Adani Green 4.375% 2024 | 71.4 |

| Adani Green 6.25% 2024 | 90.3 |

Go back to Latest bond Market News

Related Posts: