This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

7-Eleven Raises $10.95 Billion via Jumbo Issuance, 2021’s Largest Bond Deal Yet

January 28, 2021

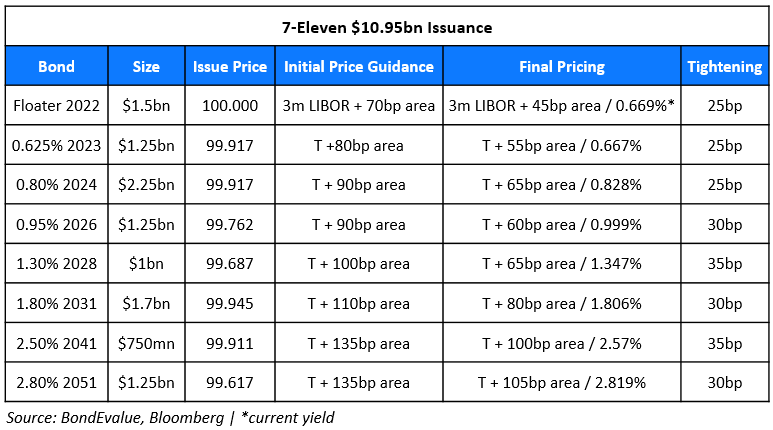

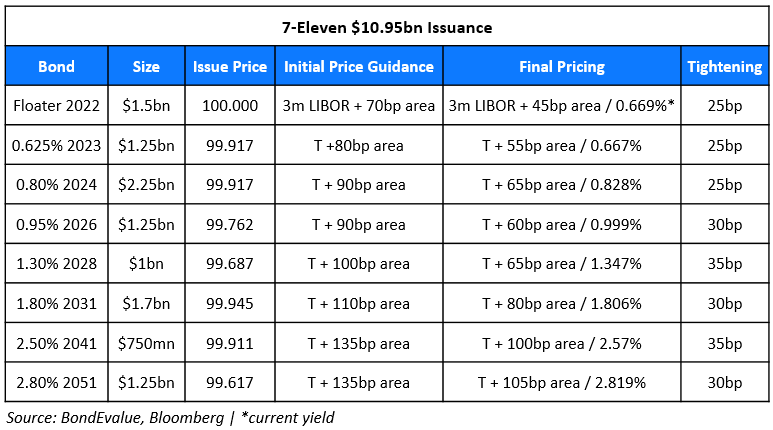

US convenience store chain 7-Eleven (Baa2/AA-) raised $10.95bn via an 8 part jumbo offering, 2021’s largest issuance yet. Below are the details of the 8 tranches:

The bonds, expected to be rated Baa2/AA- met with solid investor demand with a combined order book of$62bn, or 5.7x issue size, nearly double the typical peak oversubscription for jumbo transactions as per Bloomberg. While still not close to Aramco’s record-setting $100bn peak book for its $12bn 5-part deal (8.3x), 7-Eleven dwarfed recent trades from Broadcom ($10bn, covered 3.3x), Verizon ($12bn, covered 2.3x), Bristol-Myers ($7bn, covered 4.3x), Gilead ($7.25bn, covered 4.3x) and T-Mobile ($19bn, covered 3.9x). The company also became the most recent company to price its 20Y off the UST 20Y rather than the old long bond. The deal is also the largest M&A bond financing since T-Mobile priced $19bn for its Sprint acquisition in April 2020.

Go back to Latest bond Market News

Related Posts:

Brookfield, KKR Seeking to Pump $10 Billion in Aramco Pipelines

January 21, 2021

Softbank Outlook Revised to Stable from Negative by S&P

January 27, 2021

NBK Prices The GCC’s Second Lowest Coupon Dollar AT1 at 3.625%

February 19, 2021