This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

65% of Dollar Bonds Deliver Positive Returns in April; HY Outperforms IG Yet Again

May 3, 2021

The month of April showed a reversal in fortunes for bond investors after a dismal first quarter when 74% of dollar bonds traded lower. In April, 65% of dollar bonds in our universe delivered a positive price return (ex-coupon) as the 10Y Treasury yield eased 4-5bp during the month. In comparison, March and February saw 82% and 66% of dollar bonds delivering negative price returns.

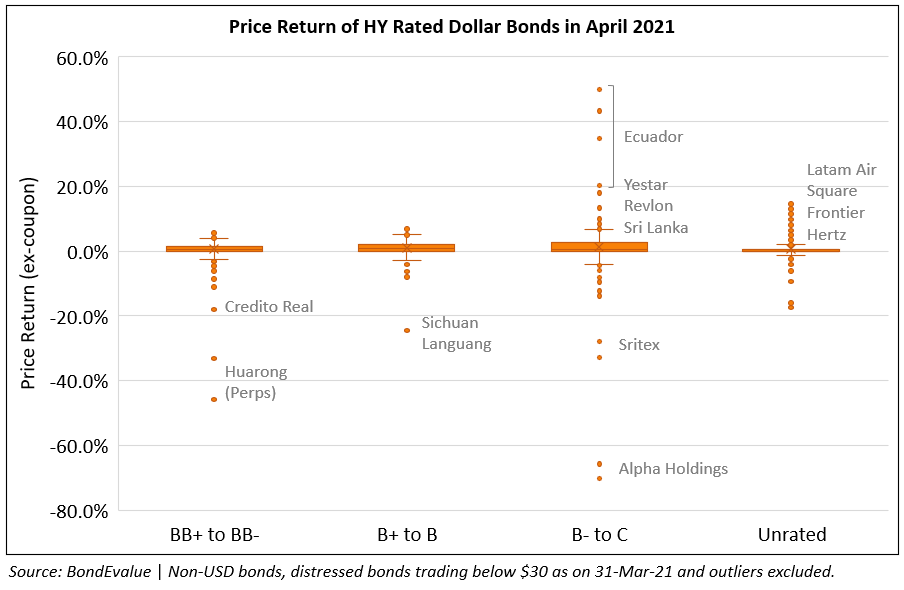

Both Investment Grade (IG) and high yield (HY) bonds performed well with the latter performing relatively better once again. 71% of HY dollar bonds ended the month in the green vs. 60% of IG bonds.

IG performed much better than the prior two months as US Treasury yields eased in April after the 10Y yield rose a massive ~67bp in February and March. An exception to this was China Huarong’s dollar bonds that went through high bouts of uncertainty over its financial position leading to a sharp selloff in its bonds, causing the long tail in the box and whisker plot below.

In the HY space (box and whisker plot in the cover image), Ecuador’s bonds saw a big jump after a positive presidential election result. On the other hand, a long negative tail was observed in the bonds of Mexico’s AlphaCredit, Huarong’s Perps and Credito Real.

Issuance Volume & Largest Deals

Global corporate dollar issuance volume stood at $108.3bn for April 2021 down 53% vs. last April’s issuance of $231bn and 46% lower than the month prior.

APAC ex-Japan & Middle East G3 issuance stood at $37.3bn, just 3% higher vs. last April’s issuance of $36bn, and 9% lower than last month’s issuance of $41bn.

The largest deals last month were dominated by US banks after record issuances with BofA raising $15bn via a six-part offering to mark the largest issuance ever by a bank. The record shattered that of JPMorgan’s issuance just a day prior which saw them raise $13bn via a five-part offering. Besides these, Goldman priced a jumbo $7bn six-trancher followed by Citi’s $5.5bn triple-trancher.

In the Asia ex-Japan region Tencent’s $4.15bn four-trancher led the deals followed by the likes of TSMC raising $3.5bn via a three-trancher, Petronas raising $3bn via a dual-trancher and Abu Dhabi Ports raising $1bn via a 10Y bond in the dollar bond markets.

Top Gainers & Losers

In the HY space, long tenor bonds of Ecuador rallied the most after Guillermo Lasso won the presidential election beating Andrés Arauz. Bonds of Hertz continued to rally after they received an improved offer from Knighthead Capital Management and Certares Management to fund the US car rental firm’s exit from bankruptcy. On the losers list, Mexican non-bank lender AlphaCredit lost 70% of its value after derivatives accounting errors came to light that now require it to revise its 2018 and 2019 financial statements.

In the IG space, China Huarong Asset Management Company also saw its bonds plummet with its Perps losing almost half its value after delaying their earnings release and uncertainty on the government’s support for the company, followed by ratings downgrades.

Go back to Latest bond Market News

Related Posts: