This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

6 New $ Deals Launched incl. JSW, Julius Baer, Trafigura; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 15, 2021

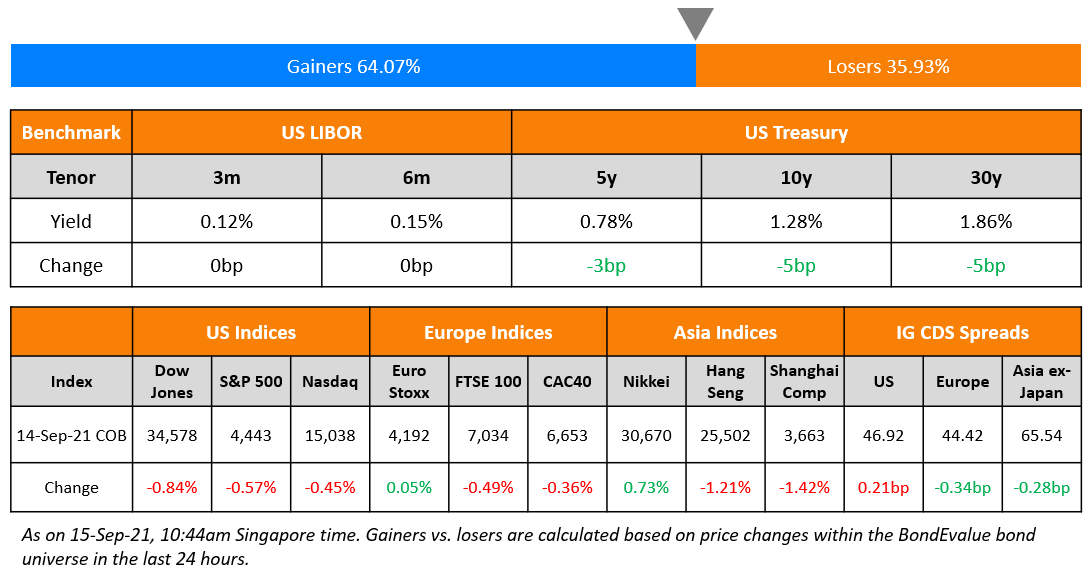

US markets dipped again despite CPI numbers suggesting that inflation could be cooling off – S&P was down 0.6% taking the MTD losses in September to 1.8% while Nasdaq slid 0.5% marking a fifth straight day of losses. All eleven sectors closed in the red with Energy, Financials, Industrials and Materials shedding between 1.2% and 1.6%. European stocks looked for direction – DAX was marginally up 0.1% while FTSE and CAC lost 0.5% and 0.4%. Brazil’s Bovespa ended 0.2% lower. Saudi TASI was down 0.1% while UAE’s ADX was broadly flat. Asian markets have started the day with a sell-off – Nikkei and HSI were down 0.7% to 0.8% and Shanghai and Singapore’s STI were down more than 0.3%. US 10Y Treasury yields were down 4bp to 1.28% after the US CPI report. US IG and HY CDX spreads widened 0.3bp and 0.6bp respectively. EU Main CDS spreads were 0.3bp tighter and Crossover CDS spreads tightened 1.9bp. Asia ex-Japan CDS spreads tightened 0.3bp.

The US Consumer Price Index (CPI) rose 0.3% MoM and 5.3% YoY. This was the slowest increase in six months and was lower than the expectations of 5.4% indicating a easing price pressures and leading to a rally in the longer tenor bonds. Liz Ann Sonders, Charles Schwab chief investment strategist said, “What we need to see to be fundamentally markets supportive is a continued easing in the inflation piece without deterioration in the economic outlook,” adding, “The next couple of weeks, economic data points become even more important to see whether it confirms the the weakness that we saw on the August jobs report or starts to suggest that maybe we’re seeing an improvement.” With the drop in Treasury yields, longer tenor corporate bonds of names like HSBC, ChemChina, Transocean, Occidental rose over 1%.

Join Us for The Upcoming 8-Module Course on Bonds – Curated for Investors & Professionals

The course will be conducted via Zoom over 8 modules on 27-30 September and 4-7 October (Monday-Thursday) at 5pm Singapore / 1pm Dubai / 10am London. The course will be conducted by senior debt capital market bankers and professionals who will cover both fundamental concepts as well as the practical aspects of bonds.

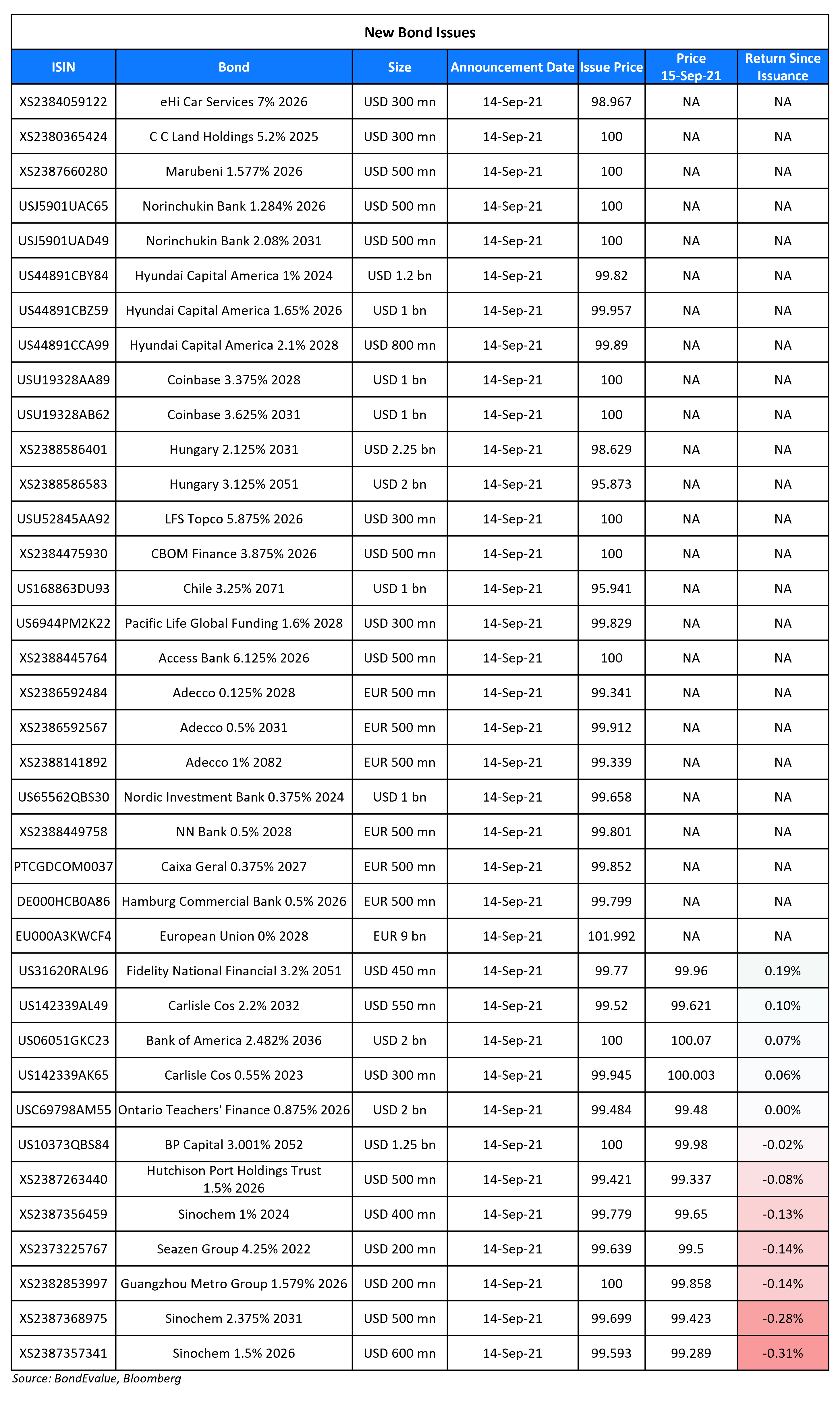

New Bond Issues

- Korea Electric Power $ 5Y green @ T+75bp area

- Bangkok Bank $ 15NC10 tier 2 @ T+250bp

- JSW Steel $ 5/10Y sustainability-linked @ 4.375/5.5% area

- Jinan City Construction Group $ 5Y @ 3%

- Trafigura $ Perp NC6 @ 6.25%

- Julius Baer Group $ Perp NC7 AT1 @ 4.25% area

Bank of America (BofA) raised $2bn via a 15NC10 bond at a yield of 2.482%, 15bp inside the initial guidance of T+135bp area. The bonds have expected ratings of Baa1/BBB+/A. The bonds have a first call date on September 21, 2031 at a price of 100. If not called, the coupon will reset to the prevailing US 5Y Treasury + 120bp.

Seazen Group raised $200mn via a 364-day bond at a yield of 4.625%, 22.5bp inside the initial guidance of 4.85% area. The bonds are unrated, and received orders over $850mn, 4.3x issue size. The bonds are issued by Future Diamond and guaranteed by Seazen Group and Seazen Resources Capital Group. The new bonds are priced 45.5bp wider to its existing 6.45% bonds due June 2022 issued by guarantor Seazen Group that currently yield 4.17%.

Hyundai Capital America raised $3bn via a three-tranche deal. It raised:

- $1.2bn via a 3Y bond at a yield of 1.061%, 27bp inside initial guidance of T+90bp area.

- $1bn via a 5Y bond at a yield of 1.659%, 27bp inside initial guidance of T+115bp area.

- $800mn via a 7Y bond at a yield of 2.117%, 25bp inside initial guidance of T+130bp area.

The bonds have expected ratings of Baa1/BBB+ (Moody’s/S&P). Hyundai Capital America is the finance provider for the Hyundai and Kia car brands in the US, and is a subsidiary of Hyundai Motor Group.

OUE Treasury raised S$150mn via a 5Y bond at a yield of 3.5%, 20bp inside initial guidance of 3.7% area. The bonds are unrated, and received orders over S$178mn, 1.2x issue size. The bonds will be issued by OUE Treasury and guaranteed by its parent. Singapore accounted for 95% while others made up 5%. Private banks bought 72%, fund managers 25% and banks 3%.

eHi Car Services raised $300mn via a 5NC3 bond at a yield of 7.25%, 37.5bp inside initial guidance of 7.625% area. The bonds have expected ratings of B+/B (S&P/Fitch), and received orders over $1.08bn, 3.6x issue size. The new issue comes alongside a tender offer for its outstanding $251.555mn 5.875% 2022s.

Sinochem raised $1.5bn via a three-tranche deal. It raised:

- $400mn via a 3Y bond at a yield of 1.075%, 45bp inside initial guidance of T+110bp area. Asia bought 81% and EMEA 19%. Banks took 60%, asset managers and fund managers 31%, and pension funds, insurers and others 9%.

- $600mn via a 5Y bond at a yield of 1.585%, 40bp inside initial guidance of T+120bp area. Asia bought 93% and EMEA 7%. Banks received 69%, asset managers and fund managers 25%, and pension funds, insurers and others 6%.

- $500mn via a 10Y bond at a yield of 2.409%, 40bp inside initial guidance of T+150bp area. Asia bought 89% and EMEA 11%. Banks took 61%, asset managers and fund managers 35%, and pension funds, insurers and others 4%.

The bonds have expected ratings of A–/A (S&P/Fitch), and received combined orders over $4.5bn, 3x issue size. The bonds are issued by Sinochem Offshore Capital and guaranteed by Sinochem Hong Kong (Group). Its parent Sinochem Group will provide a letter of support.

Guangzhou Metro Group raised $200mn via a 5Y green bond at a yield of 1.579%, 45bp inside the initial guidance of T+125bp area. The bonds have expected ratings of A+ (Fitch), and received orders over $2bn, 10x issue size. Proceeds will be allocated to finance and/or refinance eligible green projects as defined in the company’s green finance framework. The bonds will be issued by wholly owned subsidiary Guangzhou Metro Investment Finance (BVI) and guaranteed by Guangzhou Metro Investment Finance (HK). Guangzhou Metro Group has provided a keepwell deed and a deed of equity interest purchase undertaking. The new bonds are priced 11.1bp tighter to its existing 1.507% 2025s that currently yield 1.69%, despite the longer tenor. APAC bought 98% and EMEA 2%. Banks and financial institutions took 55%, asset managers, fund managers and hedge funds 42%, while insurers and private banks took 3%.

Marubeni raised $500mn via a 5Y green bond at a yield of 1.577%, 25bp inside the initial guidance of T+100bp area. The bonds have expected ratings of Baa2/BBB (Moody’s/S&P), and received orders over $2.8bn, 5.6x issue size.

Hutchison Port Holdings Trust raised $500mn via a 5Y bond at a yield of 1.621%, 35bp inside the initial guidance of T+115bp area. The bonds have expected ratings of Baa1/A– (Moody’s/S&P), and received orders over $2.2bn, 4.4x issue size. The bonds are issued by HPHT Finance (21) and guaranteed by Hutchison Port Holdings Trust and HPHT Ltd. The new bonds are priced 16.1bp wider to its existing 2% 2026s that yield 1.46%. Asia bought 95% and EMEA 5%. Fund managers received 71%, banks 13%, insurers 12%, the public sector 3%, and private banks 1%.

C C Land Holdings raised $300mn via a 4NC2 bond at a yield of 5.2%, 30bp inside the initial guidance of 5.5% area. The bonds are unrated, and received orders over $1.3bn, 4.3x issue size. Proceeds will be used for debt refinancing and general working capital. The bonds are issued by wholly owned subsidiary Perfect Point Ventures and guaranteed by C C Land Holdings. Asian investors bought 99% while EMEA bought 1%. Private banks, ultra-high-net-worth and corporates received 82%, fund managers 13%, and banks and financial institutions 5%.

Norinchukin Bank raised $1bn via a two-tranche green deal. It raised $500mn via a 5Y green bond at a yield of 1.284%, 25bp inside initial guidance of T+75bp area, and $500mn via a 10Y green bond at a yield of 2.08%, 25bp inside initial guidance of T+105bp area. The bonds have expected ratings of A1/A (Moody’s/S&P). Proceeds will be used to finance or refinance eligible green projects under the bank’s green bond framework. Norinchukin Bank is a national-level Japanese cooperative financial institution, providing services for the agriculture, forestry and fisheries industries.

The Republic of Chile raised $1bn via a 50Y social bond at a yield of 3.42%, 32bp inside the initial guidance of T+190bp area. The bonds have expected ratings of A1/A/A-. The issuer will invest an amount equal to the proceeds from the bond sale, net of underwriting discount and expenses, into projects that may qualify as “eligible social expenditures” under Chile’s Sustainable Bond Framework.

Hungary raised $4.25bn via a two-tranche deal. It raised $2.25bn via a 10Y bond at a yield of 2.279%, 30bp inside the initial guidance of T+130bp area, and $2bn via a 30Y bond at a yield of 3.344%, 30bp inside the initial guidance of T+180bp area. The bonds are unrated.

New Bonds Pipeline

- Oxley Holdings hires for S$ tap of 6.9% 2024s bond

- Maldives’ HDC hires for $ 3Y sustainability bond

- Clover Aviation Capital hires for $ bond

- Philippines hires for $ 5/10Y retail bond

- ICBC hires for $ Perp NC5 AT1 bond

- Weifang Urban Construction and Development hires for $ bond

- Bank Negara Indonesia hires for $ AT1 bond

- Pinghu State-owned Assets Holding hires for $ bond

- Beijing Environment Sanitation Engineering Group hires for $ bond

- Ayala hires for $ Perp NC5 fixed-for-life bond

Rating Changes

- Moody’s upgrades Tata Steel to Ba1; stable outlook

- Fantasia Outlook Revised To Negative On Sizable Offshore Maturities Dragging On Financial Resources; ‘B’ Rating Affirmed

- Ronshine China Downgraded To ‘B’ As Reduced Profitability Hampers Deleveraging; Outlook Stable

- Cirsa Outlook Revised To Stable On Improved Operating Performance And ‘B-‘ Rating Affirmed; Proposed Notes Rated ‘B-‘

- Fitch Revises EFG’s Outlook to Stable; Affirms IDR at ‘A’

- Moody’s changes outlook to stable, affirms Glencore’s Baa1 rating

- Moody’s affirms Cirsa’s CFR at B3; changes outlook to positive

Term of the Day

Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back. The Indonesian sovereign has launched a tender offer for 8 of its USD denominated bonds.

Talking Heads

On US Inflation Easing- Fiona Cincotta, senior financial markets analyst at City Index

“The softer inflation prints caused investors to push back on bets that the Fed could move sooner to taper bond purchases. Easing inflation would take the heat off the Fed to move prematurely…So the evidence does appear to be building that peak inflation has passed. That said, supply chain bottlenecks are expected to persist for a while so it’s unlikely that either PPI or CPI will drop dramatically or rapidly”

On breaking apart Well Fargo – U.S. Senator Elizabeth Warren

“Wells Fargo is simply ungovernable…irredeemable repeat offender…You owe your customers, your investors, and your regulators an explanation for Wells Fargo’s ongoing inability to meet legal and regulatory requirements”

On Evergrande threatening the wider real estate market

Michel Lowy of banking and asset management firm SC Lowy

“If as expected Evergrande is defaulting on its debt and goes through a restructuring, I don’t see why it would be contained. There are other developers that are suffering from the same problem of no access to liquidity and have extended themselves too much…Millions of contracts with multiple counterparties, everyone was trying to work out their exposure. With Evergrande it depresses the entire real estate sector.”

James Shi, distressed debt analyst at credit analytics provider Reorg.

The government has worked tirelessly to drive de-leveraging in the bloated real estate sector, so throwing a lifeline to Evergrande now is unlikely”

Nomura analyst Iris Chen

“We do not believe the government has an incentive to bail out Evergrande (which is a private-owned enterprise)… But they will also not actively push Evergrande down and will supervise a more orderly default, if any, in our view”

On SoftBank’s bet on Latin America – Masayoshi Son

“There is so much innovation and disruption taking place in Latin America, and I believe the business opportunities there have never been stronger…Latin America is a critical part of our strategy.”

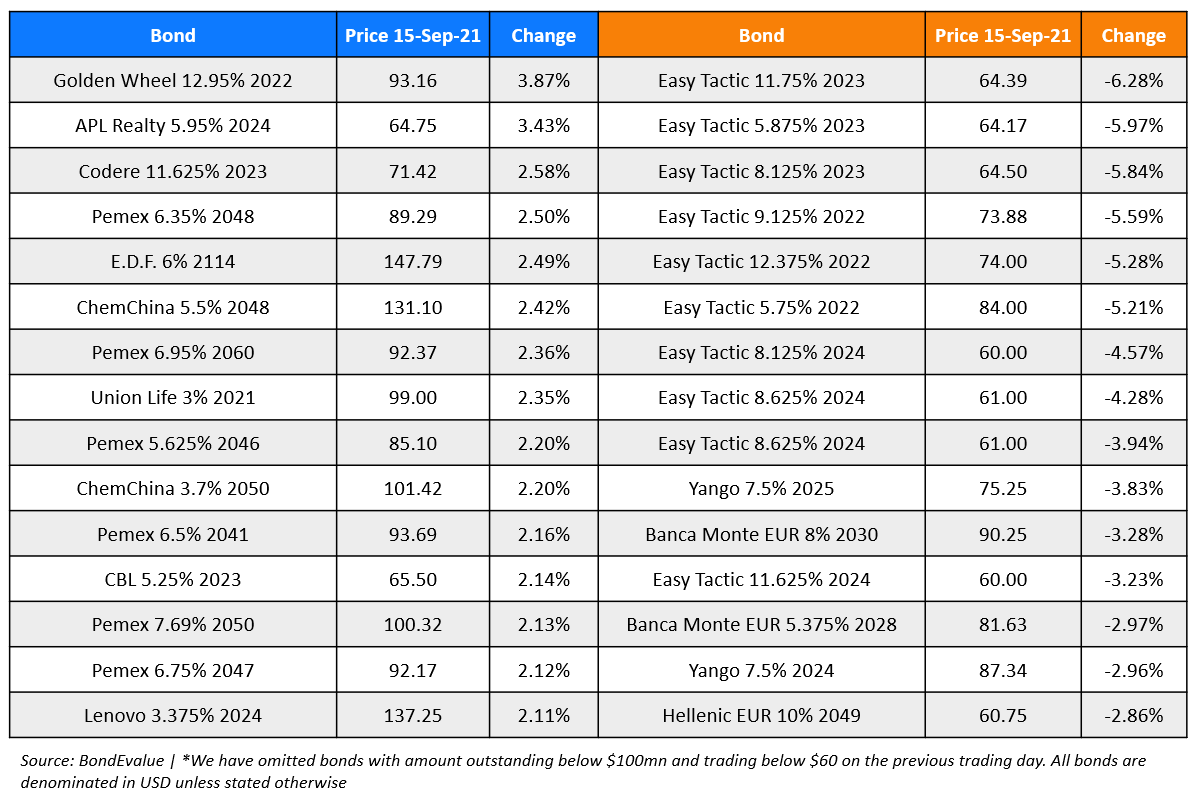

Top Gainers & Losers – 15-Sep-21*

Go back to Latest bond Market News

Related Posts:.png)