This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

6 New $ Deals incl. Greenland, Greenko; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 7, 2021

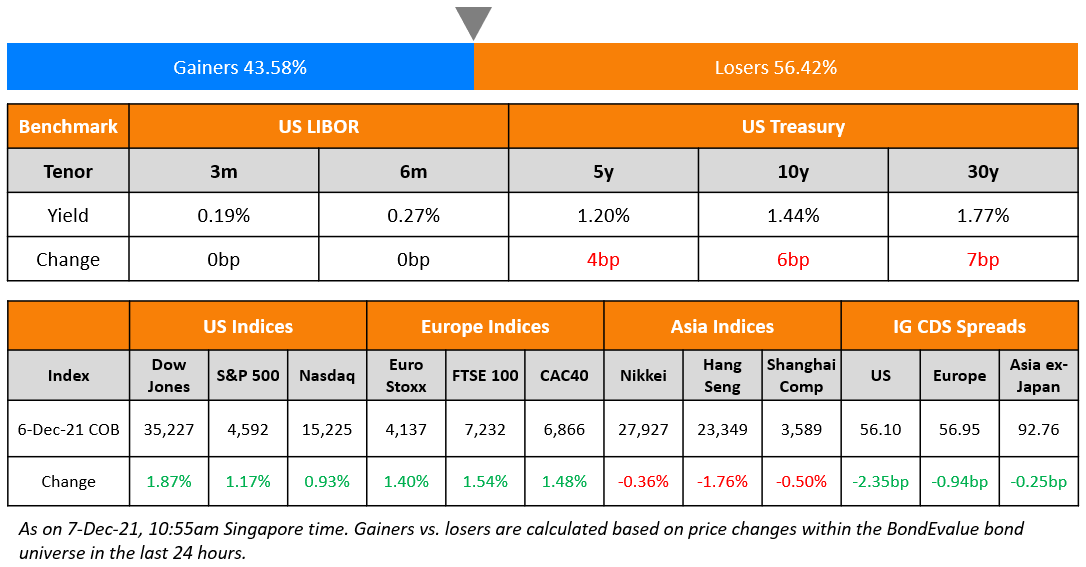

US equity markets recovered on Monday with the S&P and Nasdaq closing 1.2% and 0.9% higher. All sectors were in the green led by Industrials, Consumer Staples, Energy and Utilities, up over 1.5% each. US 10Y Treasury yields moved 6bp higher to 1.44% as the risk-off move ebbed. European markets were higher too with the DAX, CAC and FTSE down 1.4%, 1.5% and 1.5% respectively. Brazil’s Bovespa was up 1.7%. In the Middle East, UAE’s ADX was up 2.6% while Saudi TASI was down 1.1%. Asian markets have opened higher – Shanghai, HSI, STI and Nikkei were up 0.1%, 1.5%, 0.3% and 1.9% respectively. US IG CDS spreads tightened 2.4bp and HY CDS spreads tightened 12.4bp. EU Main CDS spreads were 0.9bp tighter and Crossover CDS spreads were 3.9bp tighter. Asia ex-Japan CDS spreads tightened 0.3bp.

The PBOC said it will reduce the Reserve Requirement Ratio (RRR) for most banks’ by 50bp which will help release RMB 1.2tn ($188bn) in liquidity. Analysts note that the tone on the housing sector was dovish and that the Politburo has recognized downward pressures on the economy. Bloomberg notes however, that the PBOC downplayed any expectations that it was the start of of an easing cycle by notign that the RRR cut was a “regular monetary policy action”. German Factory Orders fell 6.9% MoM in October vs. forecasts of a -0.5% print.

New Bond Issues

- Greenland Holding Group $ 8-month at 8% final

- Greenko $ 7NC3 green at 4.625% area

- Wuxi Construction and Development Investment $ 3Y green at 2.5% area

- Jinan Rail Transit Group $ 364-day at 2.4% area

- Weifang Binhai Investment Development € 364-day at 5.5% area

- Xiamen ITG Holding Group $ 364-day at 2.5% area

Dell raised $2.25bn via a two-tranche deal. It raised:

- $1bn via a 20Y bond at a yield of 3.398%, 32.5bp inside initial guidance of T+187.5bp area

- $1.25bn via a 30Y bond at a yield of 3.452%, 30bp inside initial guidance of T+200bp area

The bonds have expected ratings of Baa3/BBB/BBB. Proceeds will be used to fund tender offers for their existing bonds. The bonds as part of the tender offer include its 8.350% 2046s, 8.1% 2036s, 6.5% 2028s, 5.4% 2040s, 6.2% 2030s and 6.02% 2026s.

NTT raised €1.5bn via a dual-tranche deal. It raised:

- €650mn via a 4Y green bond at a yield of 0.082%, 28bp inside initial guidance of MS+55bp.

- €850mn via a 7Y green bond at a yield of 0.399%, 25bp inside initial guidance of MS+70bp.

The bonds have expected ratings of A (S&P). The 4Y green bond received orders over €3bn, 4.6x issue size, while the 7Y green bond received orders over €3.5bn, 4.1x issue size.

Yantai Guofeng Investment Holdings Group raised $250mn via a 3Y bond at a yield of 2.2%, 50bp inside initial guidance of 2.7% area. The bonds have expected ratings of BBB+ (Fitch). Proceeds will be used for project construction and working capital. The bonds are issued by wholly owned subsidiary Junfeng International and guaranteed by the parent.

Del Monte Pacific raised $90mn via a 3NC2 bond at a yield of 3.75%. The bonds are unrated. Proceeds will be used for general corporate purposes, including refinancing and the redemption of the borrower’s preference shares. The bonds come with a change of control put at 101 prior to December 9, 2023, and at par after. There is also an equity clawback at par plus coupon prior to that date, and a make-whole redemption at par plus applicable premium. The notes can be redeemed after December 9, 2023 at par plus half of the coupon i.e., 101.875.

Ming Yang Smart Energy Group raised $200mn via a 3Y green bond at a yield of 1.6%, 30bp inside initial guidance of 1.9% area. The bonds have expected ratings of A (Fitch), and received orders over $508mn, 2.5x issue size. Proceeds will be used for the Tongliao Kailu 600MW wind power project in Inner Mongolia Autonomous Region. The bonds are issued by wholly owned subsidiary MingYang Smart Energy (BVI). The bonds are supported by a letter of credit from Bank of China Guangdong branch. Ming Yang Smart Energy Group has provided a keepwell.

New Bonds Pipeline

- CEB International hires for $ bond

- SGSP (Australia) hires for $ green bond

Rating Changes

- Moody’s downgrades RiseSun’s ratings to B3/Caa1; outlook remains negative

- China Aoyuan Downgraded To ‘SD’ On Nonpayment Of Borrowings; Ratings Withdrawn At The Company’s Request

- Fitch Revises Teva’s Outlook to Stable; Affirms Ratings at ‘BB-‘

Term of the Day

Kung-fu Bond

Kung-fu bonds are offshore USD denominated bonds issued by Chinese issuers, aka Chinese dollar bonds. These issuances offer a source of funding from offshore markets for local borrowers and help build an international investor base. The Kungfu bond market has been primarily dominated by government related institutions, banks and real estate developers. Bloomberg reported on Monday that among 1,008 USD denominated Chinese offshore “kungfu” bonds they track, Jingrui saw the biggest daily price change gaining 8.19 cents on the dollar while Easy Tactic declined the most, by 4.81 cents.

Talking Heads

On ECB Should Keep Highly Accommodative Policy Stance – International Monetary Fund (IMF)

“With underlying inflation dynamics expected to remain weak over the medium term under the baseline, the ECB should look through transitory inflation pressures and maintain a highly accommodative monetary policy stance… Upcoming wage negotiations, which are expected to be more frequent than in previous years after many contract renewals were put on hold during the pandemic, will need close monitoring… The ECB should also stand ready to scale down and then terminate asset purchases and TLTROs, followed by a gradual adjustment of policy rates, should high inflation prove to be more durable.”

On Cracks Emerging in Treasury Bond Market as Fed Starts to Back Away

John Briggs, global head of desk strategy at NatWest Markets

“Treasury is cutting the amount of the most liquid Treasuries and the Fed is stopping its buying of the least liquid… And what we’ve seen overall in the Treasury market is that liquidity is more of a mirage. The Fed still is basically the only real balance sheet in town.”

Praveen Korapaty, head of interest-rate strategy at Goldman Sachs Group

The combination is a mechanism for more bouts of illiquidity and volatility. If the Fed is not there, others in the market will be less willing to provide liquidity in off-the-run securities. And at the same time the Treasury is cutting on-the-run issuance.”

Jay Barry, head of U.S. government-bond strategy at JPMorgan

“Off-the-runs have been outperforming on-the-runs over the last year and half given the Fed’s the biggest player in the game and they are only buying off-the-runs… there’s going to be a need for someone else to finance and own off-the-runs, and that is probably going to be the hedge-fund community or real end-users.”

On China’s Bond Rally May Stall After PBOC Signals Limits to Easing

Hao Yang, an analyst at Nanjing Securities Co.

“The RRR cut came sooner than the market had expected, which is a reflection of the PBOC’s strong willingness to ease growth concerns… China’s 10-year yields should stay within a range of 2.8%-2.9% with limited support from the RRR cut, as the market waits to see whether the easing would be effective in offsetting growth headwinds.”

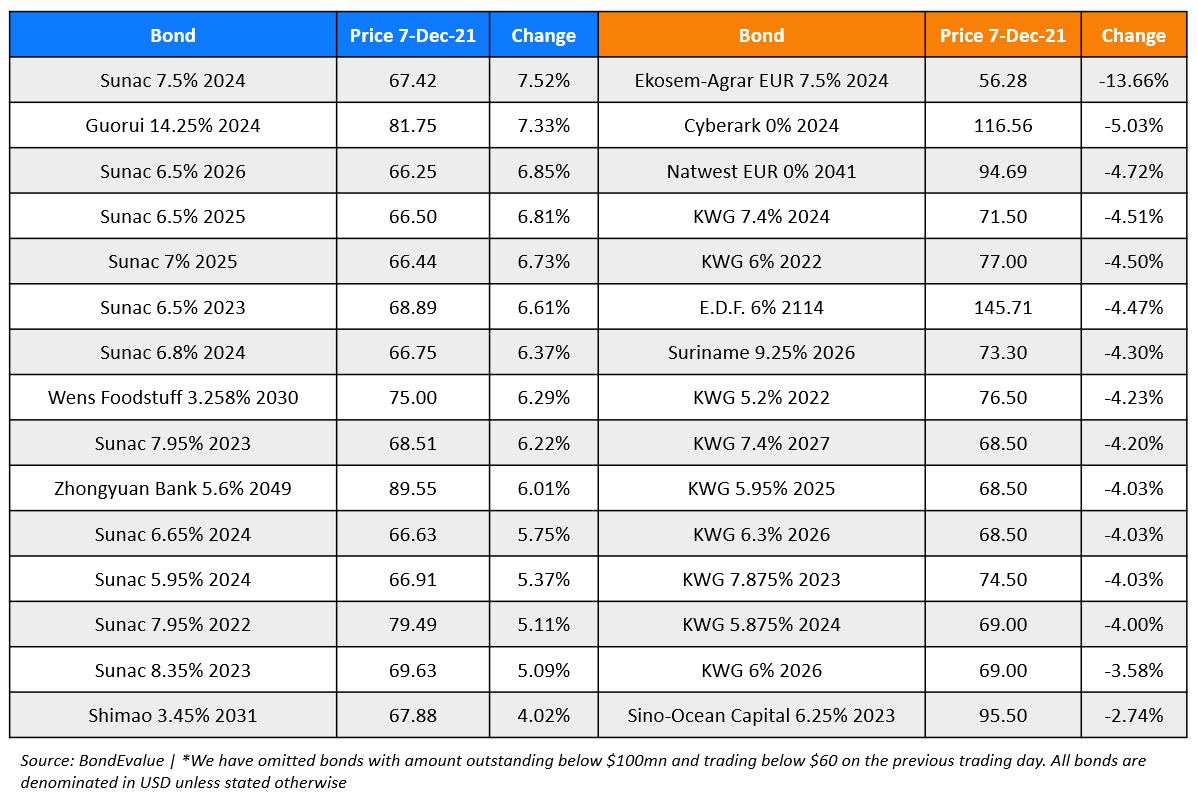

Top Gainers & Losers – 07-Dec-21*

Go back to Latest bond Market News

Related Posts: