This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

5 New Deals incl. Kexim, KEB Hana; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 12, 2021

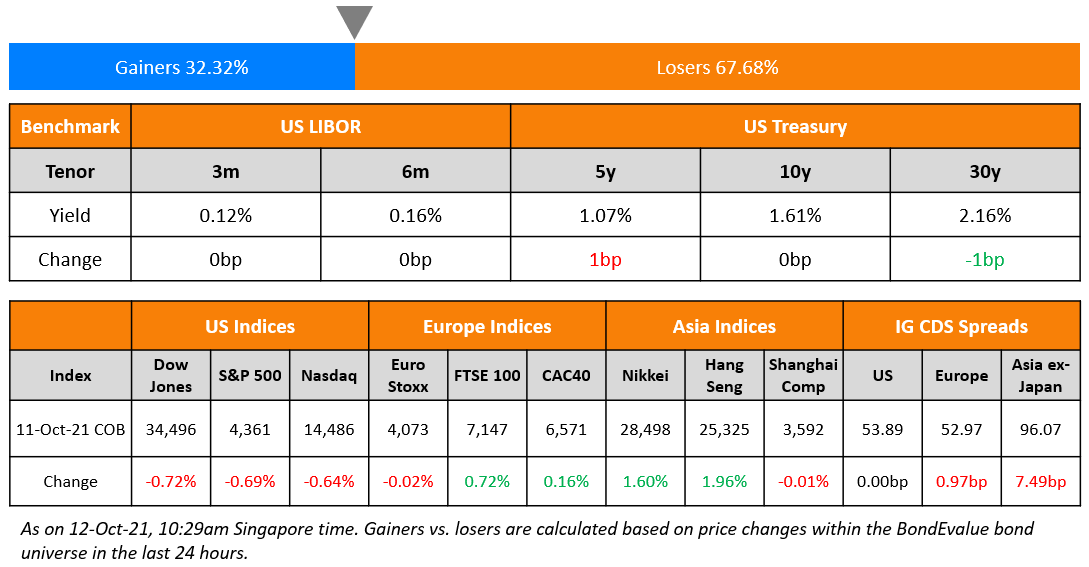

US equities ended lower again with the S&P and Nasdaq down 0.7% and and 0.6%. Barring Materials and Real Estate which were marginally in the green, all other sectors were in the red with Utilities, Communication Services and Financials falling over 1%. US 10Y Treasury yields are flat at 1.61%. European stocks were mixed with the DAX and CAC near flat while the FTSE was up 0.7%. Brazil’s Bovespa ended 0.6% lower. In the Middle East, UAE’s ADX was up 0.7% and Saudi TASI was down 0.5%. Asian markets opened lower with Shanghai, HSI and the Nikkei down 0.7%, 0.8% and 0.9% and the STI down 0.4%. EU Main CDS spreads were 1bp wider and Crossover CDS spreads widened 4.5bp. Asia ex-Japan CDS spreads widened sharply again, by 7.5bp as Chinese property developers’ bonds plummet and uncertainty on defaults loom.

New Bond Issues

- Kexim $ 7Y green @ T+60bp area

- KEB Hana Bank $ Perp NC5 sustainability AT1 @ 3.5% area

- Beijing Infrastructure Investment $ 3Y @ T+115bp area

- Zhuji State-owned Assets Management $ 3Y @ 3.5% area

- Dongfeng Motor Group € 3Y @ MS+100bp area

- Nanjing Jiangning Economic and Tech Dev. $ 364-day @ 2.9% area

Kexim raised €850mn via a 3Y green bond at a yield of -0.142%, 15-20bp inside initial guidance of MS+30-35bp. The bonds have expected ratings of Aa2/AA/AA-, and received orders over €2.5bn, 2.9x issue size. Proceeds will be used to finance or refinance projects or assets related to renewable energy, clean transportation, energy efficiency, sustainable water and wastewater management and pollution prevention and control under the Korean policy bank’s sustainable finance framework. The euro issuance comes alongside a 7Y green dollar tranche that will be priced today.

Tuan Sing raised S$200mn via a 3NC2 bond at a yield of 6.9%, unchanged from initial guidance. The bonds are unrated. Proceeds will be used to fund a tender offer for its existing S$65m ($36m) 7.75% 2022 bonds, as well as to support property development and investment, debt refinancing and general corporate needs. There will be a call on or after 18 October 2023 at 102.

New Bonds Pipeline

- Nanyang Technological University hires for S$ sustainability-linked bond

- Kookmin Bank hires for € 5Y green bond

- China plans for $ 4bn 3/5/10/30Y bond

Rating Changes

- Moody’s upgrades Danaos’ B1; outlook positive

- Moody’s downgrades Modern Land to Caa2/Caa3; ratings on review for further downgrade

- Adler Group And Adler RE Downgraded To ‘B+’ On Business Uncertainty And Tightening Liquidity; On CreditWatch Negative

- Fitch Revises Outlook on International Personal Finance to Stable; Affirms at ‘BB-‘

- Fitch Revises Outlook on Banco Comercial Portugues to Stable; Affirms at ‘BB’

- Moody’s affirms Grupo Energía Bogota’s rating and changes outlook to stable

Term of the Day

Inflation Swap

An inflation swap is an agreement between two parties to swap a floating rate linked to an inflation index (realized inflation) to a fixed rate in the same currency. The inflation swap rate is used as a well-known indicator to gauge inflation expectations, with the 5 year, 5 year Forward Rate (aka 5Y5Y Forward) being the most keenly watched inflation swap indicator by bond traders. The 5Y5Y essentially measures what the inflation rate would be for five years, starting five years from today. The 5Y5Y Forward is considered as an inflation breakeven rate and Bloomberg says that it is close to approaching a seven year high, indicating a possible shift in the ‘low inflation regime’. The 5Y5Y Forward is currently at 2.58%.

Talking Heads

“Inflation breakevens are about to cross the Rubicon.” “Consumer inflation expectations have now clearly moved out of the low inflation regime” and the 5-year, 5-year forward is “knocking again at the 250 basis points door,” the Deutsche team wrote. “There is enough evidence for breakevens to finally cross that Rubicon” to shift out of the post-2014 low-inflation regime.

“We believe that corporate profit forecasts are vulnerable, especially if consumer sentiment translates into less spending and more savings.” “Critically, the Fed and investors have embraced the view that inflation is transitory — a view not shared by consumers. If consumer sentiment doesn’t quickly improve, it could be a signal of market weakness that would be sparked by disappointing earnings, weaker spending and higher savings rates,” she warned.

“When I joined, I advised debt reduction and opposed diversification, face-to-face to several highest-ranking executives.” “But my suggestion got me severely criticized in an executive meeting later, and the criticism lasted a long time. I was told I was ‘lacking ambition’ and ‘not recognizing a major company strategy’.”

Clarence Tam, fixed income portfolio manager at Avenue Asset Managemen

“It’s a disastrous day.” “We think it’s driven by global fund outflow …. Fundamentally, we are worried the mortgage management onshore hits the developers’ cash flow hard,” he added.

According to JPMorgan analysts

“Evergrande’s contagion risk is now spreading across other issuers and sectors.”

Kenneth Ho, head of Asia Credit Strategy at Goldman Sachs

“We believe policymakers have zero tolerance for systemic risk to emerge and are aiming to maintain a stable property market, and policy support could be forthcoming if the deterioration in property activity levels worsen.” “That said, we also believe that policymakers do not want to over-stimulate, and their longer term goal is to deleverage the property sector.”

On erosion of ‘greeniums’ as ESG bond investors demanding more value

Madeleine King, co-head of global credit research at Legal & General Investment Management

“We always evaluate an issuer in its entirety, not just one bond.” “We would have given up a couple of basis points [of income from the bond] essentially for nothing,” King says. “Unlike with a green bond, [sustainability-linked bond] sets a real target,” King argues. “I think it has the potential to become the standard.”

Stephen Liberatore, head of ESG for global fixed income at US asset manager Nuveen

“The main misperception that remains in the ‘responsible investing’ universe is that you must sacrifice performance,” Liberatore says.

Scott Freedman, a portfolio manager at Newton Investment Management

“In periods that are more challenging for fixed income markets, green securities tend to [fall less sharply in price].” “They have stickier holders.” “We are not interested in buying a bond for the label,” he says. “We are not mandated by our clients to accept lower returns.”

On the claim that foreign companies are smuggling fuel

Andres Manuel Lopez Obrador, Mexican President

“We have found that some of these famous foreign companies were transporting contraband fuel and Trafigura’s import permit has been suspended.”

In a statement from Trafigura

“Trafigura strongly denies that it is or has been improperly transporting and/or delivering fuel into Mexico. Trafigura complies with applicable laws and regulations in the jurisdictions in which it operates, including Mexico.” “Trafigura has provided documents and evidence of compliance with applicable requirements to the relevant authorities and will continue to work with the authorities to clarify this situation.”

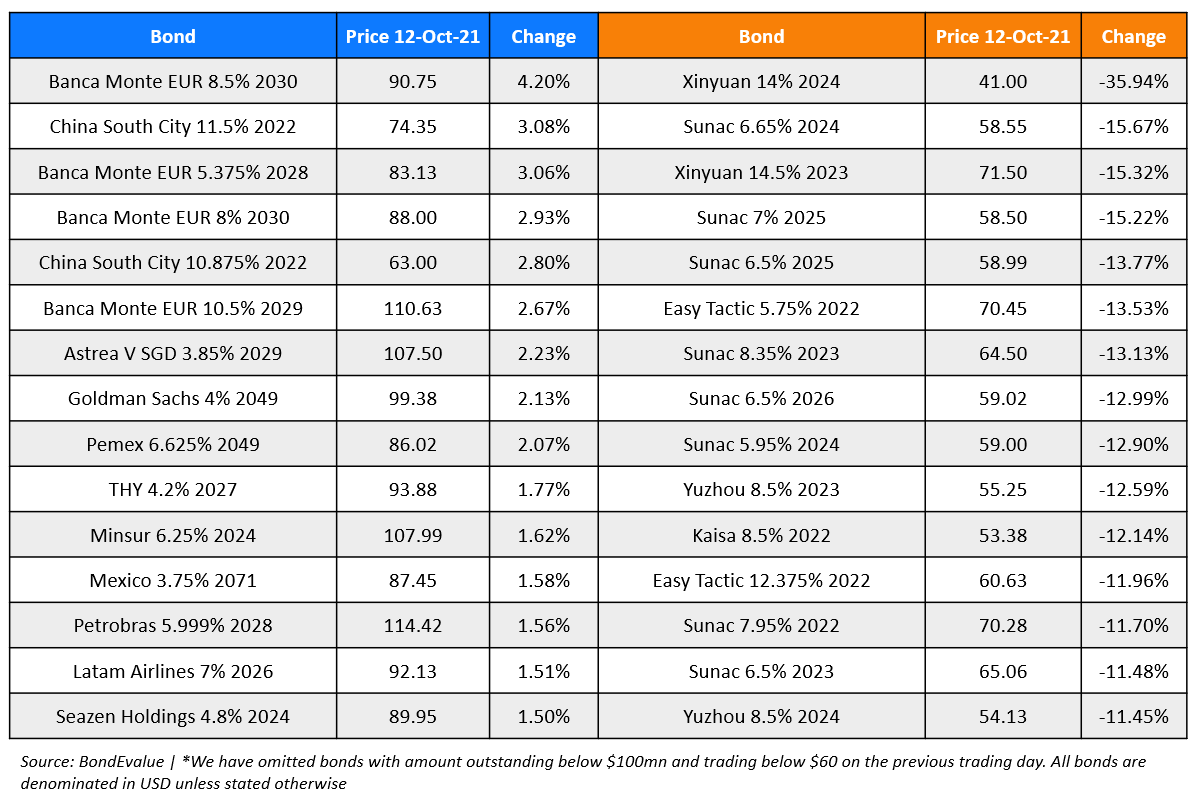

Top Gainers & Losers – 12-Oct-21*

Go back to Latest bond Market News

Related Posts: