This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

$38.25bn in Dollar Deals Priced in Primary Markets; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 5, 2023

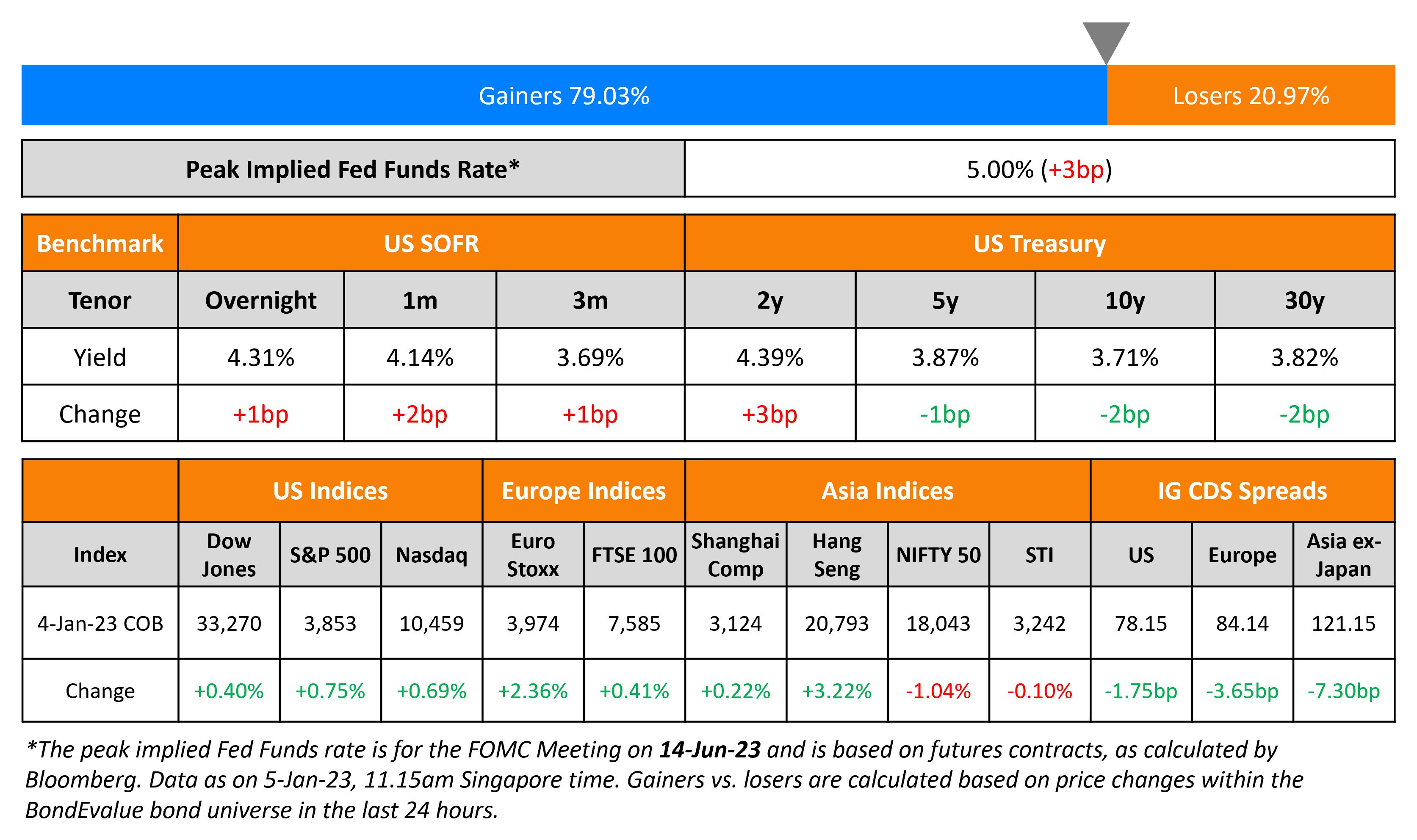

US Treasuries yields were marginally lower yesterday. The peak fed funds rate was up 3bp to 5% for the June 2023 meeting. The probability of a 25bp hike at the FOMC’s February 2023 meeting stands at 68%, unchanged from yesterday. The FOMC’s minutes released yesterday indicated the Fed’s intention to keep “flexibility and optionality when moving policy to a more restrictive stance”. All officials agreed that the central bank should slow the pace of its rate increases. They added that they made made “significant progress” last year in raising rates to bring inflation down. They also noted that any “unwarranted easing in financial conditions, especially if driven by a misperception” by public to the Fed could complicate its price stability objectives.

On the data front, US ISM Manufacturing came in at 48.4, lower by 0.6 points from November’s 49 print. This was the second straight contraction after 29 consecutive months of expansion. Within the ISM reading, the ‘price paid’ component fell to 39.4, down 3.6 points compared to the November’s 43 – this is the index’s lowest reading since April 2020, indicating some signs of a slowing down in inflation. US equity markets ended higher, with the S&P and Nasdaq up 0.8% and 0.7% respectively. US IG and HY CDS spreads were 1.8bp and 7.9bp tighter.

European equity markets ended higher too. The European main and crossover CDS spreads tightened by 3.7bp and 21.7bp respectively. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads tightened by 7.3bp. Issuers from the APAC sold about $15bn of dollar bonds on Wednesday, out of the total $38.25bn in dollar deals priced globally, as the primary markets gather steam in the beginning of the year.

New Bond Issues

- AAHK $ 3Y/5Y/7Y/10Y at T+105/T+135/T+160/T+185bp areas

- ADB $ 3Y/10Y at MS+32/MS+62bp areas

.png) StanChart raised $2.5bn via a two-tranche issuance. It raised $1bn via a 4NC3 bond at a yield of 6.17%, 25bp inside initial guidance of T+230bp area. It also raised $1.5bn via a 6NC5 bond at a yield of 6.301%, 25bp inside initial guidance of T+270bp area. The bonds are rated A3/BBB+/A. The new 6NC5s were priced at a new issue premium of 14bp over its 7.767% bonds due November 2028, callable in November 2027.

StanChart raised $2.5bn via a two-tranche issuance. It raised $1bn via a 4NC3 bond at a yield of 6.17%, 25bp inside initial guidance of T+230bp area. It also raised $1.5bn via a 6NC5 bond at a yield of 6.301%, 25bp inside initial guidance of T+270bp area. The bonds are rated A3/BBB+/A. The new 6NC5s were priced at a new issue premium of 14bp over its 7.767% bonds due November 2028, callable in November 2027.

Credit Suisse raised $3.75bn via a dual-trancher. It raised $1.25bn via a 2Y bond at a yield of 8.06%, 17.5bp inside initial guidance of T+387.5bp area. It also raised $2.5bn via a 5Y bond at a yield of 7.555%, 17.5bp inside initial guidance of T+387.5bp area. The senior unsecured bonds are rated A3/A-/BBB+. Proceeds will be used for general corporate purposes. The new 2Y priced at a new issue premium of 32bp to its older 3.7% 2025s that yield 7.74%. The new 5Y was priced 36.5bp wider to its older 5% 2027s that yield 7.19%.

BNP Paribas raised €1.25bn via a PerpNC7.5 AT1 bond at a yield of 7.375%, 37.5bp inside initial guidance of 7.75% area. The bonds are rated A1/A-/BBB+. The coupons are fixed until the first reset date of 11 June 2030 and if not called, resets every five years at 5Y MS+463.1bp. The trigger event would occurs, at any time, the CET1 ratio falls below 5.125%. Proceeds will be used for capital adequacy purposes as AT1 capital. The net proceeds will be applied for general corporate purposes and to increase its own funds. The new AT1s priced 34.5bp over its older 6.875% Perp callable in December 2029 that are currently yielding 7.03%.

Spanish lender Banco Sabadell raised Banco de Sabadell raised €500mn via a PerpNC6 AT1 bond at a yield of 9.375%, a solid 62.5bp inside initial guidance of 10% area. The AT1s were priced at par with coupons payable quarterly. The bonds are rated B+ and received orders of over €2bn, 4x issue size. If not called between their first call date of 18 July 2028 and the first reset date of 18 January 2029, the bond’s coupon will reset to the 5Y MS+683bp. The trigger event would occur if the bank’s CET1 ratio falls below 5.125%. The new AT1s priced 52.5bp over its older 5% Perps callable in May 2027 that are currently yielding 8.85%. This comes after Sabadell skipped the first call on its €400mn Perp in October last year citing rising refinancing costs.

Deutsche Bank raised €500mn via a 6NC5 bond at a yield of 5.441%, 5bp inside initial guidance of MS+255bp area. The bonds are rated Baa1/BBB-/BBB+ and received orders over €850mn, 1.7x issue size.

Lloyds Bank raised €750mn via a 6NC5 bond at a yield of 4.534%, 15bp inside initial guidance of MS+175bp area. The bonds are rated A3/BBB+/A and received orders over €1bn, 1.3x issue size.

Indonesia raised $3bn via a three-trancher. It raised:

- $1bn via a 3Y bond at a yield of 4.80%, 35bp inside initial guidance of 5.15% area. The new bonds were priced at a new issue premium of 29bp over its older 4.55% sukuk due March 2026 that currently yield 4.51%.

- $1.25bn via a 10Y bond at a yield of 5.10%, 40bp inside initial guidance of 5.5% area. The new bonds were priced at a new issue premium of 25bp to its older 4.7% bonds due June 2032 that currently yield 4.85%.

- $750mn via 30Y bond at a yield of 5.75%, 40bp inside initial guidance of 6.15% area. The new bonds were priced at a new issue premium of 16bp to its older 5.45% bonds due September 2052 that currently yield 5.59%.

The bonds are rated Baa2/BBB/BBB, and received orders over $17.5bn, 5.8x issue size. The 5Y received orders books of $3.6bn – Asia took 33%, EMEA 37% and the US 30%. Fund managers took 68%, banks 19%, central banks/SWFs 4%, insurers/pension funds 8% and private banks 1%. The 10Y received $4.7bn in orders – Asia took 28%, EMEA 31% and the US 41%. Fund managers took 67%, banks 17%, central banks/SWFs 6%, insurers/pension funds 10% and private banks less than 1%. The 30Y received $6.15bn in orders – Asia took 30%, EMEA 26% and the US 44%. Fund managers accounted for 69%, banks 11%, central banks/SWFs 2%, insurers/pension funds 17% and private banks 1%. Proceeds will be used for general purposes.

Hong Kong SAR raised $3bn via a four-trancher issuance. Details are given in the table below:

The senior notes are rated AA+/AA- (S&P/Fitch), and received orders over $$13bn, 4.3x issue size.

KEXIM raised $3.5bn via a three-tranche deal. It raised:

- $1bn via a 3Y bond at a yield of 4.986%, 35bp inside initial guidance of T+120bp area

- $1.5n via a 5Y bond at a yield of 5.08%, 35bp inside initial guidance of T+155bp area

- $1bn via 10Y blue bond at a yield of 5.178%, 35bp inside initial guidance of T+180bp area

The bonds are rated Aa2/AA/AA- and received orders over $17bn, 4.9x issue size. Proceeds from the 3Y and 5Y bonds will be used for general corporate purposes including foreign currency loans and debt repayment. The 3Y saw in over $4.9bn – central banks/agencies/insurers took 37%, asset/fund managers 35%, banks 22%, corporates 4% and private banks 2%. APAC took 27%, EMEA 32% and the US 41%. The 5Y received over $5.7bn of orders from 234 accounts. APAC made up 39%, EMEA 36% and the US 25%. Central banks and agencies took 22%, asset and fund managers 46%, insurers and pension funds 8%, bank treasuries 22% and private banks and brokers 2%. The 10Y received over $6.4bn of orders – APAC took 43%, EMEA 27% and the US 30%. Central banks/agencies took 17%, asset/fund managers 58%, insurers/pension funds 15%, banks 8% and private banks 2%. The 30Y received orders over $6.15bn – Asia took 30%, EMEA 26% and the US 44%. Fund managers got 69%, banks 11%, central banks/SWFs 2%, insurers/pension funds 17% and private banks 1%. Proceeds from the 10Y blue bond (Term of the Day, explained below) will be used to finance or refinance existing projects related to sustainable marine transportation that are covered by the Korean policy bank’s sustainable finance framework.

NAB raised $3.5bn via a three-trancher. It raised:

- $1.15bn via a 3Y bond at a yield of 4.966%, 15bp inside initial guidance of T+100bp area

- $1.1bn via a 5Y bond at a yield of 4.944%, 20bp inside initial guidance of T+130bp area

- $1.25bn via 10Y bond at a yield of 6.429%, 25bp inside initial guidance of T+300bp area.

The bonds are rated Baa1/BBB+/A-. The 3Y and 5Y received orders of $2.2bn and $2.5bn while the 10Y Tier 2 saw orders of over $3.7bn.

New Bonds Pipeline

- Sunny Optical Technology mandates for $ 3.5Y/5Y SLB

- SK Hynix Plans $ 3Y, 5Y SLB and/or 10Y Green

Rating Changes

Term of the Day

Blue Bond

Blue bonds are a type of sustainable debt wherein the proceeds from such issuance are earmarked for marine/water projects related to ocean conservation (hence the name blue bonds). These are similar to green bonds, which are earmarked for green or environmentally-friendly projects. Blue bonds became popular in late 2018 when Seychelles issued the world’s first sovereign blue bond.

Talking Heads

On Global Bonds Extending New Year Rally on Signs Inflation Has Peaked

Schroders Asset Management – Paul Grainger, head of global fixed income and currency

“Greater signs of disinflation and the threat of inflation receding is exactly what bond investors need to see. Indicators like global shipping costs and economic surveys “have been pointing to this dynamic for a while… We are now finally beginning to see it reflected in official inflation measures”

Piet Christiansen, chief strategist at Danske Bank

“With core inflation showing no signs of budging in the December data, the ECB is likely to remind markets that they see significant tightening in the period ahead”

On Green bonds set to drive corporate ESG debt out of slump in 2023

Charlotte Edwards, Head of ESG FICC Research at Barclays

“We expect green bond issuance to continue to dominate the market thanks to strong demand and a long list of green projects that need funding as companies put decarbonization plans into action”

Top Gainers & Losers – 05-January-23*

Go back to Latest bond Market News

Related Posts: