This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Featured Article

The Alchemy of Atomic Settlement

by Dr. Rahul Banerjee, Co-Founder & CEO, BondEvalue | Oct 1, 2021

2:58 PM: Place Market Sell order for bonds

2:59 PM: Order Matches

3:00 PM: Cash received in your account, FAST transfer out of the exchange

From placing the order to receiving cash, the process is now possible in a matter of minutes. Traditionally, it took 48 hours, excluding holidays. The Bondblox Bond Exchange currently operates on this model.

This is the alchemy of atomic settlement, another way to describe instant Delivery-Versus-Payment (DVP). It works both ways, if a fund manager receives a large cash inflow into his bond fund, it can start earning coupons from the same day! If an individual finds himself in the need for money suddenly, a lot of money, his bond portfolio can be sold instantly to generate liquidity.

What is Atomic Settlement?

Atomic settlement (T) is defined as the instant exchange of two assets whereby the transfer of one asset occurs if and only if the transfer of the other asset also occurs. Traditionally, bonds are bought and sold in decentralised over-the-counter (OTC) markets through intermediaries who compete to fulfil trade obligations. Orders between buyers and sellers are matched at time T, while the actual exchange of securities for cash currently takes place later – either at the end of the day (T+0) or one to three days later (T+1 to T+3).

Why Do We Need Atomic Settlement?

Today, trades that are settled DVP still have a lot of settlement risk between the counterparties. One party will need to pay for an asset (in a buy trade) or deliver an asset (in a sell trade) while the other party delivers or pays accordingly only after the receipt of funds or assets. Both sides agree on a period of time after which this settlement happens, and each side knows that there exists the risk that parties may default on their obligations. In a scenario where a bond has much higher volatility, such as during the height of the COVID-19 pandemic, or like Evergrande has today, these risks are massive. Troubled times present a lot of anguish among bond owners and those who wish to buy into market opportunity. As a collective market, we tend to have both buyers and sellers , but the market lacks the mechanism to match them (Dr Rahul Banerjee, 2020). It is usually the case that the market is unable to match buyers and sellers because of the heightened risks of settlement failures that exist in such situations, a problem that atomic settlement can look to mitigate.

Settlement risk carries more impact than just loss of funds. For an industry that runs heavily on trust between bond investors and their brokers, the existence of such settlement risk can poison trust and damage the intermediary’s reputation, especially in times of crisis. Imagine being a customer of Lehman Brothers during the financial crisis of 2008. In the weeks leading up to their bankruptcy, there was widespread fear that Lehman Brothers would not fulfil their obligations of delivering securities or paying cash. There were also many customers and broker accounts who moved to other broker-dealers to avoid the inflating settlement risk of dealing with the bank. Costs associated with crisis management also rose for Lehman Brothers, as they had needed to provide additional collateral, deposits and margins at clearing houses (Fleming & Sarkar, 2014).

Previously, it made sense to have a central securities depository (CSD) to immobilise paper certificates and eliminate the need to settle trades by physical transfers. Today it is different, securities are maintained as electronic book-entry records in CSDs instead. As long as the exchange of assets are not settled instantaneously, settlement risks will continue to pervade the industry.

Atomic Settlement is (Mostly) Still Not a Reality Today

The reason atomic settlement has been impossibly hard to achieve is that the exchange of cash and securities need to happen simultaneously. This is not an easy feat to achieve, given how it took years for the US to shorten the duration of its settlement cycle.

Historically, trades took 5 business days to settle. It was not until 1995 when the US settlement cycle shortened from T+5 settlement to T+3 settlement, and it was 22 years before the settlement cycle was shortened again to T+2 in 2017. In May 2021, the Securities Industry and Financial Markets Association (SIFMA), the Investment Company Institute (ICI), and The Depository Trust & Clearing Corporation (DTCC) announced plans to migrate to T+1 settlement by the end of Q3 2021.

The transition towards instant settlement is not an easy process due to well established legacy technology for settlements, the issue of settlement liquidity, cross-border inefficiencies, and operational risk in current market operating hours.

The settlement systems for cash within a country are typically handled by central banks along with commercial banks and specialist payment organisations, which still rely on legacy technology for settlement. While the technology has improved over the years to adapt to enhance efficiencies and shorten settlement cycles, there appears to be a limit on how much time can be shaved off in the settlement cycle based on the existing technology. Banks and financial institutions must undergo high-risk, expensive, and long projects if they wish to overhaul their existing settlement process.

In a letter by SIFMA to the US Securities and Exchange Commission (SEC), SIFMA highlighted that moving to same-day settlement remains a challenge as it would “require re-engineering how securities trade and settle” in the following areas:

- The mechanics of global settlements, FX, margin investing, and securities lending need to be redesigned to fulfil regulatory and contractual requirements in under 12 hours (from the current 24 hours)

- Retail investors may need to pre-fund accounts

- Smaller firms and vendors may need to bear the competitive burden and resources to shift to T+0 settlement

- Industry stakeholders need to operate for longer hours, which may impact the ability to carry out non-automated activity, increasing potential for trade failures

Another barrier to instant settlement is settlement liquidity, which counterparties may face if there is insufficient cash or securities to fulfil trade obligations. While the Central Securities Depositories Regulation (CSDR) introduced in 2014 has a settlement discipline regime which penalises trade failures, it does not eliminate the fact that short-traded positions can still exist and there will be a need to cover these positions to avoid settlement failure. Intermediaries will need additional resources or improved inventory management to access and borrow securities in a timely manner to support instant settlement while complying to CSDR.

Next, there are cross-border inefficiencies that impede the transition to instant settlement. International cash and securities transfers are even more complex and involve primarily the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network and large global banks. SWIFT is a messaging network used by banks and financial institutions to send and receive transfer instructions quickly and securely. However, while the merits of SWIFT transfers lie in its extensive network, transfers via SWIFT are not instant, and the speed of delivery and payment via SWIFT instructions also depend on whether the initiating bank has any direct relationship with the destination bank. Moreover, firms that handle cross-border transfers of cash and securities will need to maintain holdings in multiple CSDs across different jurisdictions, making it challenging to effectively manage inventory and meet local settlement obligations. Unless all firms have good inventory management capability across multiple markets, instant settlement cannot be achieved easily.

Lastly, the ability to settle cross-border transactions instantly also depends on the market operating hours. Trades between two markets and time zones can only take place if both markets are open at the same time. Instant settlements across borders and time zones cannot happen unless market operating hours become longer or even round-the-clock.

DLT allows Atomic Settlement, today

According to the Bank for International Settlements (BIS), tokenisation of securities is “the process of issuing new securities or representing existing securities as digital tokens”. Most tokenisation projects of cash payments and securities take place using distributed ledger technology (DLT), which is a decentralized database managed by multiple participants across multiple locations that enables participants to access, validate and update records simultaneously and securely. Unlike the exchange of book-entry record of cash and securities, which require the CSD to verify the identity of parties involved before the transfer can occur, transfer of digital tokens are authorised using digital signatures in the form of public or private keys.

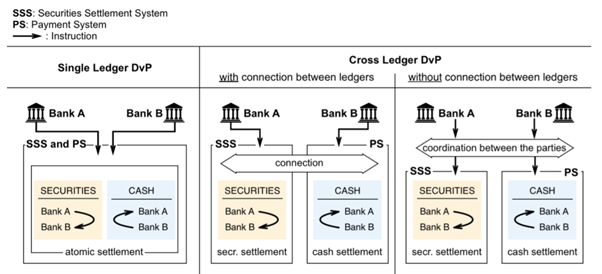

With tokenisation, existing account-based DvP exchanges of cash and securities (account vs account or AvA transfers) can be complemented by three new arrangements:

- Account-based securities in exchange for cash tokens (account vs token or AvT transfer)

- Security tokens in exchange for account-based cash (token vs account or TvA transfer)

- Security tokens in exchange for cash tokens (token vs token or TvT transfer)

Both AvT and TvA transfers require technical and legal compatibility across traditional account-based systems and the newer token-based systems.

TvT transfers can take place on a single ledger or across ledgers. For TvT transfers on the same ledger, both cash and securities are recorded on the same ledger, and use smart contracts for clearing and settlement to achieve atomic settlement:

- Both the buyer and seller submit their tokens (using digital signatures) as inputs for the smart contract and instructions to transfer cash token for securities token (for the buyer) or securities token for cash token (for the seller)

- The smart contract is submitted for validation on the distributed ledger

- If transaction is validated, cash and securities tokens are simultaneously and instantly transferred to respective recipients

- If transaction validation fails, the smart contract for the exchange of tokens is not executed and the tokens remain with their original owners

At Bondblox, the system is a single ledger system that has both bonds and cash on a single ledger in a prevalidated state ensuring settlement guarantee.

Source: European Central Bank and Bank of Japan, Project Stella

Around the world, central banks and financial institutions have embarked on tokenisation projects in their quest towards atomic settlement.

In Singapore, the Monetary Authority of Singapore (MAS) and Singapore Exchange (SGX) collaborated on Project Ubin III to achieve connectivity and settlement finality across separate ledgers. Five key observations were identified from this project:

- Smart contracts can be used to integrate and programme conventional rulebook conventions

- As developments are underway to compress the trade settlement cycle, regulators need to constantly re-evaluate and update existing rulebooks and regulations on settlement time and duration to maintain a fair and orderly market

- There is a need to appoint an arbitrator for dispute resolution relating to principal exposure risk, such as in cases when buyer does not withdraw securities before time limit expires, allowing seller to recover the securities and receive cash payments

- There remains the need to safeguard privacy of investors while establishing connectivity across ledgers

- The mechanisms that lock assets to their corresponding ledger have an impact on participants and market liquidity.

In the Philippines, the Union Bank of the Philippines and Standard Chartered Ventures have co-created a blockchain platform for retail bond issuance, as part of a proof-of-concept to tokenise securities.

In India, the Securities and Exchange Board of India (SEBI) announced that stock exchanges, clearing houses and depositories will need to offer T+1 settlement from 2022 onwards, in addition to the existing T+2 settlement cycle. However, Association of National Exchanges Members of India (ANMI) has responded to SEBI with concerns that several operational and technical challenges need to be tackled before existing market infrastructure can efficiently handle the shorter settlement cycle.

Benefits of Atomic Settlement

Tokenised assets that exist on permissioned, distributed ledgers have restrictions on who can validate transactions on the ledger, who can initiate transactions on the ledger and to what extent can parties view information on the ledger. This nature of transfer instruction validation on DLT allows for four key benefits – secure transactions, simultaneous action, fast settlements, and cost savings.

- Anyone and trade with anyone, even in turbulent markets, which makes the markets truly open and democratic. This allows new and smaller players to access the level of liquidity that today is available to the largest.

- The DLT can process multiple actions simultaneously, reducing the time required in the clearing and settlement stages.

- Removal of third parties means less back-and-forth between involved parties. The use of DLT also allows for instructions to be processed immediately, which can reduce or eliminate time needed for settlement. The ledger is the single source of truth and the record of ownership

- It is far cheaper as fee charges do not have to be paid to various intermediaries who exist in the traditional chain.

Conditions for True Atomic Settlements

It is worth highlighting that using DLT alone does not equate to atomicity in settlements. For the financial market to successfully transit to atomic settlements, we will need the following to happen:

- Interoperability of multiple financial institutions’ ledgers - it is insufficient for financial institutions to merely migrate towards DLT. Connectivity between the different ledgers must be built and optimised to facilitate seamless DvP transfers across ledgers.

- Tokenising both cash and securities – there are limitations to the operational efficiencies that can be achieved with existing technology for settlement. While TvA and AvT transfers offer an alternative to DvP settlements, they should be viewed as transitional settlement mechanisms in the operational migration towards instant settlement via TvT transfers.

- Robust rulebooks that lay out governing rules and regulation on the time and duration of settlement are needed. Additionally, a well laid out mechanism for dispute resolution and correction of erroneous trades if they happen are necessitated.

- Participants may need pre-funding, as they may not be fully up to speed due to institution/ currency specific legacy systems.

Conclusion

The progress towards achieving atomic settlement is a challenging road but one that needs to be taken. The Bondblox Bond Exchange has demonstrated over the past year that atomic settlements work and greatly benefit participants. The current decade will be one where atomic settlements will become the norm, allowing a reduction in systemic risk and efficient markets.

References

Bank of International Settlements. (2020). On the future of securities settlement. Retrieved from: https://www.bis.org/publ/qtrpdf/r_qt2003i.htm

Fleming, M. & Sarkar, A. (2014). The Failure of Resolution of Lehman Brothers. Retrieved from Federal Reserve Bank of New York Economic Policy Review, December 2014 edition: https://www.newyorkfed.org/medialibrary/media/research/epr/2014/1412flem.pdf

Mark Profeti (n.d.). 4 Barriers to Instant Settlement. Retrieved from: https://www.globalcustodian.com/blog/distributed-ledger-technology-key-t0-settlement/

Rahul Banerjee (2020). The Troubled Bond Market – When Sellers Can’t Sell and Buyers Can’t Buy. Retrieved from: https://bondevalue.com/news/troubled-bond-market-sellers-cant-sell-buyers-cant-buy/

Announcements