This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond

investing

made easy

BondbloX simplifies bond investing by allowing investors to track & trade bonds electronically – just like stocks

Regulated by the Monetary Authority of Singapore

as a Recognised Market Operator ("RMO")

Download our mobile app

Sign Up

Regulated by the Monetary Authority of Singapore

as a Recognised Market Operator ("RMO")

As investors, it is important for you to have access to transparent & accurate data on bond prices & bond features. Only then can you make informed investment decisions.

We at BondbloX help with both – tracking & trading – of bonds conveniently via an App

Track corporate & sovereign bond data including price, yield, spread

Filter our bond universe to find suitable bonds that meet your needs

Trade bonds online with full transparency on order book & fees

Track bond prices

Set up your bond portfolio in minutes to track bond price & yield movements on-the-go.

Buy bonds

You can now buy bonds at your fingertips. Onboard with us to start trading bonds online.

Regulated as a

Recognised Market Operator (RMO)

Trusted Global Custodians

Our equity investors

Industry recognitions

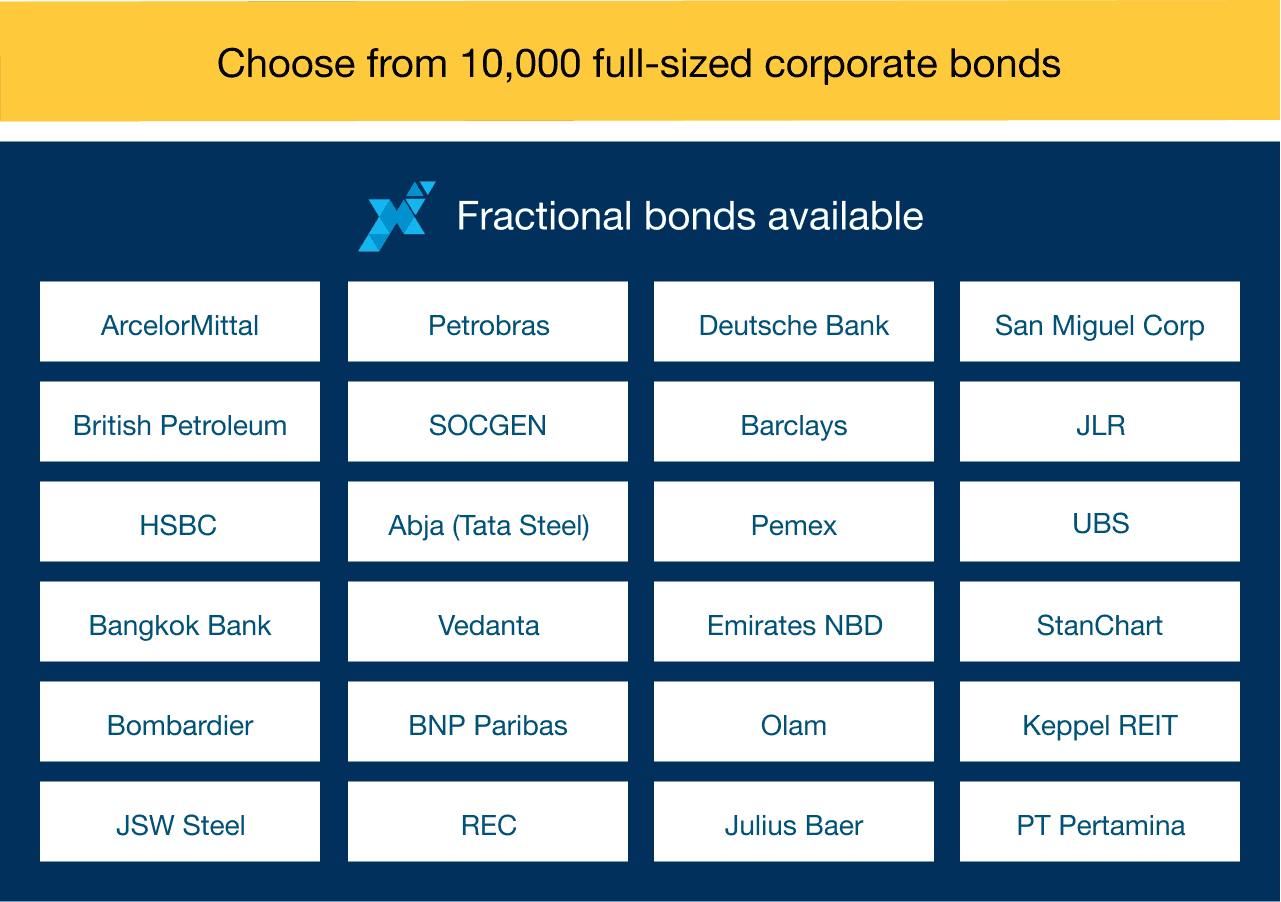

Invest in fractional & full-sized bonds

Invest in fractional bonds starting with $1,000

Now, invest in bonds in smaller denominations starting $1,000 vs. the conventional $200,000. 200x diversification opportunities via BondbloX

Enjoy the most of your returns with low fees

BondbloX charges 0.20% per trade & 0.20% annualised fee on AUM

Bond investing made easy - buy bonds like equities

Buy bonds electronically, just like you buy stocks

Instant settlement & zero counterparty risk

Trading BondbloX involves zero settlement & zero counterparty risk. All transactions are instantly settled by the exchange

Why Invest in Bonds?

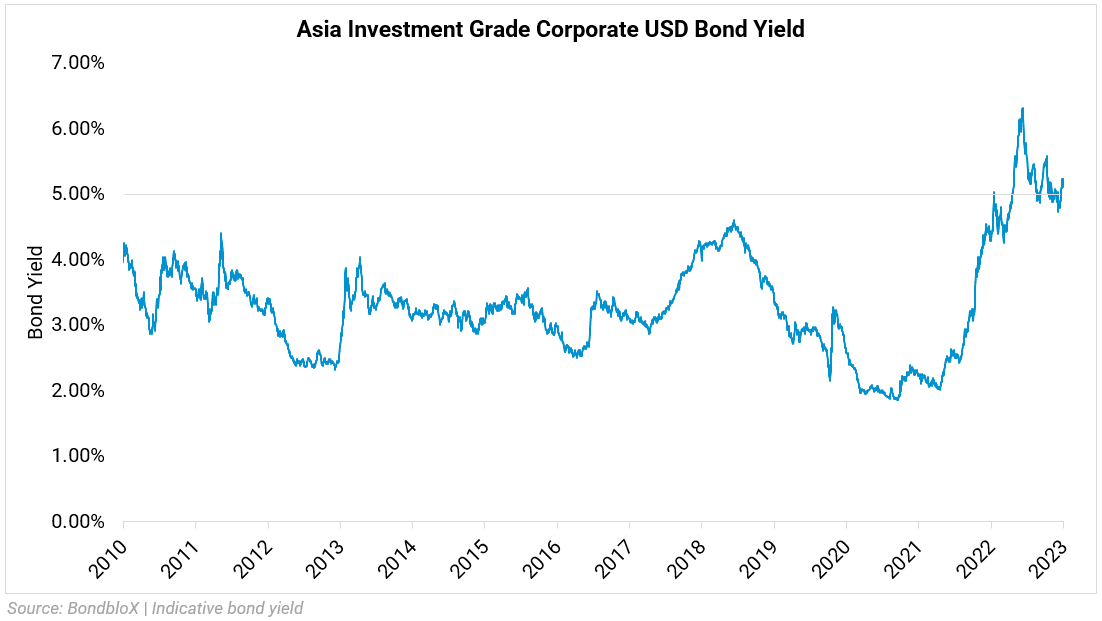

Bond yields are at levels not seen in over a decade – many investment grade bonds offer over 5% today.

Diversification is key! Adding bonds to a portfolio of stocks reduces overall portfolio risk.

Bonds by nature offer fixed income with predictable and steady cash flows.

Key FAQs

What are the exchange fees associated with BondbloX?

Exchange fees, in the following types, may be applied:

- Transaction fee for BondbloX

- Platform access/AUM fee

Other non-exchange fees may apply on deposits and withdrawals

- We do not charge fees on any funding or withdrawal transfers made to/from BondbloX Pte. Ltd. However, fees may be levied on funds by corresponding banks and/or financial intermediaries, which are not accrued to BondbloX Pte. Ltd.

For further information, refer to our market information page.

Is BondbloX linked to any cryptocurrencies?

No. BondbloX is a debenture within the definition of securities in the SFA and is not linked to any cryptocurrencies.

What is a BondbloX?

BondbloX represents fractional bonds issued by BondbloX Pte. Ltd., traded on the BondbloX Bond Exchange, and contains fractional interests in the Underlying bond.