This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Xerox Unveils Capital Reorganization Plan

February 13, 2026

Xerox Holdings has launched a major balance-sheet restructuring aimed at cutting debt and restoring financial stability. The company distributed warrants to shareholders on 9 February 2026, giving one warrant for every two shares owned. Each warrant can be exercised at $8/share until February 2028. Investors may either pay cash or exchange certain Xerox bonds maturing in 2028, 2029 and 2039 for equity. The list of bonds that can be exchanged for warrants are shown in the table below:

-png-1.png)

The structure is designed to reduce the company’s heavy debt load. A full cash exercise could raise about $618mn, while debt-for-equity exchanges would immediately lower liabilities and future interest costs. However, analysts note that the plan risks substantial shareholder dilution. Xerox has registered more than 82mn new shares for potential issuance and an additional 5.2mn shares for resale from an adviser. If all warrants are exercised, total shares outstanding could rise roughly 64% to over 211mn, likely weakening its earnings per share. The restructuring comes as Xerox continues to face severe market challenges, with the management prioritizing reducing interest-bearing debt to create room for an operational turnaround.

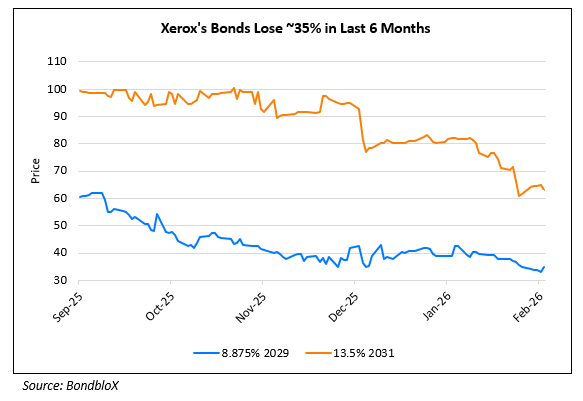

Xerox’s bonds have lost more than ~35% of the value in the last 6 months.

Go back to Latest bond Market News

Related Posts: