This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Warsh Nominated as New Fed Chair by Trump

February 2, 2026

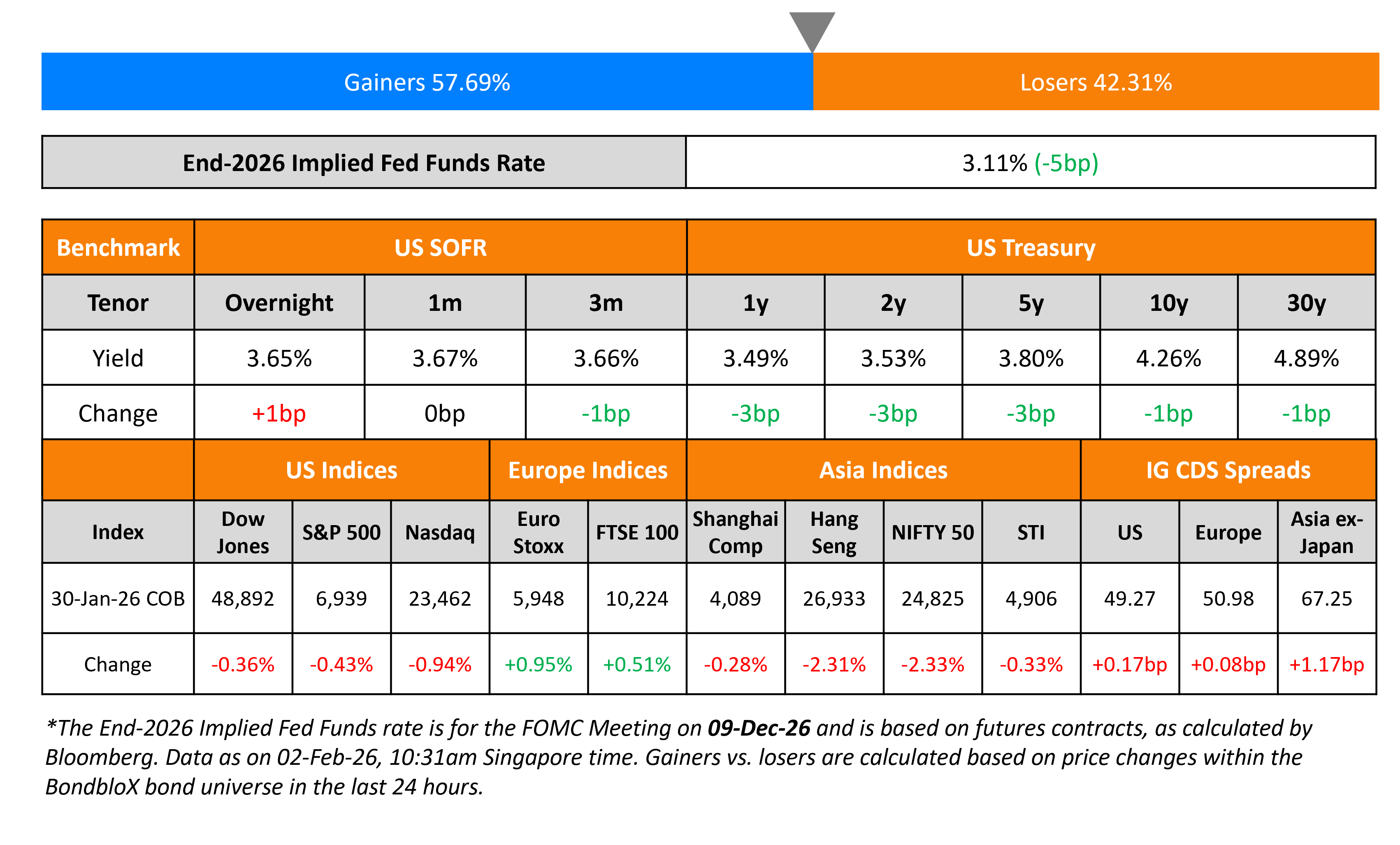

The US Treasury yield curve bull steepened further with short-end yields down by 3bp while long-end yields were stable. The PPI print for December came-in at 3.3% YoY, rising higher than expectations of 2.9%. Kevin Warsh was nominated by US President Donald Trump, as the new Fed Chairman to replace Jerome Powell in May. Separately, St. Louis President Alberto Musalem said that the Fed should hold off from lowering rates further to prevent stoking inflationary pressures. Also, the Fed’s Michelle Bowman said that she saw merit in waiting to lower rates further.

Looking at US equity markets, the S&P ended 0.4% lower and the Nasdaq was 0.9% lower. US IG CDS spreads widened by 0.2bp while HY CDS spreads were 2.1bp wider. European equity indices ended higher. The iTraxx Main CDS spreads were 0.1bp wider and the Crossover CDS spreads were 0.3bp wider. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads widened by 1.2bp.

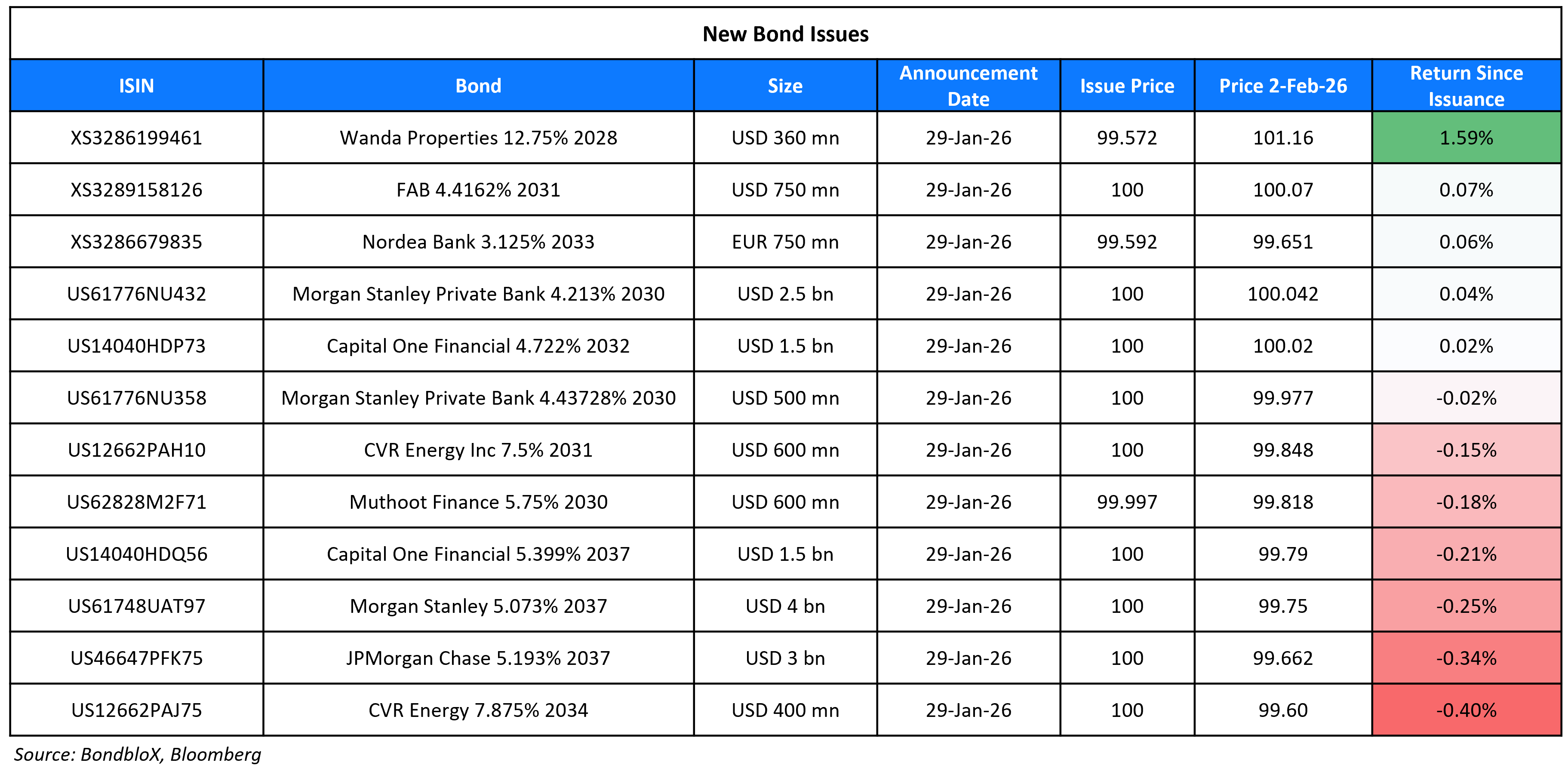

New Bond Issues

- CMBC International $ 3Y at SOFR+115bp area

Azul raised $1.375bn via a for its 5NC2 bond at a yield of 10.125%, 12.5bp inside initial guidance of 10.250% area. The senior secured first lien bond is rated B2/B- (Moody’s/Fitch). Proceeds, along with other investments, will be used to refinance its $1.57bn DIP facility and for general corporate purposes as part of the company’s Chapter 11 restructuring plan. The offering was upsized to $1.375bn from $1.21bn.

Rating Changes

- Italy Outlook Revised To Positive On Fiscal And External Resilience; ‘BBB+/A-2’ Ratings Affirmed

- Fitch Upgrades SM Energy to ‘BB+’; Off Rating Watch Positive; Outlook Stable

Term of the Day: Clean-up Call

A clean-up call refers to a call provision, whereby once a stated percentage of a security is retired, the issuer is obliged to call the remainder of the tranche. While clean-up calls are generally more commonly observed in mortgage-backed securities (MBS), they may also be present as a feature in some bonds. This is different from a normal call option in a bond where the issuer has an option to redeem their bond fully during the specified call date./period.

Talking Heads

On ‘Sell America’ Trade Risk Fades Under Warsh’s Fed – Fulcrum Asset Management

“There’ll be a very big sigh of relief, including in the dollar. The danger of a really crisis-ridden Sell America trade… Many market observers will like this mix of a smaller balance sheet but a more deregulated banking system”

On African Lenders Setting Up Early-Warning Network on Debt Distress

“We have come up with a program for early warning systems or early distress signals that allow us to provide support collectively to countries in distress to create instruments that would ameliorate stressful scenarios”

On Clean-up Call Clause Slashing Investor Gains in an Instant

Jack Daley, TwentyFour Asset Management

“Some people won’t have fully understood the product that they’re involved in or they are locked up in more passive funds”

Steven Oh, PineBridge Investments

“When the market is very strong, as an issuer you’re going to push the envelope on terms and that includes call provisions”

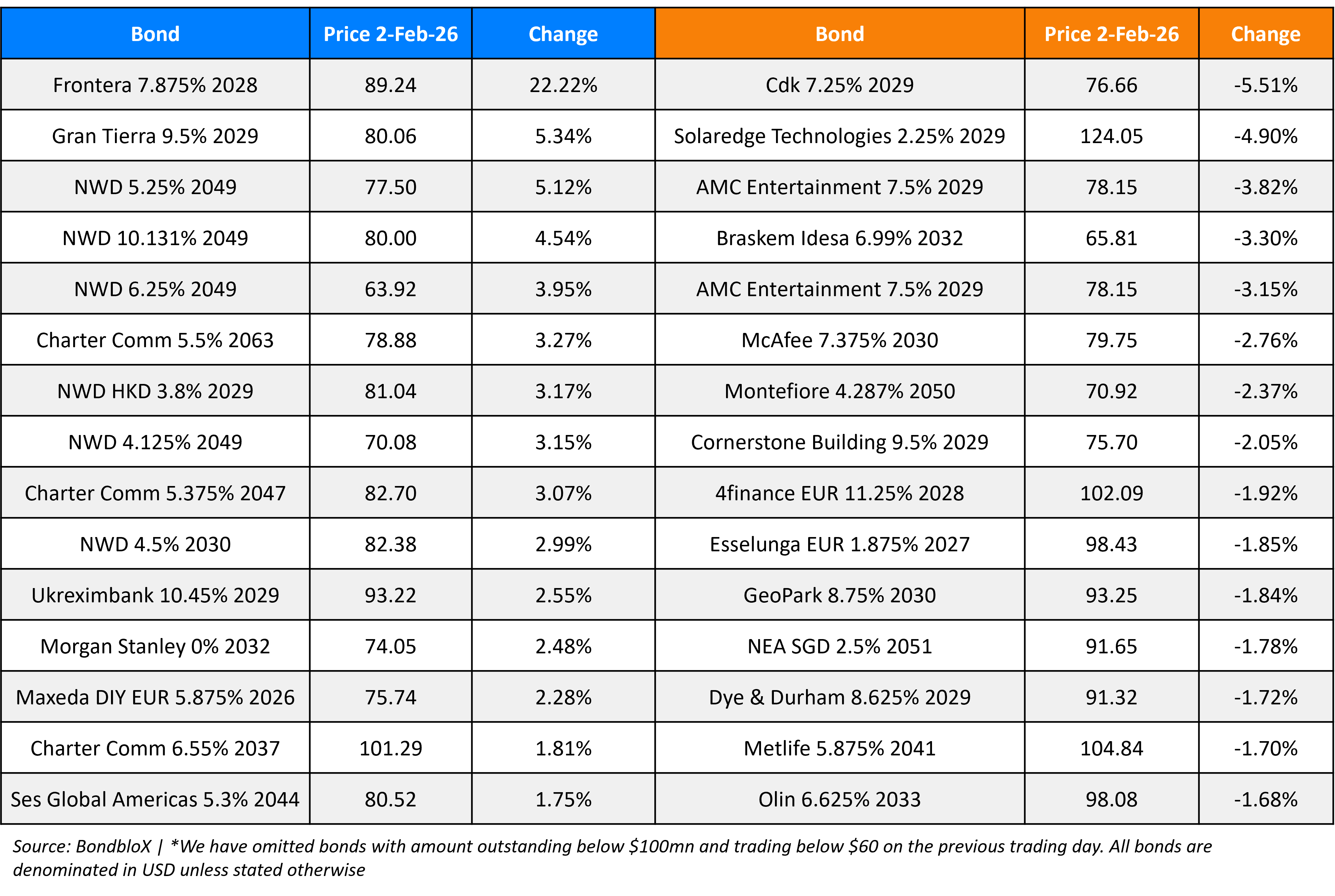

Top Gainers and Losers- 02-Feb-26*

Go back to Latest bond Market News

Related Posts: