This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

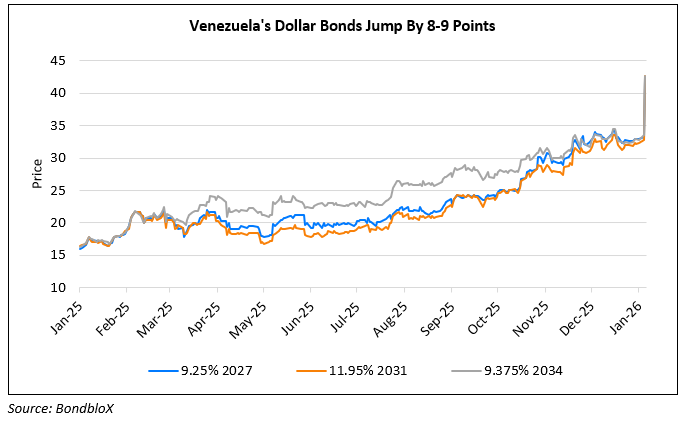

Venezuela’s Dollar Bonds Surge on Debt Restructuring Optimism

January 6, 2026

Dollar bonds of Venezuela surged sharply by 8-9 points across the curve after the US captured President Nicolás Maduro, prompting a group of long-standing creditors to meet and assess prospects for recovering value on roughly $37bn of its outstanding dollar debt. Representatives from major asset managers, including Ashmore and GMO, struck an optimistic tone, with some expecting debt restructuring talks to resume as early as this year after nearly eight years of default and stalled negotiations under US sanctions. Investors are betting that US involvement and a potential leadership transition could pave the way for negotiations, possibly within an 18–24 month timeframe. Creditors are, however, waiting for political conditions to stabilize before formally engaging, as uncertainty remains around the interim leadership under Vice President Delcy Rodríguez and the durability of the transition. Proposals under early discussion include a single restructuring of Venezuela’s and its oil-company PDVSA’s debt and the use of oil-backed instruments to attract broader creditor support Investors however caution that the process could still be uneven and politically sensitive.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018