This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Venezuela – The $37bn Debt Question

January 12, 2026

Jan 12, 2026: The Venezuela Creditor Committee — that includes Fidelity Management & Research, Morgan Stanley Investment Management and Greylock Capital Management has said that it is prepared to start talks over Venezuela’s restructuring after receiving authorization. It is to be noted that Venezuela remains under US economic sanctions, prohibiting it from accessing capital markets, a critical step in a restructuring.

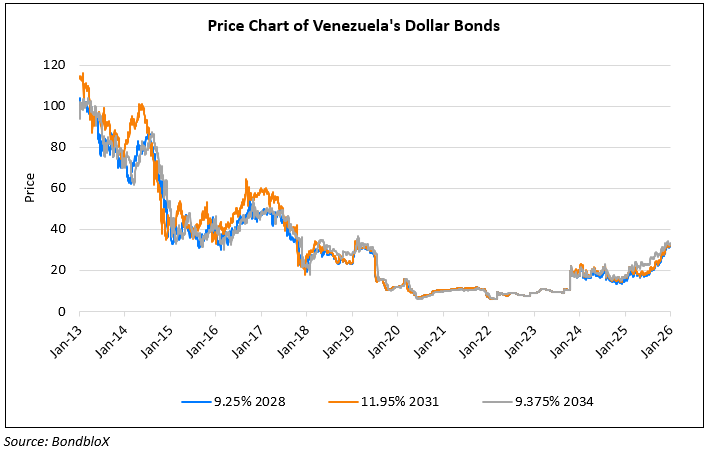

Jan 6, 2026: Dollar bonds of Venezuela surged sharply by 8-9 points across the curve after the US captured President Nicolás Maduro, prompting a group of long-standing creditors to meet and assess prospects for recovering value on roughly $37bn of its outstanding dollar debt. Representatives from major asset managers, including Ashmore and GMO, struck an optimistic tone, with some expecting debt restructuring talks to resume as early as this year after nearly eight years of default and stalled negotiations under US sanctions. Investors are betting that US involvement and a potential leadership transition could pave the way for negotiations, possibly within an 18–24 month timeframe. Creditors are, however, waiting for political conditions to stabilize before formally engaging, as uncertainty remains around the interim leadership under Vice President Delcy Rodríguez and the durability of the transition. Proposals under early discussion include a single restructuring of Venezuela’s and its oil-company PDVSA’s debt and the use of oil-backed instruments to attract broader creditor support Investors however caution that the process could still be uneven and politically sensitive.

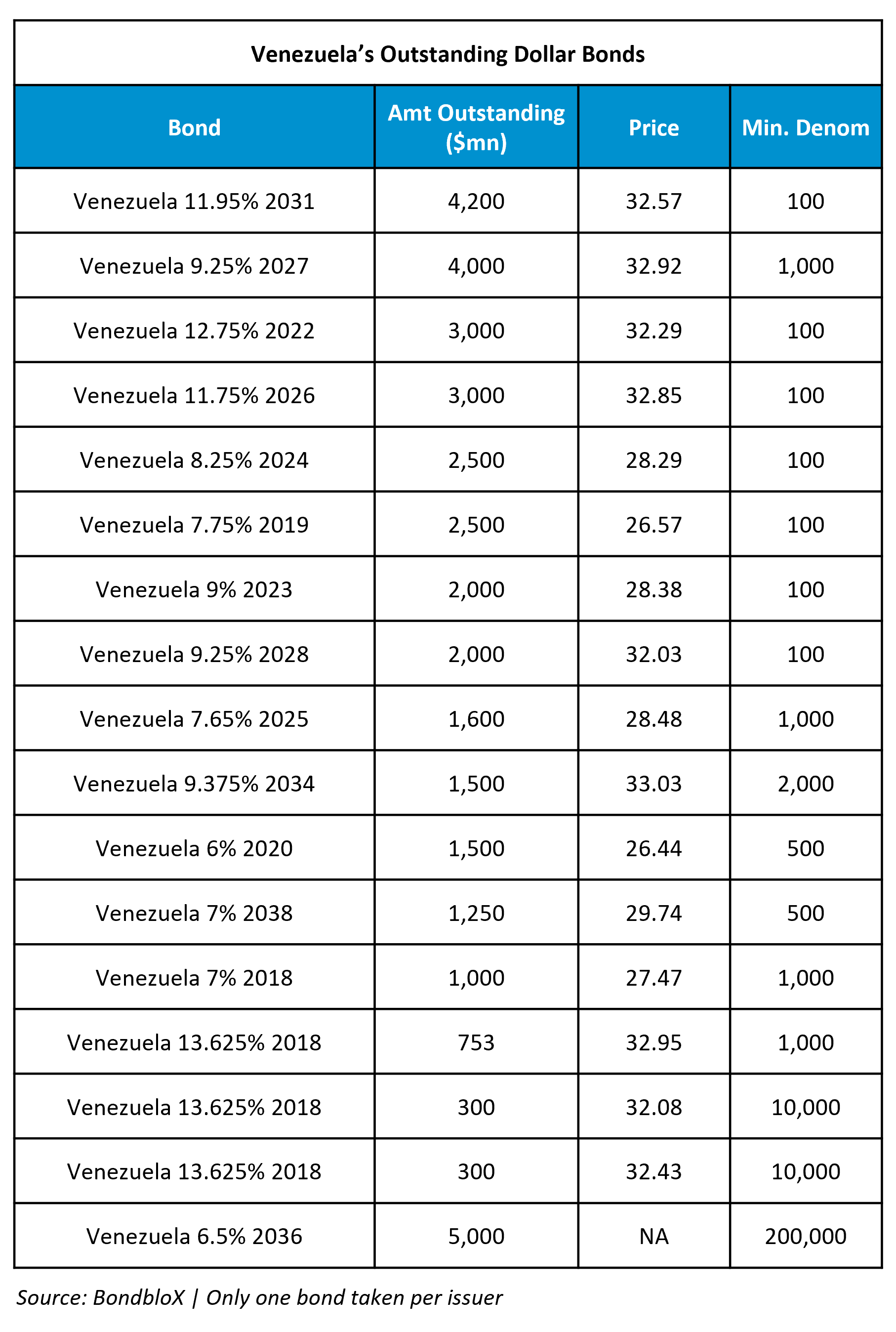

Jan 5, 2026: Venezuela has nearly $37bn in dollar bonds outstanding currently trading at an average price of 30-33 cents on the dollar, equating to a market value of over $11bn. All eyes in the coming weeks and months will be on these bonds, with the possibility of a potential upside amid the recent events. Venezuela’s defaulted dollar bonds nearly doubled in 2025 – its 9.25% 2027s have gained nearly 70% in the last 6 months, currently trading at 33.3 cents on the dollar. Some analysts highlight potential optimism around a future debt restructuring that could eventually lift recovery values toward 50–60 cents.

Venezuela’s President Nicolás Maduro was captured by the US over the weekend, leading expectations of a potential regime change. The US indicated it will temporarily oversee Venezuela during a leadership transition, focusing on restoring oil infrastructure. OPEC data shows that Venezuela holds more than 303bn barrels of proven oil reserves, the largest in the world, accounting for about 17% of global oil reserves. However, output has fallen to around 1mn bpd amid US sanctions and years of underinvestment.

Historically, Venezuela (rated C by Moody’s) has been in default since 2017. The US eased secondary trading sanctions in 2023, after which JPMorgan re-included the bonds in its indexes. However, Bloomberg added that trading remains thin and concentrated among distressed investors.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018