This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

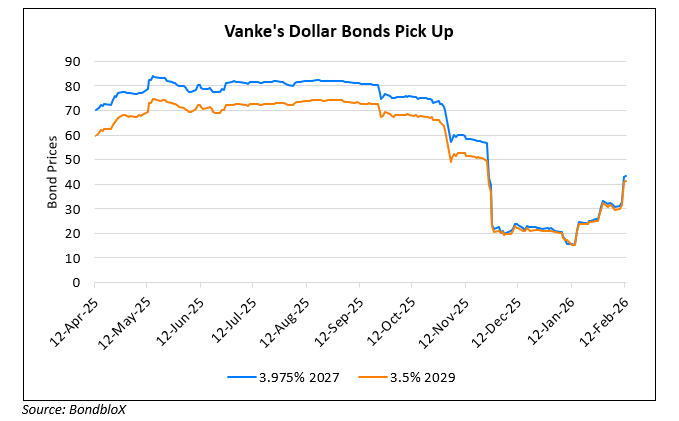

Vanke’s Dollar Bonds Soar on Reports of Municipal Government Rescue Package

February 12, 2026

China Vanke’s dollar bonds climbed higher by over 7 points amid reports that the Shenzhen municipal government is drafting a rescue package worth ~RMB 80b ($11.58bn) for the developer. The plan is said to align with the central government’s directives to adopt a “no default” approach to prevent further contagion in the property sector. While still in preliminary stages, the report indicated that a potential RMB 20b ($2.9bn) share placement could take place to inject liquidity, although the pricing and timing remain undisclosed. The government support follows recent guidance from the SASAC aimed at stabilizing state-backed developers. Vanke currently has a massive $50bn in interest-bearing liabilities. While it recently secured bondholders’ approval to defer repayments on three yuan-denominated bonds, it continues to remain under pressure to restructure its broader debt pile. Neither the Shenzhen government nor Vanke have officially confirmed the package.

For more details, click here

Go back to Latest bond Market News

Related Posts: