This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

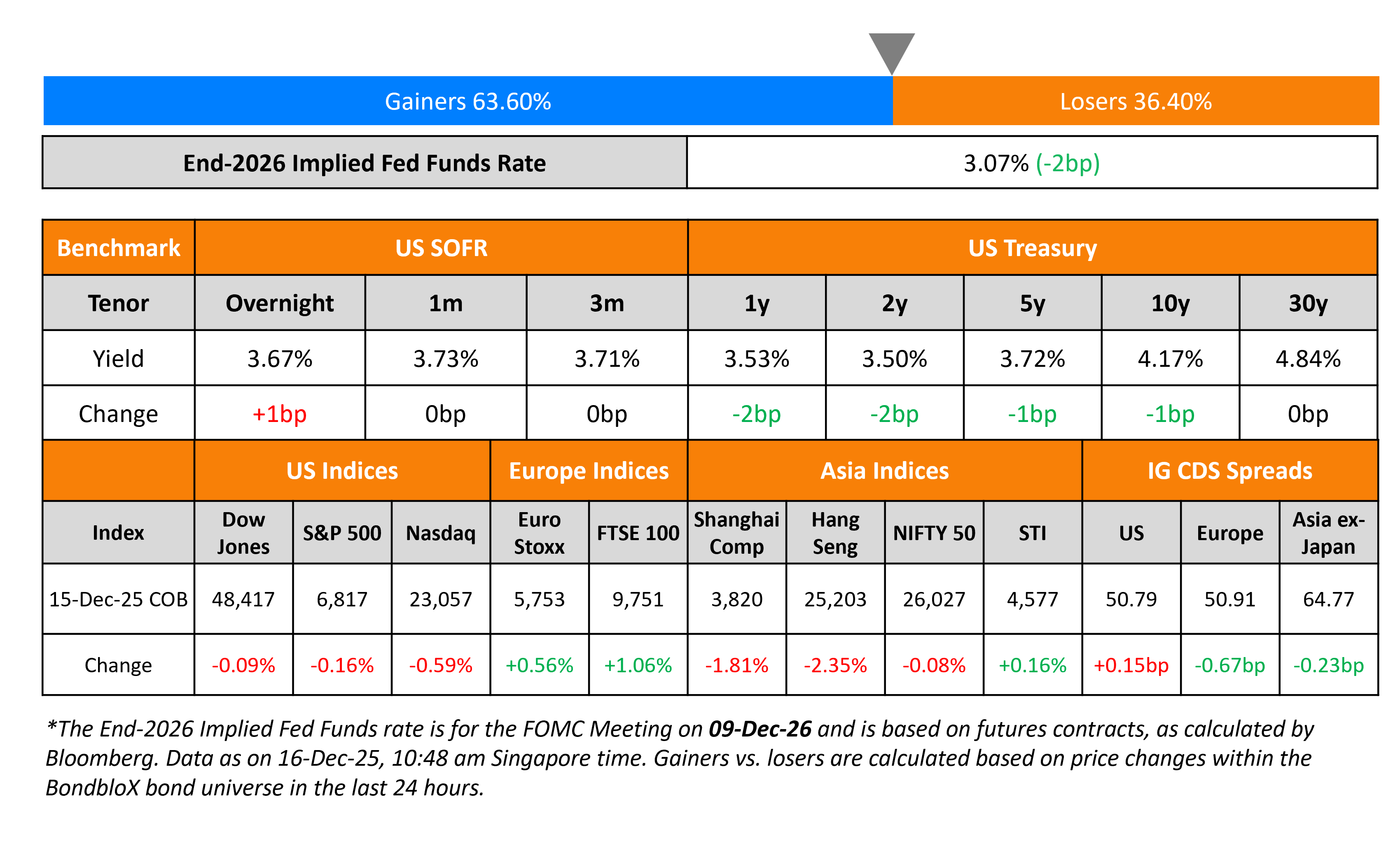

US Treasury Yields Ease Marginally

December 16, 2025

US Treasury yields eased marginally by 1-2bp across the curve. Markets await the delayed jobs report data which will be released later today. The NY Empire State Manufacturing Index for December came in at -3.9, vs expectations of 10 and the previous reading of 18.7. Several Fed speakers spoke about monetary policy yesterday. New York Fed President John Williams said that they were well positioned for the next year, adding that “the FOMC has moved the modestly restrictive stance of monetary policy toward neutral”. Boston Fed President Susan Collins said that she supported last week’s rate cut, but it was a “close call” due to concerns about elevated inflation. Fed Governor Stephen Miran said that prices were “once again stable” and that keeping policy tight will lead to job losses.

Looking at US equity markets, the S&P and Nasdaq ended 0.2% and 0.6% lower respectively. US IG and HY CDS spreads widened by 0.2bp. European equity indices ended higher. The iTraxx Main CDS spreads tightened by 0.7bp while the Crossover CDS spreads were 2.5bp tighter. Asian equity markets have opened lower this morning. Asia ex-Japan CDS spreads tightened 0.2bp.

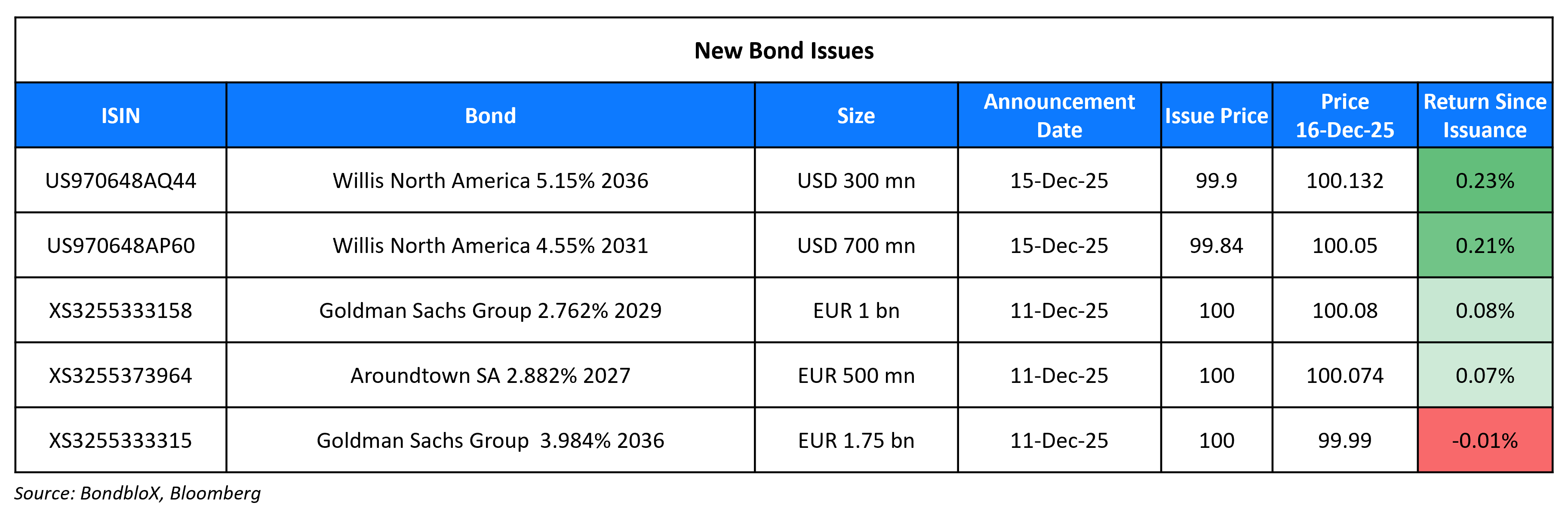

New Bond Issues

- Ganzhou Urban Investment $ 3Y at 5% area

Rating Changes

- Fitch Upgrades OQ S.A.O.C to ‘BBB-‘; Outlook Stable

- Crescent Energy Co. Upgraded To ‘BB-‘ On Completed Permian Acquisition And Planned Debt Repayment, Outlook Stable

- Seaspan Corp. Upgraded To ‘BB’ From ‘BB-‘ On Improved Profitability; Outlook Stable; Debt Rating Raised To ‘BB’

- Vital Energy Inc. Upgraded To ‘BB-‘ From ‘B’ On Acquisition By Crescent Energy Co.; Ratings Off Watch; Outlook Stable

- Moody’s Ratings upgrades BBVA’s deposit ratings to A1; outlook stable

- Raizen S.A. Downgraded To ‘BBB-‘ From ‘BBB’ On Delayed Deleveraging Prospects; Outlook Remains Negative

- Whirlpool Corp. Downgraded To ‘BB’, Outlook Negative On Underperforming Credit Metrics

- Fitch Downgrades Humana’s Ratings; Outlook Stable

- IIFL Finance Outlook Revised To Positive On Recovering Market Share In Gold Loans; ‘B+/B’ Ratings Affirmed

Term of the Day

Collateralized Loan Obligations (CLO)

Collateralized Loan Obligations (CLO) are securities backed by a pool of underlying loans. The loans are packaged together by a process of securitization. The loans are bundled together in tranches in an order of risk – for example, the AAA rated tranche comes with the lowest default risk while a BB tranche has a higher default risk. Investors can choose the tranche they prefer based on risk appetite. Given that the underlying loans are floating rate loans, they are also considered a hedge against inflation.

Talking Heads

On EM Dollar Bond ETF Drawing Biggest Haul Since 2023

Anders Faergemann, PineBridge

“Investors are coming out of 2025 with a higher level of comfort in emerging markets helped by strong returns in sovereign bonds. Inflows into the asset class could be a game changer”

On CLO Managers Betting Big on Deal Revival to Lift Profits in 2026

Michael Marzouk, Aristotle Pacific Capital

“Corporate fundamentals remain in good shape and the Fed is easing, which should help spur more M&A off trough levels and make for a very busy 2026”

Thomas Majewski, Eagle Point Credit

“Picture a wall of sand coming at you from one side and you’re trying to move boulders on the other”

Citigroup strategists

“While it should boost corporate animal spirits and lift economic growth in 2026, it also poses a threat to certain business”

On Short-Maturity Treasury Yields Declining as Fed Debate Simmers

Jack McIntyre, Brandywine Global Investment Management

“You need to be patient and see how the data plays out”

Tony Rodriguez, Nuveen

“There’s not room for more cuts without losing credibility and negatively impacting the long end of the market, without the data supporting it”

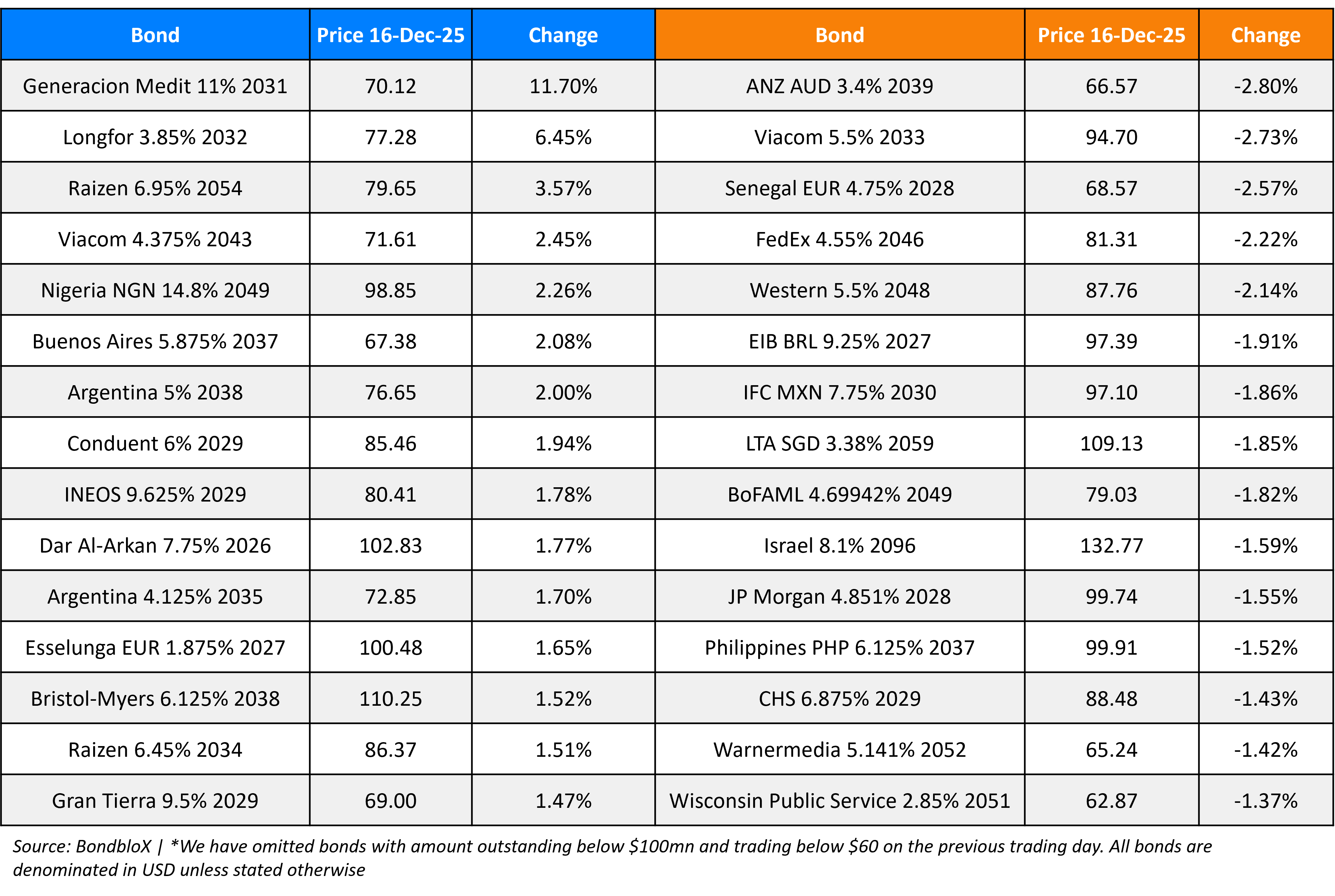

Top Gainers and Losers- 16-Dec-25*

Go back to Latest bond Market News

Related Posts: