This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yield Curve Steepens Further

December 15, 2025

The US Treasury yield curve steepened further with the 10Y and 30Y rising by 3-5bp. The markets continue to await the Non-Farm Payroll data set to release tomorrow. In terms of Fed speakers, Cleveland’s Fed President Beth Hammack said that she prefers interest rates to be slightly more restrictive to keep putting pressure on inflation. Chicago’s Fed President Austan Goolsbee said that he dissented against a rate cut last week because he wanted to wait for more data on inflation. However, he added that he is projecting more rate cuts for 2026 than many of his colleagues. Philadelphia’s Fed President Anna Paulson took a more dovish stance, saying she was “still a little more concerned about labor market weakness than about upside risks to inflation”. US President Donald Trump said on Friday that Kevin Warsh has moved to the top of his list as the next Federal Reserve chair, though Kevin Hassett also remains in contention, according to the Wall Street Journal.

Looking at US equity markets, the S&P and Nasdaq ended 1.1% and 1.7% lower respectively. US IG CDS spreads widened by 0.9bp while HY spreads widened by 3.8bp. European equity indices ended lower too. The iTraxx Main CDS spreads widened by 0.7bp while the Crossover CDS spreads were 3.8bp wider. Asian equity markets have opened broadly lower this morning. Asia ex-Japan CDS spreads tightened 0.9bp.

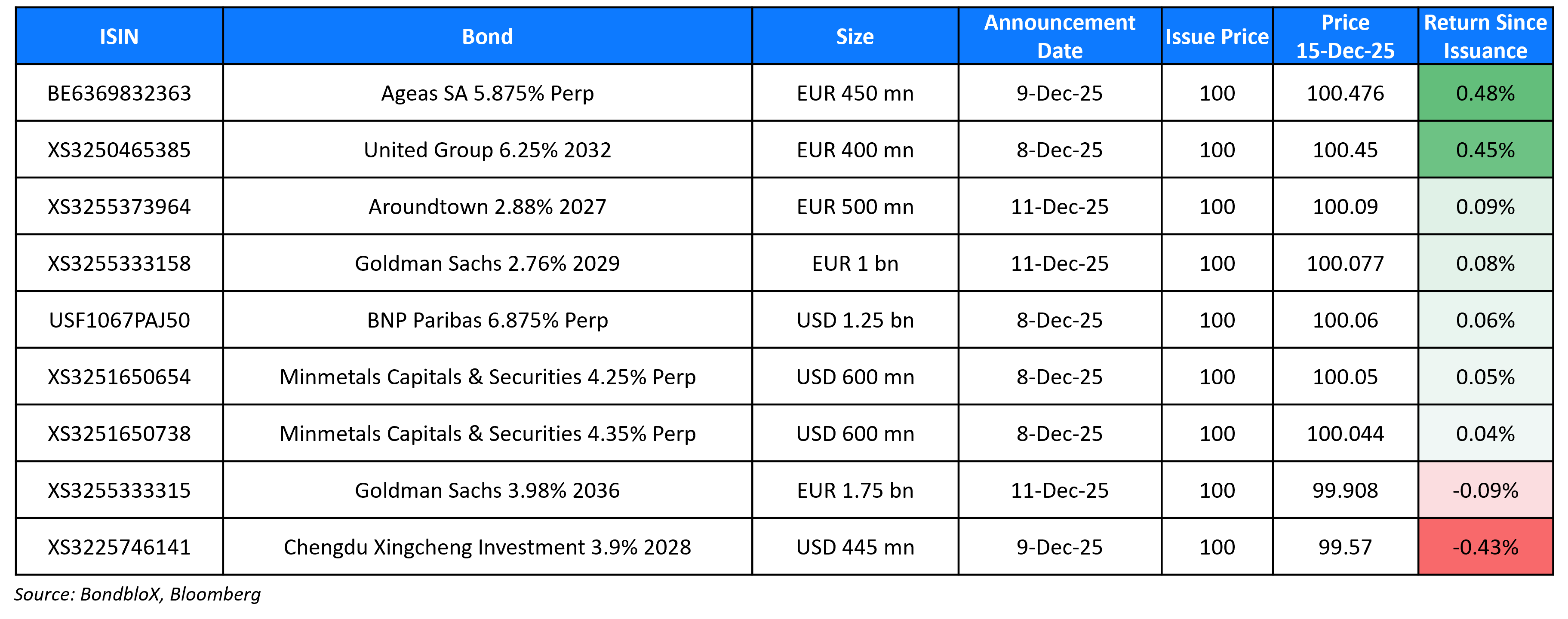

New Bond Issues

Rating Changes

- Fitch Upgrades BTG Pactual and BTGH’s IDRs to ‘BB+’; Outlook Stable

- Fitch Upgrades Cote d’Ivoire to ‘BB’; Outlook Stable

- Moody’s Ratings upgrades SK hynix’s ratings to Baa1; outlook stable

- Eurobank Holdings Upgraded To ‘BBB-/A-3’ On Merger; Ratings Off CreditWatch; Ratings Withdrawn

- Fitch Upgrades San Marino to ‘BBB-‘; Outlook Positive

- Petra Diamonds Upgraded To ‘B-‘ From ‘SD’ On Completed Debt Restructuring; Outlook Stable

- Gap Inc. Upgraded To ‘BB+’ From ‘BB’ On Improved Operating Performance; Outlook Stable

- Cleveland-Cliffs Inc. Downgraded To ‘B+’ From ‘BB-‘ On Elevated Leverage; Outlook Stable

- Fitch Revises Intralot’s Outlook to Negative; Affirms IDR at ‘B+’

- Fitch Revises Efes’s Outlook to Negative; Affirms Rating at ‘BB’

- Heineken N.V. Outlook Revised To Positive On Market Share Gains And Profit Pool Growth; ‘BBB+/A-2’ Ratings Affirmed

- Moody’s Ratings changes outlook on Trinidad & Tobago to negative, affirms Ba2 ratings

Term of the Day

Dim Sum Bonds

These are bonds denominated in offshore Renminbi (CNH) and issued outside China (mostly in Hong Kong). The first dim sum bond was issued in 2007 by China Development Bank – a 2Y offshore RMB bond in Hong Kong, with a 3% coupon and size of RMB 5bn ($750mn). These instruments get their name from dim sum, a popular delicacy in Hong Kong. Dim sum bonds are typically issued by issuers that have a need for Renminbi but do not want to go through regulatory approvals as dim sum issuance are not subject to regulatory approval from mainland China or Hong Kong, provided that they are sold to professional investors.

Talking Heads

On Rising China’s Dim Sum Bonds Boom

Lynn Song – ING Bank

“China’s low interest rates are a key incentive for issuers to sell long-dated debt. Companies opting to secure financing costs at these low levels likely believe that China’s economic outlook will improve in the coming years.”

On Fed Market Split Over Fed’s Path in 2026

George Catrambone – DWS Americas

“The single most important data point for next year may be Tuesday’s employment figures. It’s all I’m looking at, and where the labor market goes so do rates.”

Janet Rilling – Allspring Global Investments.

“A new chair “means the Fed tilts even more dovish, regardless of the economy running a bit hot. The cover could end up being in the employment market. It’s not our expectation that it’s going to be a big jump in unemployment, but nonetheless, if it’s looking a little softer, that could be the cover for cutting rates.”

On Wall Street Betting on What Pops The AI Bubble

Sameer Bhasin – Value Point Capital

“These stocks don’t correct because the growth rate goes down. These stocks correct when the growth rate doesn’t accelerate any further.”

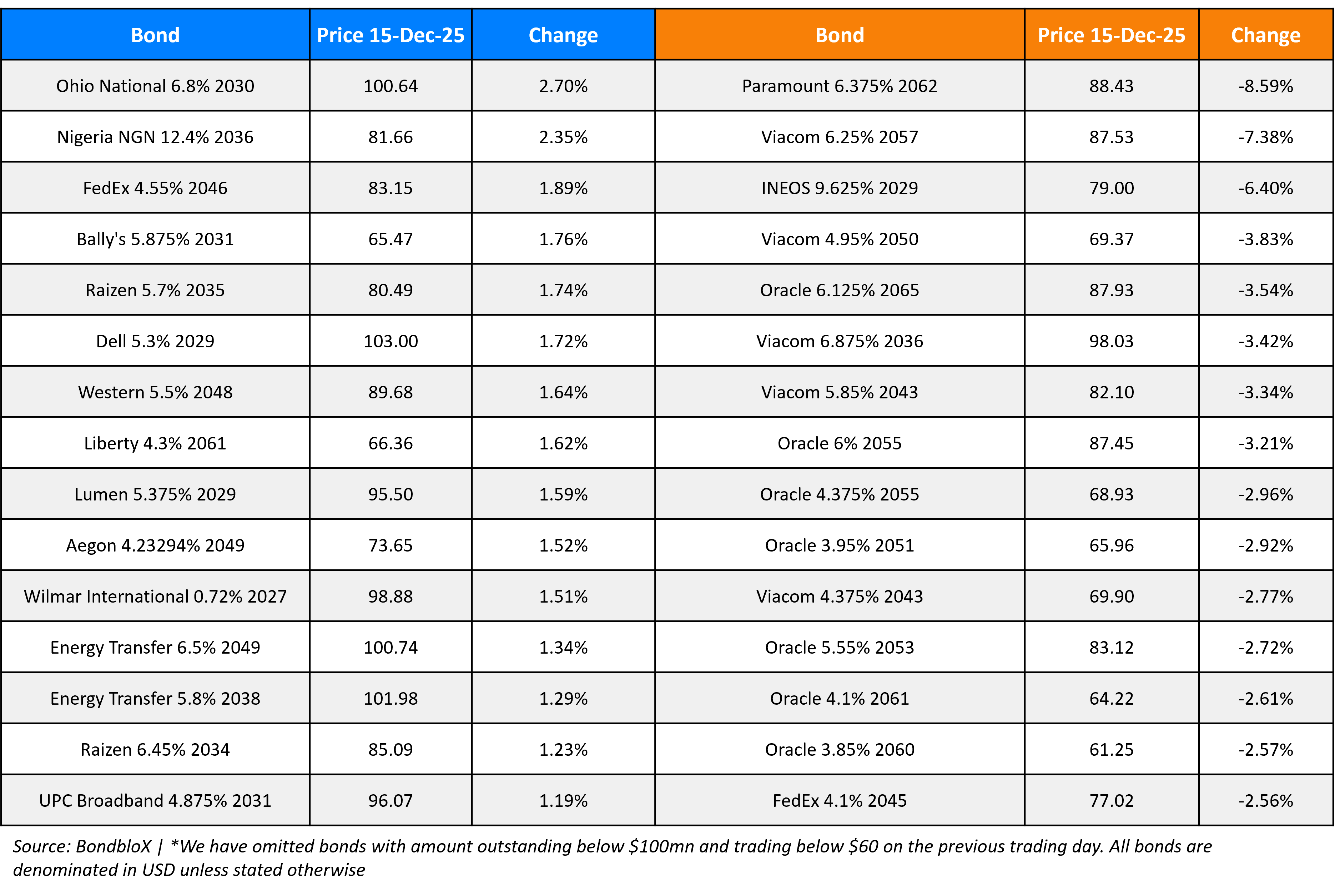

Top Gainers and Losers- 15-Dec-25*

Go back to Latest bond Market News

Related Posts: