This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Retail Sales Miss Expectations; Alphabet, Intesa, ENBD and others Price Bonds

February 11, 2026

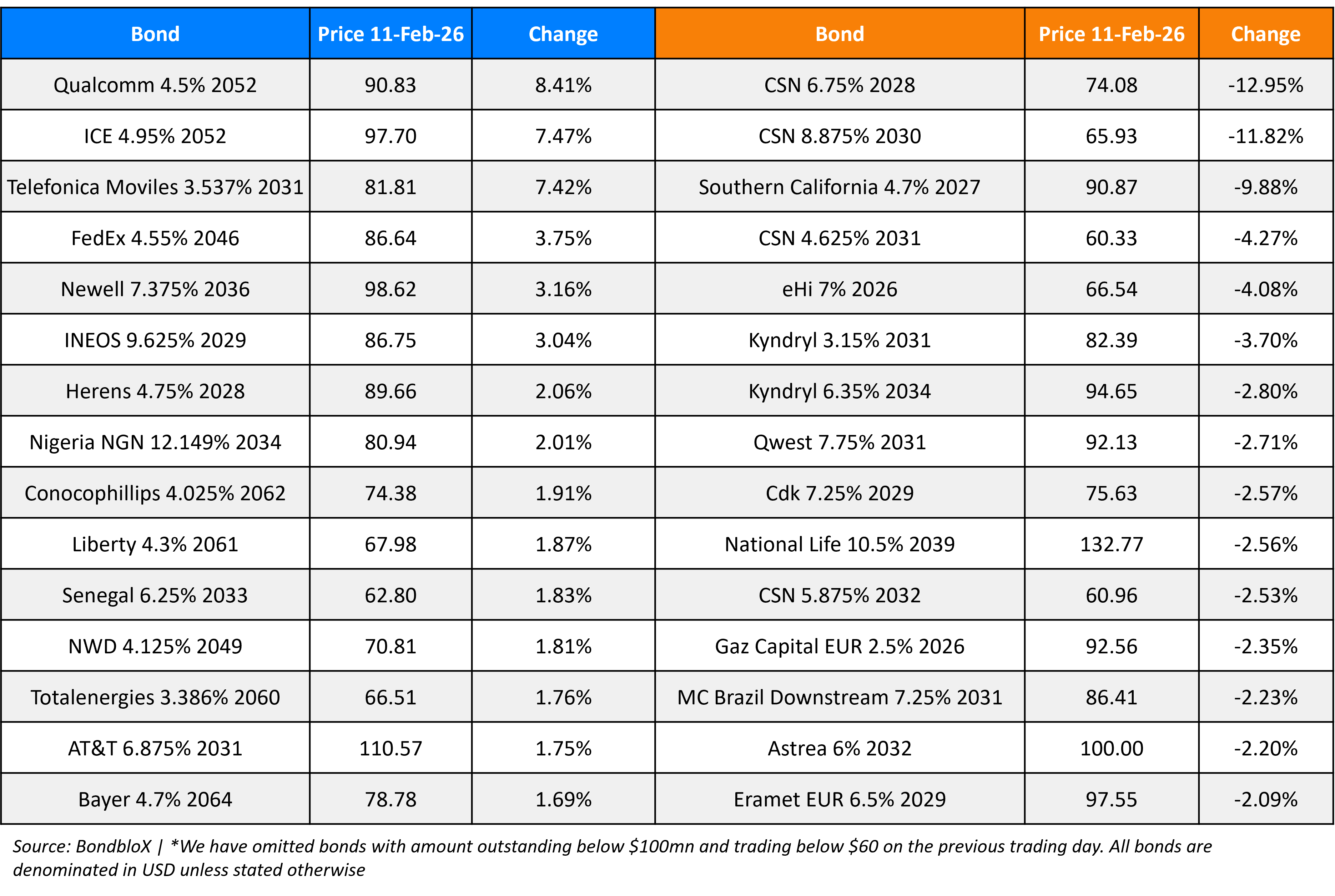

US Treasury yields moved lower by 4-5bp on Tuesday. US Retail Sales for December softened, showing no growth as compared to expectations of a 0.4% print. Also, the NFIB Small Business Optimism Index came in at 99.3, slightly lower than expectations of 99.8. Dallas Fed President Lorie Logan said that a slowing down in inflation would not be enough to warrant more rate cuts. On similar lines, Cleveland Fed President Beth Hammack said that she expects interest rates will be “on hold for quite some time”.

Looking at US equity markets, the S&P and Nasdaq closed 0.3% and 0.6% lower respectively. US IG CDS spreads widened by 0.6bp and HY CDS spreads were 2.9bp wider. European equity indices ended lower too. The iTraxx Main CDS spreads were 0.6bp wider and the Crossover CDS spreads were 1.3bp wider. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads were tighter by 0.2bp.

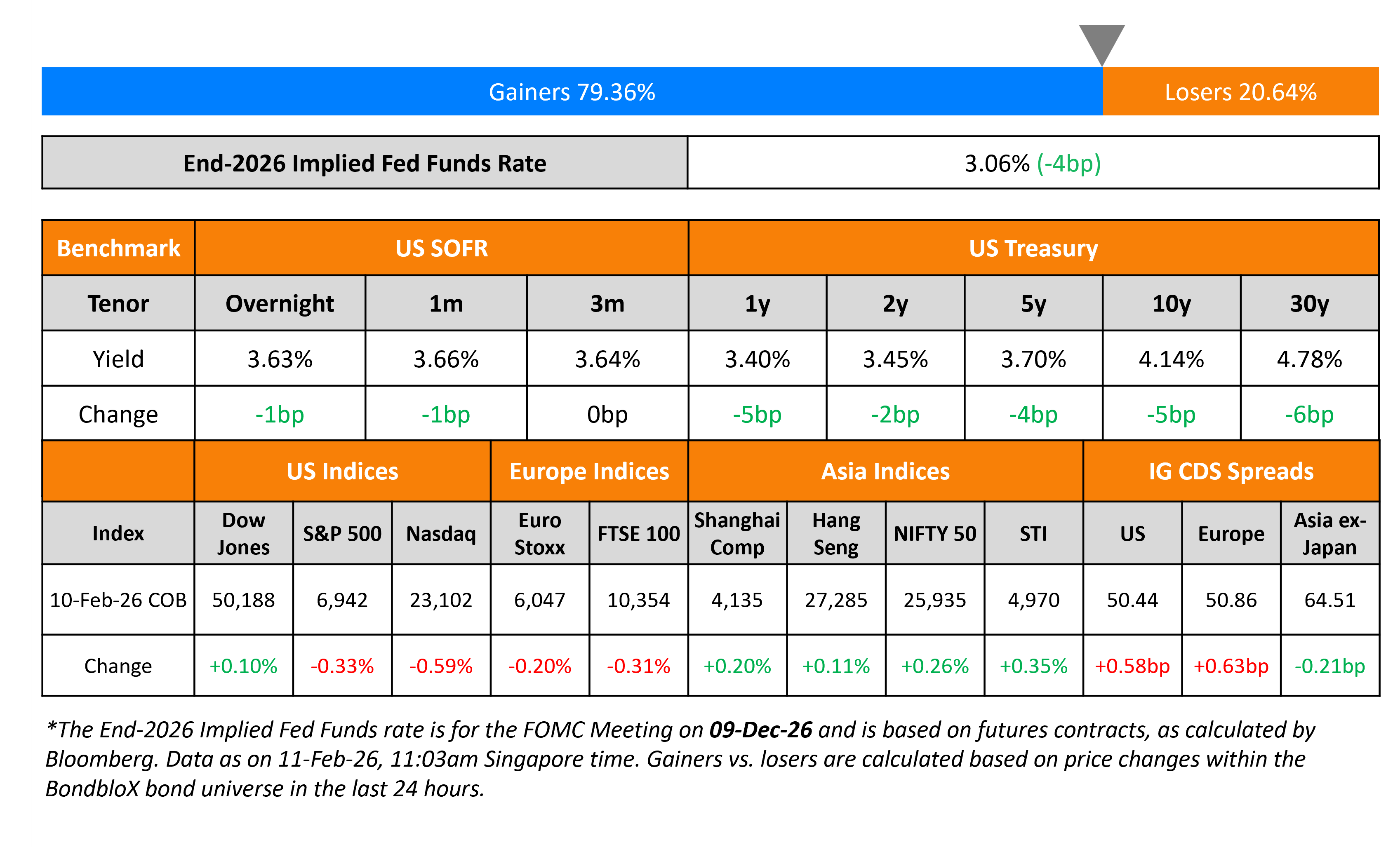

New Bond Issues

- Macquarie Bank Ltd. A$ 10.5NC5.5 Fixed/FRN Tier-2 at SQ ASW+145bp/3m BBSW+145bp areas

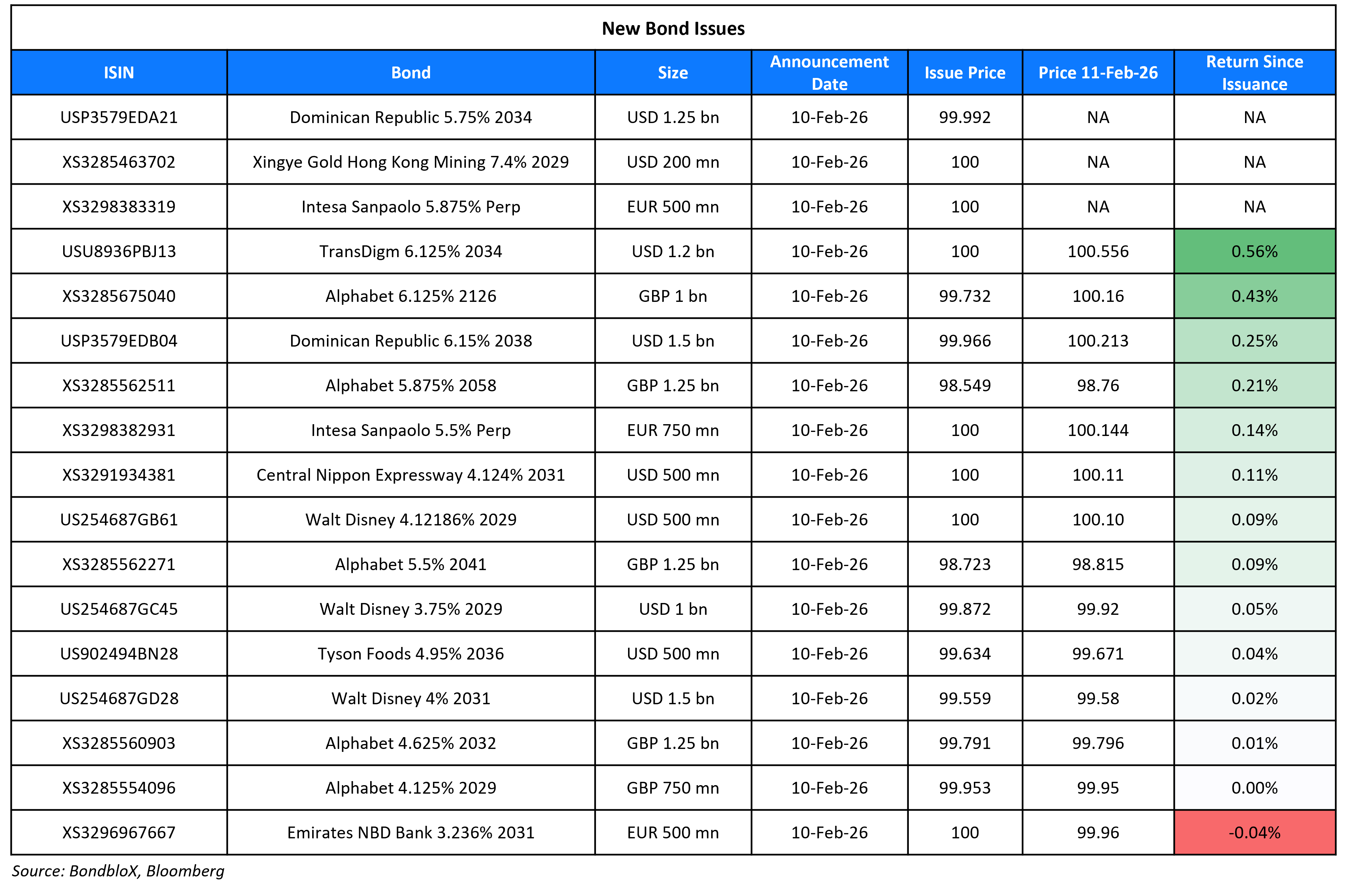

Alphabet raised £5.5bn via a five-trancher.

The senior unsecured notes are rated Aa2/AA+. The 100Y issuance was the first by a tech company since 1997 where Motorola issued a century bond. Proceeds along with the proceeds from its other USD and CHF notes will be used for general corporate purposes, which may include repaying outstanding debt.

Intesa Sanpaolo raised €1.25bn via a two-trancher:

- It raised €750mn via a PerpNC6 AT1 bond at a yield of 5.5%, 50bp inside initial guidance of 6.0% area. If not called by 17 February 2032, the coupon will reset to the 5Y Mid-Swap plus 302.8bp.

- It also raised €500mn via a PerpNC10 AT1 bond at a yield of 5.875%, 50bp inside initial guidance of 6.375% area. If not called by 17 February 2036, the coupon will reset to the 5Y Mid-Swap plus 314.4bp.

The junior subordinated notes are rated Ba2/BB/BB+, and received orders of over €3.95bn, ~3.2x issue size. Proceeds will be used for general funding purposes and for regulatory capital purposes.

Dominican Republic raised $2.75bn via a two-tranche deal. It raised $1.25bn via an 8Y bond at a yield of 5.75%, 35bp inside initial guidance of 6.10% area. It also raised $1.5bn via a 12.25Y bond at a yield of 6.15%, 35bp inside initial guidance of 6.5% area. The senior unsecured notes are rated Ba2/BB/BB-. Proceeds will be used for general purposes of the government.

TransDigm raised $1.2bn via a 8NC3 bond at a yield of 6.125%, 12.5bp inside initial guidance of 6.25% area. The senior subordinated note is rated B3/B. Proceeds, together with cash on hand and a $1bn term loan will be used to fund its acquisitions of Stellant Systems, Jet Parts Engineering and Victor Sierra Aviation Holdings.

Emirates NBD raised €500mn via a 5Y green bond at a yield of 3.236%, ~25.5bp 12.5bp inside initial guidance of T+100/105bp area. The senior unsecured note is rated A1/A+ (Moody’s/Fitch). Proceeds will be used to finance or refinance a portfolio of eligible green loans.

Inner Mongolia Xingye raised $200mn via a 3Y sustainability bond at a yield of 7.4%, 30bp inside initial guidance of 7.7% area. Proceeds will be used to finance domestic and offshore project infrastructure and supplement working capital in accordance with its framework.

Central Nippon Expressway raised $500mn via a green bond at a yield of 4.124%, 2bp inside initial guidance of MS+64bp area. The senior unsecured note is rated A1. Proceeds will be used to finance eligible projects expected to contribute to climate resilience and adaptation.

New Bonds Pipeline

- Congo $ 7Y bond

-

Mashreqbank $500mn PerpNC5.5 AT1 bond

- IMB Bank A$ 10NC5 Tier-2 bond

Rating Changes

- Moody’s Ratings downgrades Stellantis to Baa3, outlook stable

- Carmaker Stellantis Downgraded To ‘BBB-‘ On Expected Protracted Earnings And Cash Flow Recovery; Outlook Negative

- Valaris Ltd. ‘B+’ Issuer, ‘BB’ Issue Ratings Placed On CreditWatch Negative On Acquisition By Transocean

- Blue Ribbon LLC Downgraded To ‘D’ From ‘CCC+’ Following Credit Agreement Amendments

Term of the Day: Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back.

Talking Heads

On Asia Junk Bond Rally Has Further to Go – Raymond Gui, UBS Asset Management

“A lot of Asian high-yield companies have successfully reduced their leverage… We expect default risk to remain low this year, like 2025. This will be a key driver for the Asian high‑yield market to perform well again… There is a good chance for Asia high yield to outperform US high yield this year again”

On Software Posing ‘All-Time’ Risk to Speculative Credit – Deutsche Bank

“The reality today has now changed from when many of these firms were initially financed… meaningful chunk of debt outstanding that risks souring broader sentiment, if software defaults increase”

On Robust Foreign Demand for US Debt Auctions Allays Fears – TD strategists

“When you ask a lot of foreign investors what they’re doing with their Treasury holdings, they’ll admit their nervousness around other investors selling but most — at least in our experience — haven’t admitted to selling their Treasuries themselves”

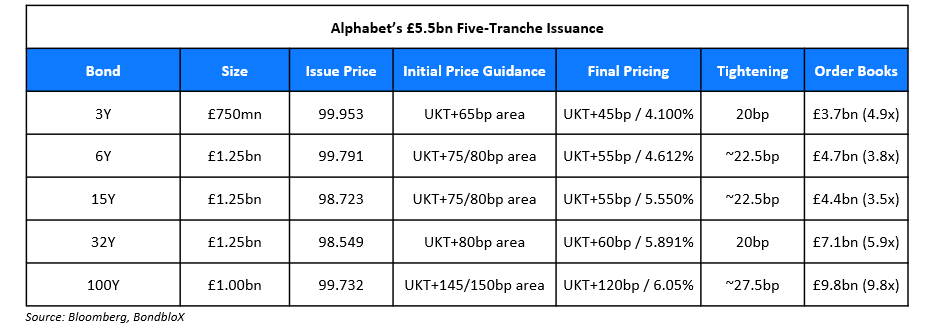

Top Gainers and Losers- 11-Feb-26*

Go back to Latest bond Market News

Related Posts: