This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US PPI, Core PPI Rises

October 14, 2024

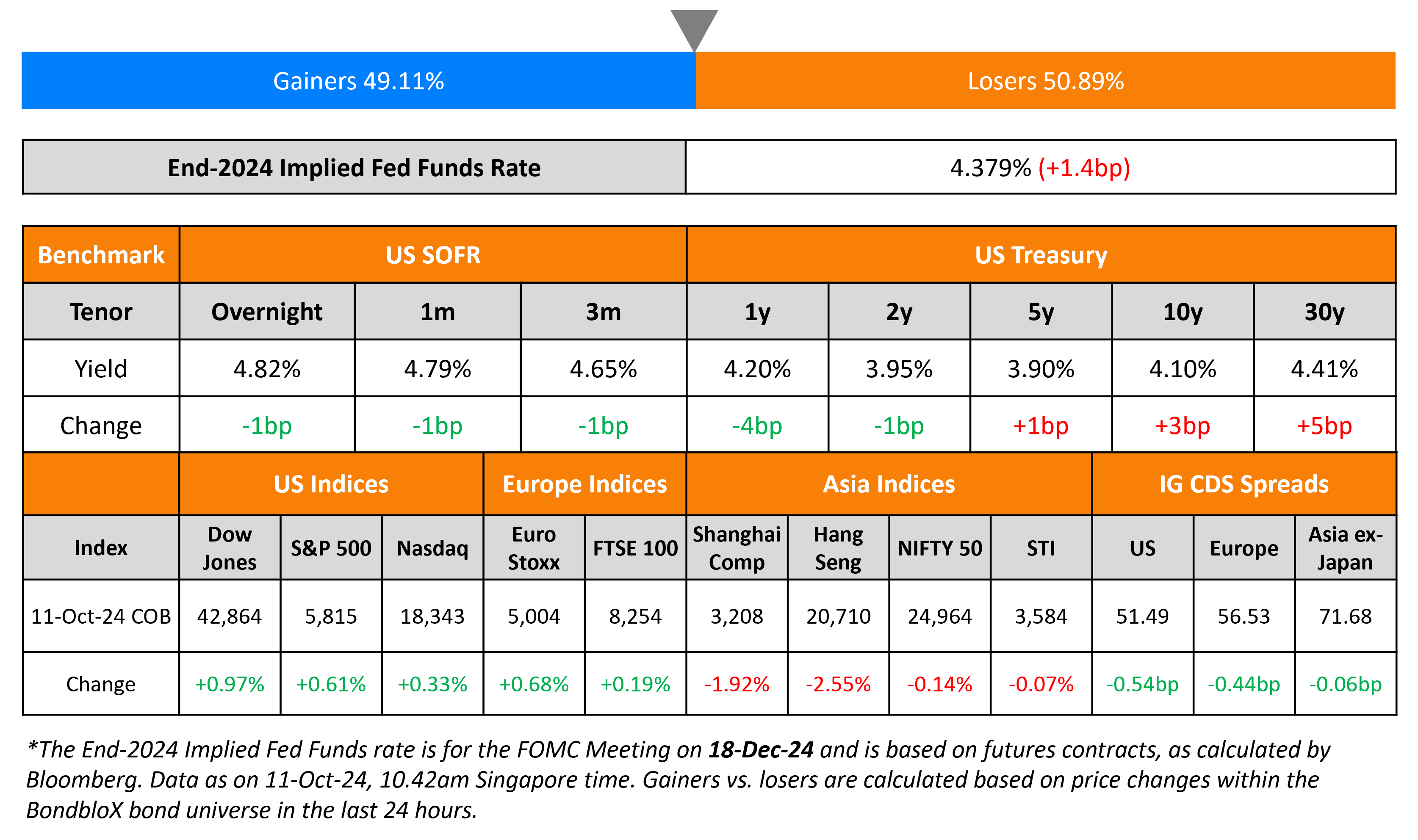

The US Treasury yield curve bear steepened on Friday, with long-end yields having risen by about 3bp on average while short-end yields remained steady. US PPI YoY for September rose by 1.8% vs. expectations of 1.6% and the prior month’s 1.9% reading. The Core PPI rose by 2.8%, higher than expectations and the prior reading of 2.6%. US IG and HY CDS spreads tightened by 0.5bp and 2.6bp respectively. Looking at US equity markets, S&P and Nasdaq both closed higher, by 0.6% and 0.3% respectively.

European equities followed suit and closed broadly higher across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.4bp and 0.9bp respectively. Asian equities have opened broadly higher this morning. Asia ex-Japan IG CDS spreads were 0.1bp tighter. In Saturday’s China stimulus briefing, while a host of measures were targeted at reviving the property sector, there was a lack of policies to boost domestic consumption that analysts noted have disappointed expectations.

New Bond Issues

New Bonds Pipeline

- Adani Hybrids Renewables hires for $ 20Y bond

- Power Construction Corp of China hires for $ PerpNC5 bond

- China Huadian hires for $ PerpNC3 bond

- Korea Land & Housing hires for $ 2Y/3Y bond

Rating Changes

- Moody’s Ratings upgrades Ghana’s ratings to Caa2 and changes the outlook to positive

- Moody’s Ratings upgrades Banorte’s deposit ratings to Baa1; outlook changed to stable

- Adler Group S.A. And Adler RE Upgraded To ‘B-‘ After Completing Debt Restructuring; Outlook Negative

- Fitch Revises France’s Outlook to Negative; Affirms at ‘AA-

- Moody’s Ratings changes Volkswagen’s outlook to negative

Term of the Day

Zero Bear Steepening

Bear Steepening refers to a move in the yield curve where the longer-dated bond yields move higher than the shorter-dated bond yield (far maturity bonds sell-off more than near maturity ones). A bear steepening move can occur due to different reasons some of them being long term expectations of inflation picking up, higher supply of longer-dated bonds, central bank tapering purchases with a focus on the long-end bonds etc.

Talking Heads

On Volatile Bond Market Putting Traders on Defense Amid Fed-Cut Doubts

Solita Marcelli, UBS Global

“We continue to recommend investors position for a lower-rate environment… (deploy cash, MM holdings etc.) into assets that can offer more durable income”

Roger Hallam, Vanguard

“Our central case is that the economy does slow next year as Fed policy will still be restrictive”

Anmol Sinha, Capital Group

“The shorter maturity part of the yield curve, five years and less, looks more compelling to us at the moment”

On ECB Set to Deepen Global Easing With Rate Cut It Didn’t Expect

David Powell, Bloomberg Economics

“ECB will lower borrowing costs by 25 basis points in October and again in December. After that we see quarterly moves as policymakers feel their way to neutral”

On Slamming Fed Over September 50bp Cut – Trump Adviser Scott Bessent

“If you were concerned about the integrity of the institution, you would not have done it. You especially would have not done a jumbo cut… Tell me on what planet is it conceivable that waiting two months is make or break, versus the integrity of the institution”

Top Gainers & Losers 14-October-24*

Go back to Latest bond Market News

Related Posts:

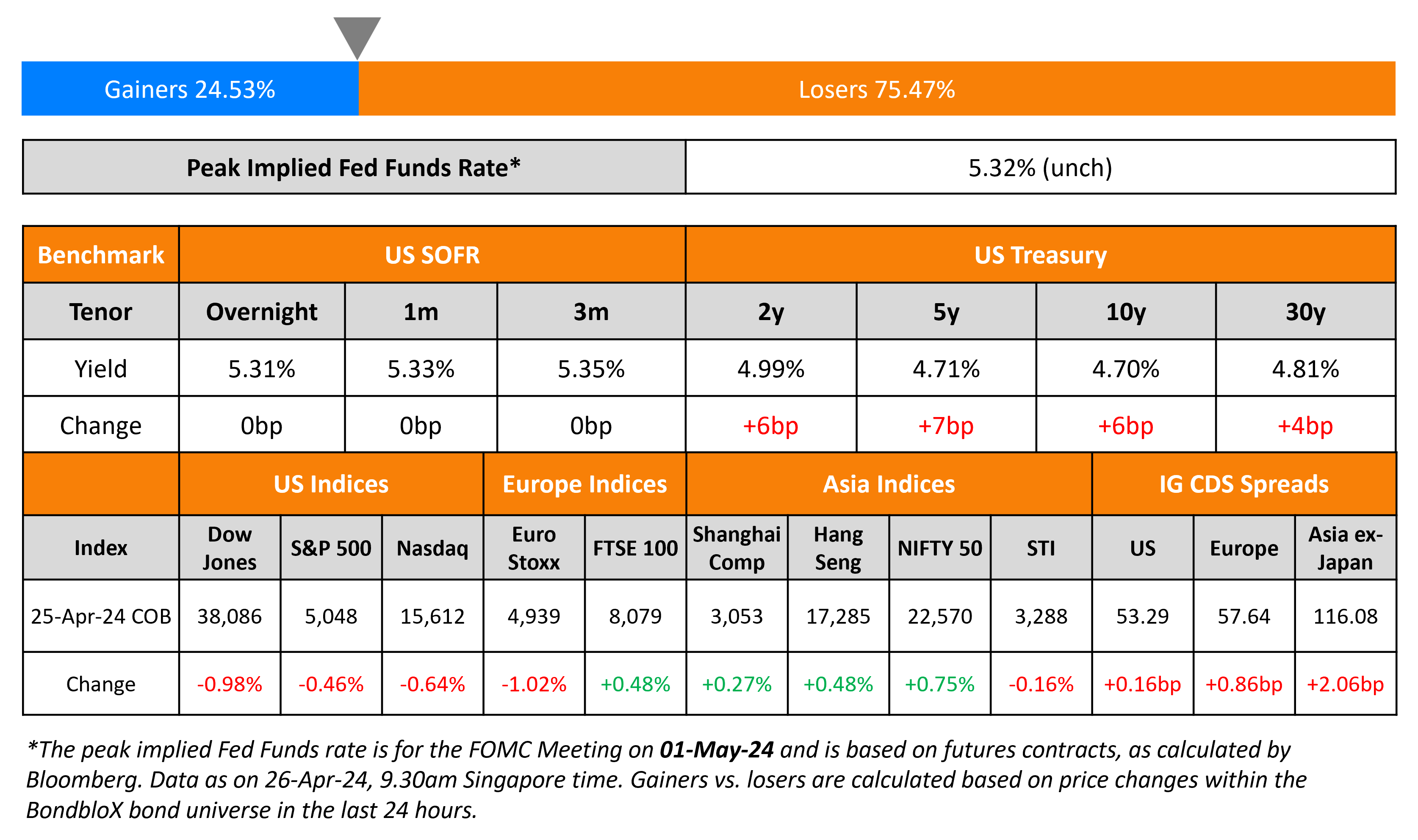

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024